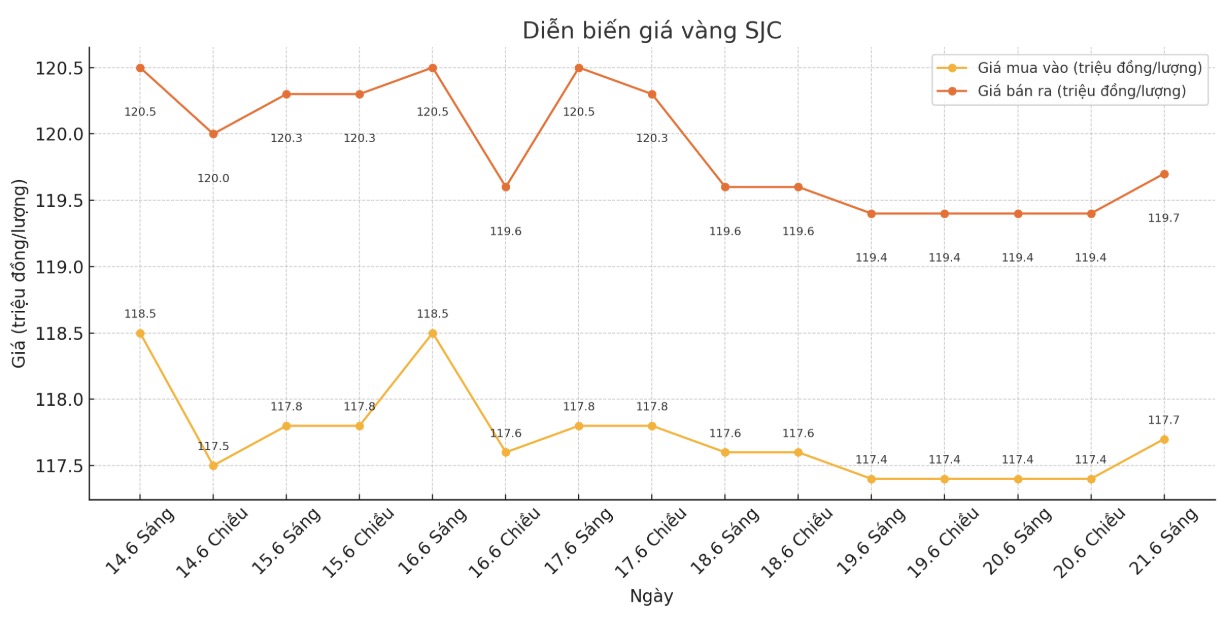

Updated SJC gold price

As of 9:30 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 117.7 crore VND1.7 million/tael (buy in - sell out), an increase of VND300,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 117.5-119 seven million VND/tael (buy in - sell out), an increase of 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.5-119 seven million VND/tael (buy in - sell out), an increase of 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 117-119 7.5 million VND/tael (buy in - sell out), an increase of 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2.7 million VND/tael.

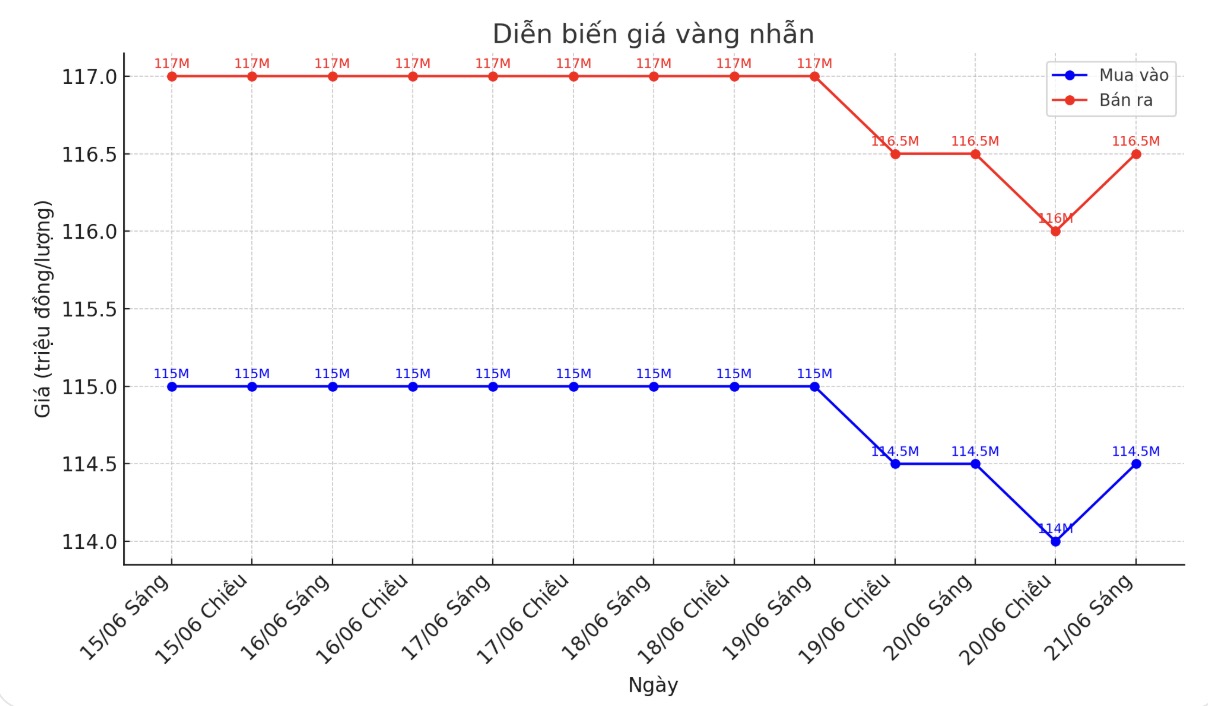

9999 round gold ring price

As of 9:30 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND 114.5-116.5 million/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114.5-117.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.5-116.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

