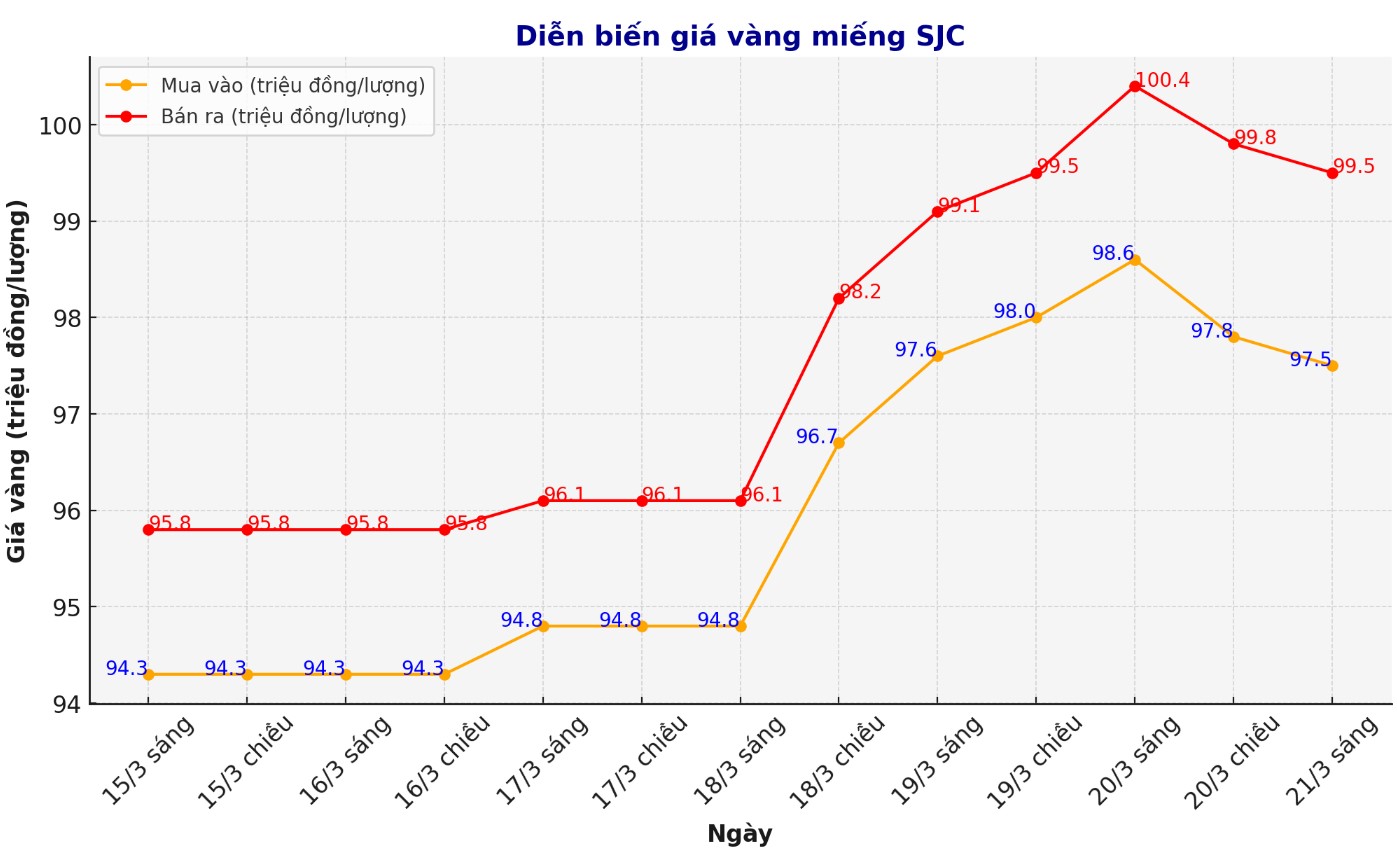

Updated SJC gold price

As of 9:10 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 97.5-99.5 million VND/tael (buy - sell), down 1.1 million VND/tael for buying and down 900,000 VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 97.8-99.8 million VND/tael (buy - sell), down 800,000 VND/tael for buying and down 600,000 VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 98-99.8 million VND/tael (buy - sell), keeping the same for buying and increasing by 300,000 VND/tael for selling. The difference between buying and selling prices is at 1.8 million VND/tael.

