As expected, the US Federal Reserve (FED) kept interest rates unchanged in the range of 4.25% - 4.50% and did not provide many instructions on monetary policy.

According to the latest interest rate forecast, the FED expects interest rates to be at 3.9% by the end of the year, unchanged from the previous forecast. The interest rate is expected to fall to 3.4% in 2026 and 3.1% in 2027.

Although not in a hurry to cut interest rates, the FED has adjusted the pace of narrowing the accounting balance sheet. From April, the Commission will slow down the pace of cutting stock holdings by lowering the monthly repurchase limit for Treasury bonds from $25 billion to $5 billion. The committee will maintain the monthly repurchase limit for corporate debt and mortgaged securities at $35 billion, the Fed said.

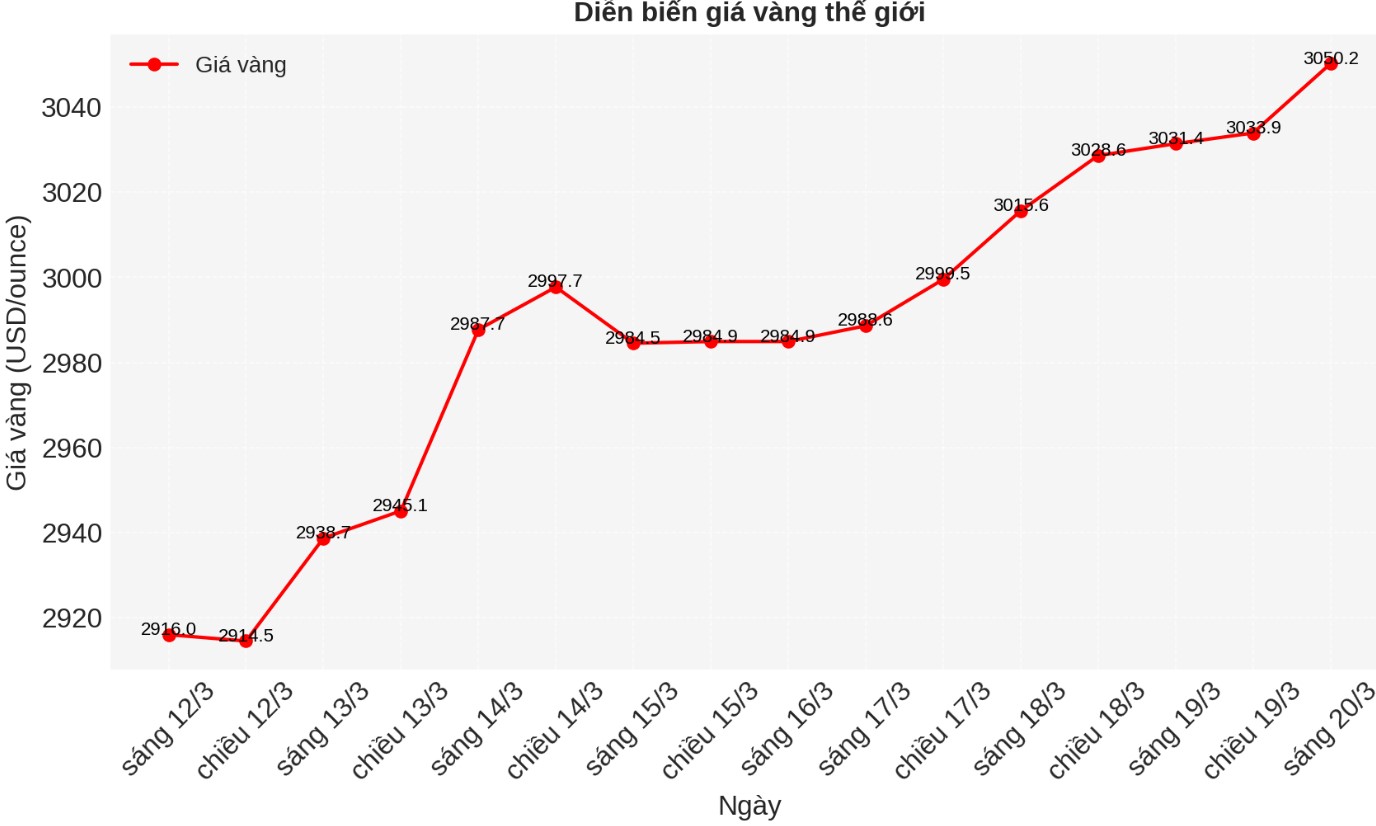

The gold market has no new momentum despite prices remaining near a record high of over $3,000/ounce. Spot gold prices have recently been recorded at $3,031.16/ounce, almost unchanged from the previous day.

Stephen Brown, deputy chief economist for North America at Capital Economics, said that although the Fed still maintains its forecast of two interest rate cuts this year, there are many uncertainties in this easing cycle.

Although the Federal Open Market Committee (FOMC) has kept its forecast for an average of two rate cuts this year, some officials now agree with us that the possibility of policy easing is no longer high. We continue to believe that FED officials are underestimating the extent that tariffs could push inflation higher, he said.

Although the Fed's monetary policy does not create a clear trend for gold, some analysts believe that gold prices are still supported as the latest economic forecasts show increased inflationary risks.

In terms of economic activity, the FED currently forecasts that US GDP will grow by 1.7% this year, down from 2.1% in the previous forecast. GDP is expected to stabilize at 1.8% over the next two years, lower than previous forecasts of 2.0% and 1.9%.

The Fed also forecasts a relatively stable US labor market, with the unemployment rate rising to 4.4% this year, slightly above the 4.3% forecast in December. The unemployment rate is expected to remain at 4.3% until 2027, unchanged from the previous forecast.

Regarding inflation, the FED forecasts the core personal consumption expenditure (PCE) price index to increase by 2.8% this year, higher than the previous forecast of 2.5%. Core inflation is expected to grow by 2.2% in 2026 and 2.0% in 2027, unchanged from the previous forecast.

General inflation is also forecast to increase this year and next year before decreasing in 2026. The Fed forecasts inflation to rise to 2.7% this year, up from the previous forecast of 2.5%. Inflation is expected to reach 2.2% next year, up from the previous forecast of 2.1%. The inflation forecast for 2027 remains unchanged at 2.0%.

Jeffrey Roach - Chief Economist at LPL Financial, said that the Fed's neutral stance is not surprising as the central bank is still "waiting for the impact of upcoming tariff policies".

However, new FED forecasts could support gold prices due to weakening the USD. new, more optimistic forecasts will put downward pressure on the US dollar in the short term, Roach said.