Updated SJC gold price

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 116.8-19.3 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2.5 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 116.8-119,3 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 116.8-119,3 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2.5 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 116-119 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

9999 round gold ring price

As of 9:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 111.5-124.5 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114-117 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 111.5-114.5 million VND/tael (buy in - sell out), down 800,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

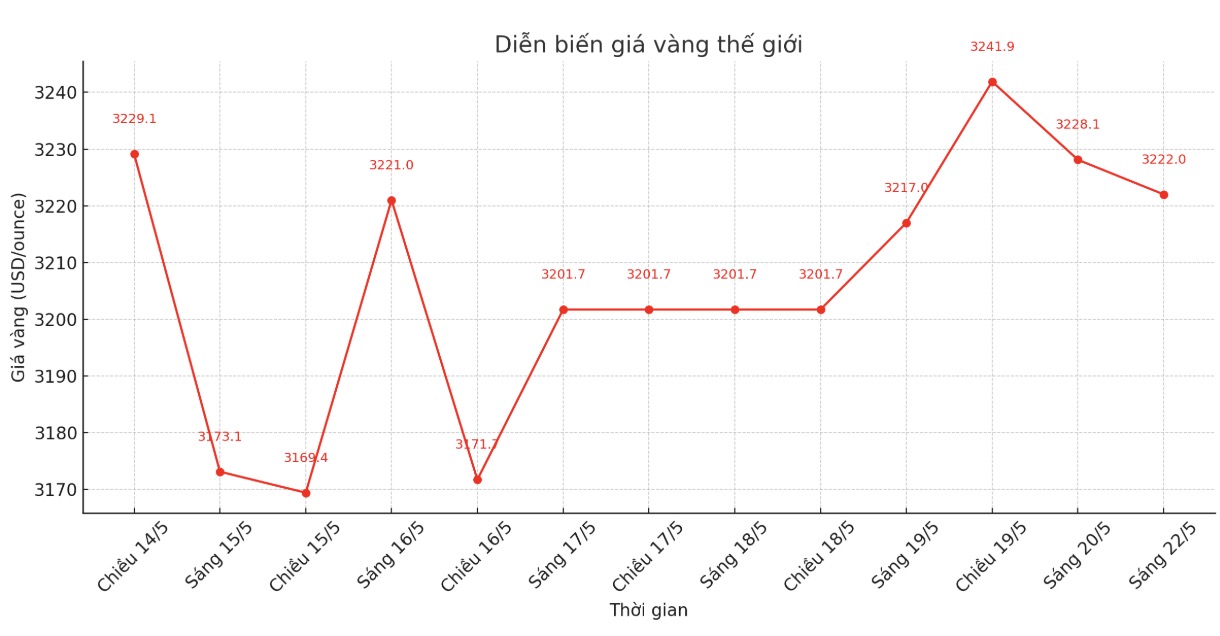

World gold price

At 9:05, the world gold price listed on Kitco was around 3,222 USD/ounce, up 5 USD/ounce.

Gold price forecast

Skilled market analyst Nikos Tzabouras of Tradu.com said that gold's appeal as a safe haven has rapidly increased due to concerns about the US public debt situation.

Increased risk-off sentiment combined with a weakening US dollar has helped gold recover after a strongest week of the year, opening up the opportunity to reach a new record high, he said.

Credit rating agency Moody's has downgraded its US national credit rating from Aaa to Aa1, becoming the last in the group of large companies to do so, citing concerns about the countrys growing debt.

Senior market strategist Bob Haberkorn of RJO Futures commented that in the next few months, gold will remain a safe investment and continue to be an asset to keep in the portfolio.

In the latest report, Goldman Sachs maintained its gold price forecast at $3,700/ounce by the end of this year and $4,000/ounce by mid-2026, despite the US Federal Reserve's delay in cutting interest rates and the risk of a slight decline in the US economic downturn.

In another development, Kavita Chacko - Director of Indian Research at the World Gold Council (WGC) said that demand for gold in India in April was generally quite gloomy as the holiday season took place in different directions, accompanied by large withdrawals from ETF funds, but gold imports still maintained their resilience.

In the latest update, Ms. Chacko commented that the weakening of the USD, the unstable geopolitical and economic situation in the world, and large inflows into global gold ETFs helped gold accelerate in April.

However, prices have cooled down as the London bullion Market Association (LBMA) gold price fell 8% in the afternoon in May. In India, domestic gold prices have similar developments with a slight adjustment of about 5%, thanks to the increase in the price of the rupee.

Ms. Chacko also said that although LBMA gold prices have increased by 583 USD/ounce (equivalent to 22%) in 2025, domestic gold prices have increased by 23%. Despite recent declines, gold has outperformed other major assets from year to year, Chacko said.

The demand for holiday gold in India has recently Differentiated somewhat. Due to high gold prices and strong fluctuations and economic uncertainty, gold jewelry sales in April and early May were quite weak, except for the Akshaya Tritiya holiday, she said. Consumers are expected to delay shopping, wait for stable prices or switch to buying lighter jewelry to suit fixed budgets and actual needs.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...