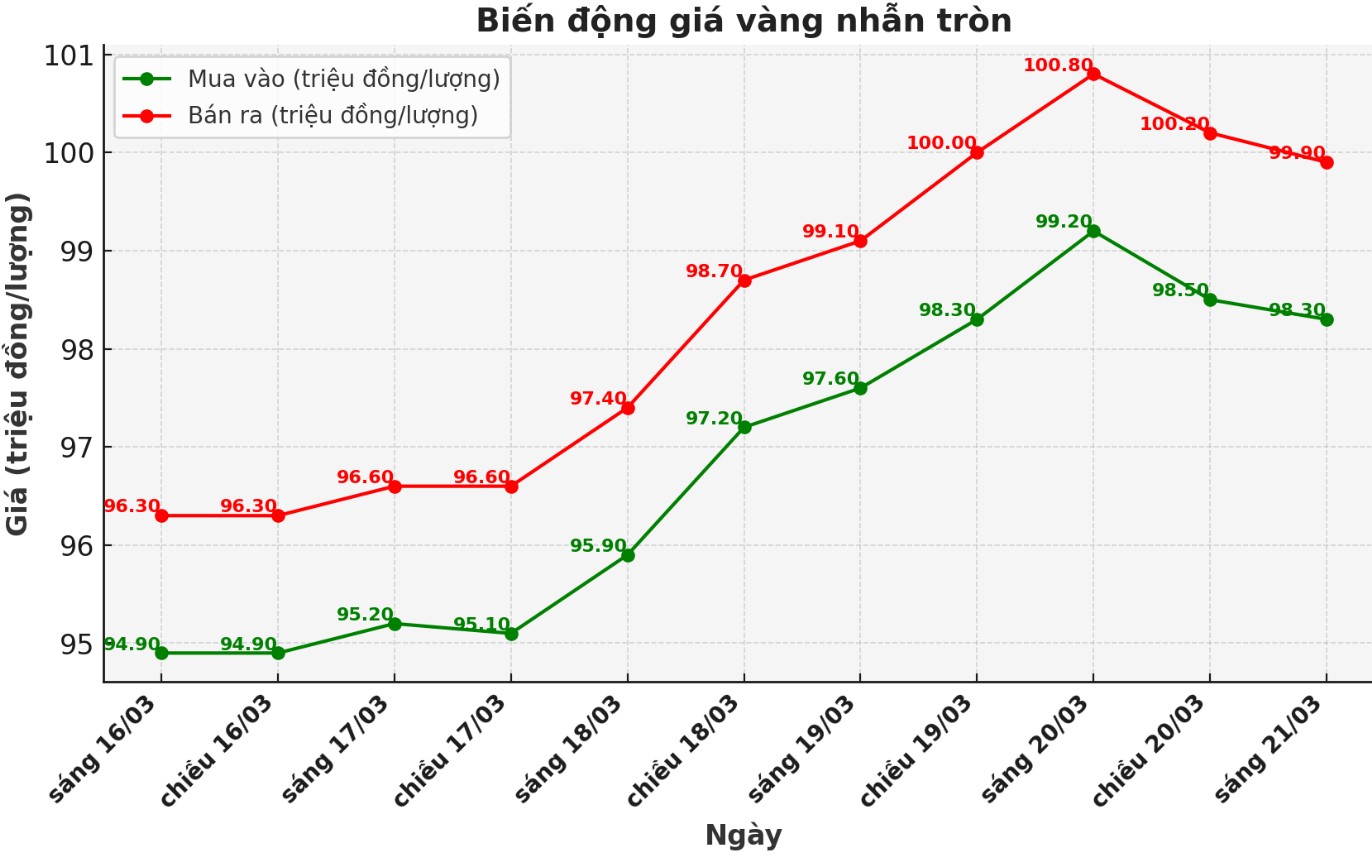

9999 round gold ring price

As of 8:50 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 98.3-99.9 million VND/tael (buy in - sell out), down 900,000 VND/tael for both buying and selling. The difference between buying and selling is listed at 1.6 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 98.6-100.4 million VND/tael (buy - sell); increased by 250,000 VND/tael for buying and increased by 400,000 VND/tael for selling. The difference between buying and selling is 1.8 million VND/tael.