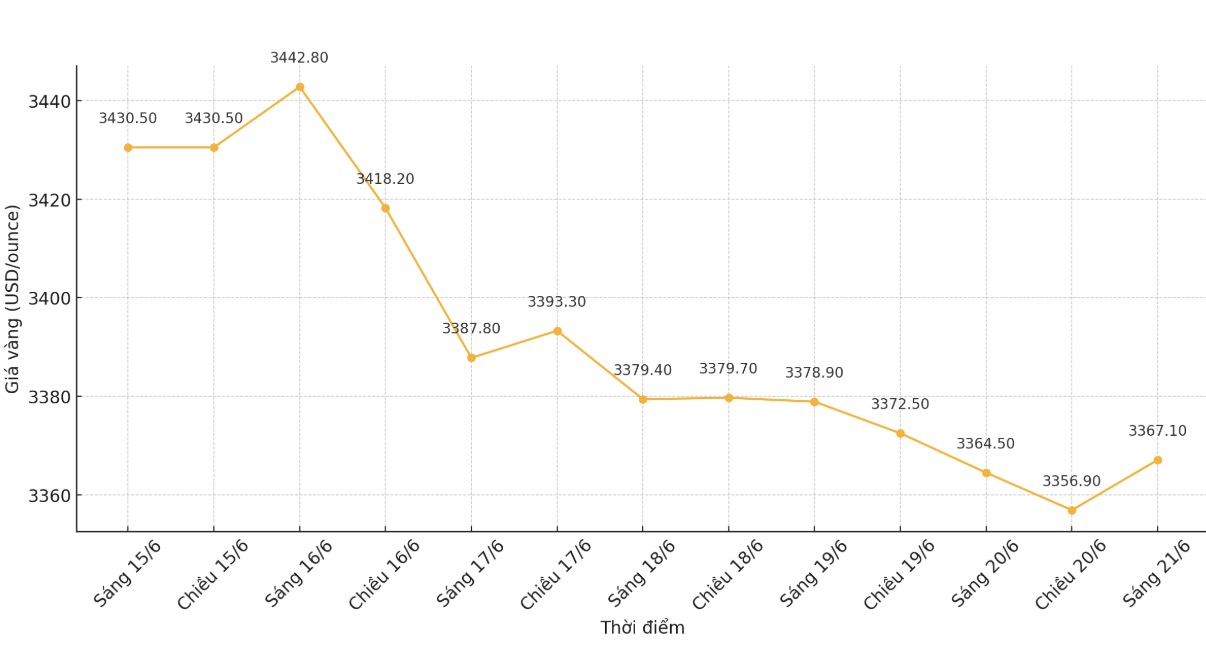

World gold price

At 9:30 a.m., the world gold price was listed around 3,367.1 USD/ounce, up 10.2 USD compared to 1 day ago.

Gold price forecast

World gold prices continued to decline as short-term futures traders felt uneasy as the weekend approached and began taking profits.

Citigroup forecasts gold prices could fall below $3,000/ounce by the end of the year. The nearly 30% increase in gold prices this year has attracted strong attention from investors, as more and more analysts target gold prices up to 4,000 USD/ounce. However, not all banks are optimistic about gold.

In the latest report, commodity analysts at Citigroup (a US multinational financial group) lowered their gold price forecasts and warned investors that the precious metal could fall below $3,000/ounce by the end of the year.

According to the new report, Citigroup has adjusted its gold price target for the next 0-3 months to 3,300 USD/ounce, instead of 3,500 USD/ounce as before. At the same time, they also lowered their gold price forecast for the next 6-12 months to 2,800 USD/ounce, down from the previous 3,000 USD/ounce.

The latest spot gold price recorded at 3,369.54 USD/ounce, almost unchanged compared to the previous session. Citi's year-end target means a decrease of about 16% compared to the current price.

Analysts believe that gold's safe-haven appeal will gradually decrease as we move into 2026, as economic conditions improve.

We see that investment demand for gold will weaken by the end of 2025 and 2026, when support for US President Donald Trump and the country's growth momentum are effective, especially as the US midterm election approaches, Citigroup experts said.

In that warehouse, Christopher Vecchio - Head of futures and foreign exchange at Tastylive.com, said gold is still in a long-term uptrend. However, Mr. Vecchio added that the speculative positioning shows some short-term challenges for this metal.

Its hard to see gold maintaining a breakehead above $3,400 an ounce as everyone is bullish on the metal. We can see that many people are buying gold and many are also selling USD. This creates an obstacle for gold at the moment, the expert said.

Mr. Mike McGlone - senior macro strategist at Bloomberg Intelligence - commented that gold is still one of the few large assets that maintain strength in the context of instability. According to him, the adjustment of gold prices from the peak of 3,454 USD/ounce to around 3,370 USD/ounce is just a necessary consolidation phase, not a signal to reverse the trend.

Usually, when the market hits historical highs, prices will accumulate before continuing to rise. I think gold is currently expressing that model, Mr. McGlone shared.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...