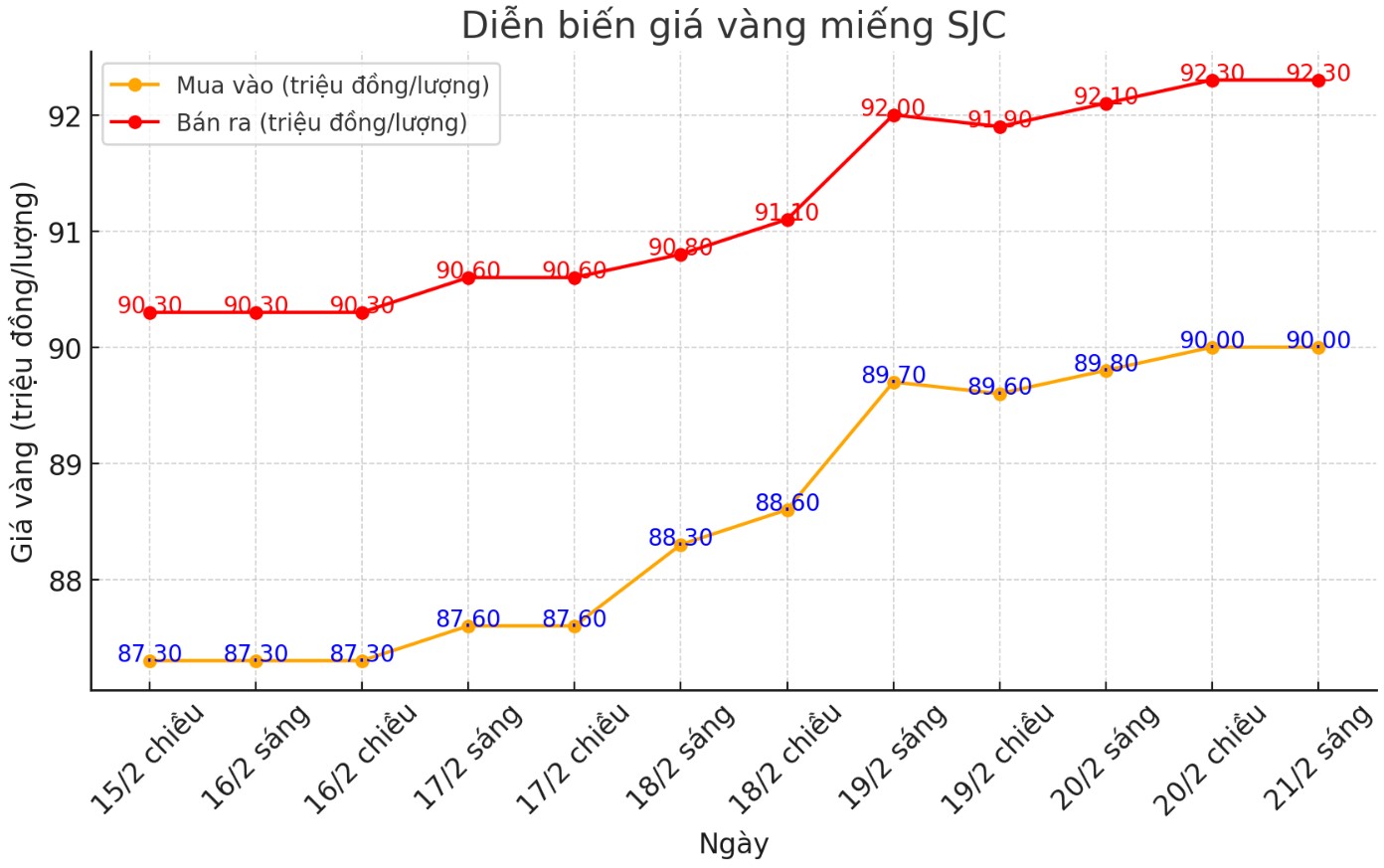

Updated SJC gold price

As of 10:00, the price of SJC gold bars was listed by Saigon Jewelry Company at VND90-92.3 million/tael (buy in - sell out); increased by VND200,000/tael for both buying and selling.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2.3 million VND/tael.

Meanwhile, the price of SJC gold bars was listed by DOJI Group at 90-92.3 million VND/tael (buy - sell); increased by 200,000 VND/tael for both buying and selling.

The difference between the buying and selling prices of SJC gold at DOJI Group is at 2.3 million VND/tael.

At the same time, Bao Tin Minh Chau listed the price of SJC gold bars at 90.1-92.4 million VND/tael (buy - sell); increased by 300,000 VND/tael for both buying and selling.

The difference between buying and selling SJC gold at Bao Tin Minh Chau is at 2.3 million VND/tael.