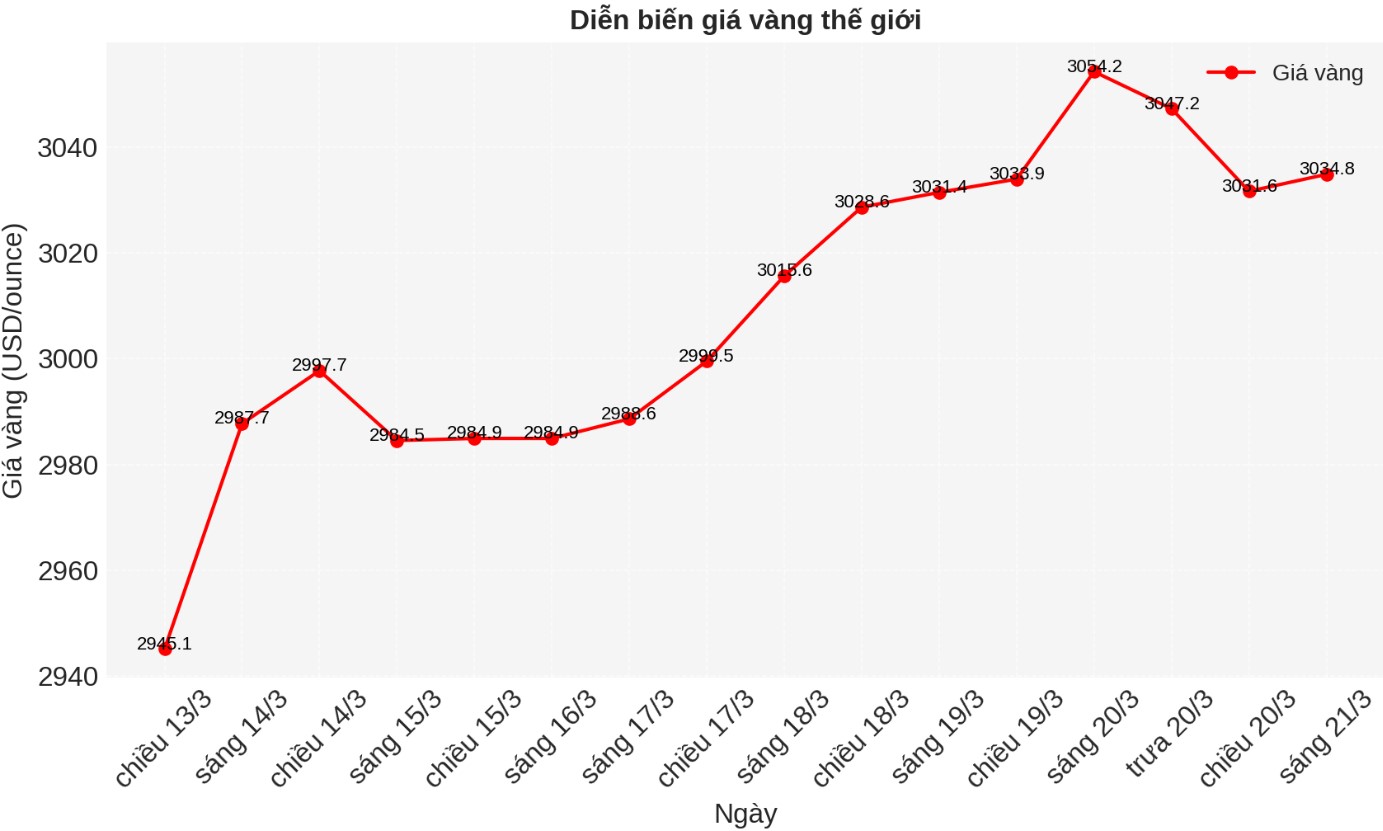

World gold price

At 9:15 a.m. on March 21, the world gold price listed on Kitco was around 3,034.8 USD/ounce, down 19.4 USD/ounce compared to the beginning of the trading session yesterday morning.

Gold price forecast

World gold prices fell in the context of the USD's recovery trend. Recorded at 9:15 a.m. on March 21, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 103.520 points (up 0.03%).

According to Kitco, gold prices are under profit-taking pressure after a survey by the US Federal Reserve (FED) Philadelphia showed solid production activity in March and the decision to keep interest rates by the Bank of England (BoE).

The Fed Philadelphia Production Survey shows that the manufacturing business outlook index fell to 12.5 from February's 18.1 level, but was still better than expected to fall to 8.8. Although production activities have decreased slightly, this result shows that the situation is still more stable than expected. However, a New York Fed survey reported a sharp decline in the manufacturing sector with the Empire State Manufacturing Survey down to -20.0 from 5.7 in February.

Although there was no big impact from economic data, the market recorded some slight profit-taking activities after a strong rally in gold prices.

Meanwhile, the BoE decided to keep the key interest rate (Bank Rate) at 4%. The 8-1 vote on keeping interest rates unchanged has led many experts to believe that the BoE has a more happy view than the previous forecast of 7-2. The BoE continues to focus on controlling inflation, despite the economy facing uncertainties affecting growth expectations.

UK CPI inflation rose to 3.0% in January, up from 2.5% in December. Inflation is forecast to continue to increase to 3.75% in the third quarter of 2025. The BoE also warned that monetary policy will need to remain at a limited level long enough to ensure inflation risks are controlled and the 2% inflation target can be achieved sustainably in the medium term.

Although the BoE did not make major changes to policy, language and the vote showed a cautious stance on future rate cuts.

allegiance Gold CEO Alex Ebkarian believes that speculators are trying to take advantage of the market and make a profit... Therefore, every time gold prices reach high levels, there will be resistance.

Gold has not even functioned as a safe haven asset for retail investors because technically, we are not in a recession. We are seeing a slowdown in the economy and that could create more uncertainty and more demand for safe-haven assets, Ebkarian said.

FXTM senior research analyst Lukman Otunuga said that gold will continue to maintain a strong uptrend with the next resistance level at the psychological level of 3,100 USD/ounce. He also stressed that a drop below $3,030 an ounce could trigger a lower price cut for gold.

See more news related to gold prices HERE...