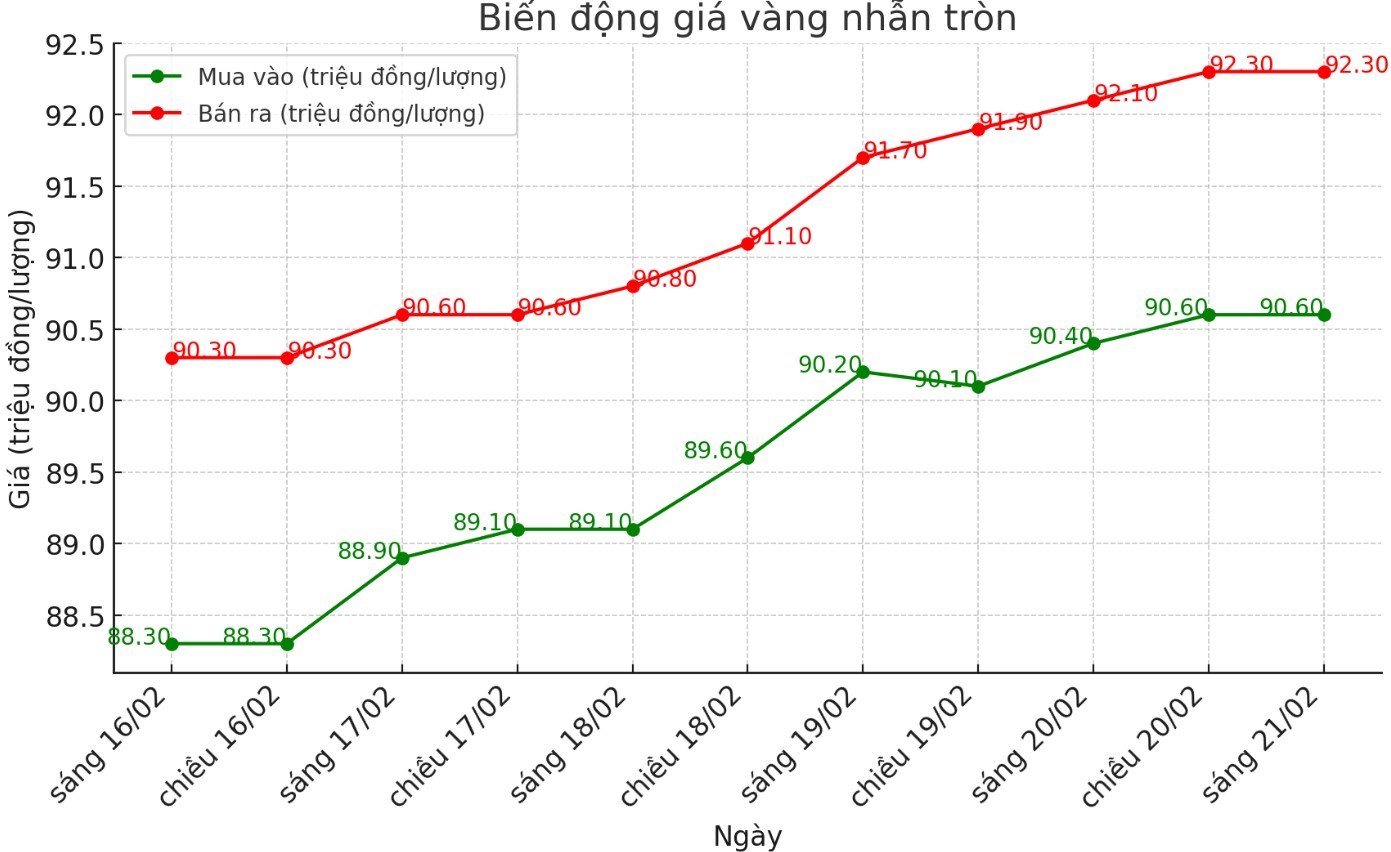

9999 round gold ring price

As of 9:25 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 90.6-92.3 million VND/tael (buy - sell); an increase of 200,000 VND/tael for both buying and selling compared to early this morning.

The difference between buying and selling is at 1.7 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 90.1-92.3 million VND/tael (buy - sell), down 350,000 VND/tael for buying and up 100,000 VND/tael for selling compared to early this morning.

The difference between buying and selling is at 2.2 million VND/tael.

World gold price

As of 10:00, the world gold price listed on Kitco was at 2,939.6 USD/ounce, up 1.6 USD/ounce compared to the beginning of the previous trading session.

Gold price forecast

World gold prices increased in the context of the USD decreasing. Recorded at 10:00 on February 21, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 106.330 points (up 0.06%).

According to Kitco - this increase is supported by safe-haven demand and purchases according to technical analysis.

Concerns about the global trade war caused by President Donald Trump's tariff threats are still the main cause of cash flow into safe-haven assets such as gold.

Speaking on CNBC, Peter Grant, Vice President and senior metals strategist at Zaner Metals, said: Overcoming trade tensions continue to increase concerns about inflation and growth, thereby increasing safe-haven demand for gold...

In another development, the Chinese gold market recorded a strong increase in January. Gold prices increased sharply in both international and domestic markets, while the central bank of this country continued to increase gold reserves. This move may have a positive impact on the psychology of domestic investors

LBMA gold price (in USD) increased by 8%, while Shanghai gold price (in USD) increased by 5%, said Ray Jia, Head of China Market Research at WGC. However, the price of gold according to RMB increased more slowly due to the strengthening of the domestic currency and the number of trading days decreased due to the Lunar New Year.

Jia said key factors contributing to gold prices reaching record levels in January included increased geopolitical risks - such as the Trump administration's tariff policies, increased inflows into gold ETFs and concerns about inflation.

See more news related to gold prices HERE...