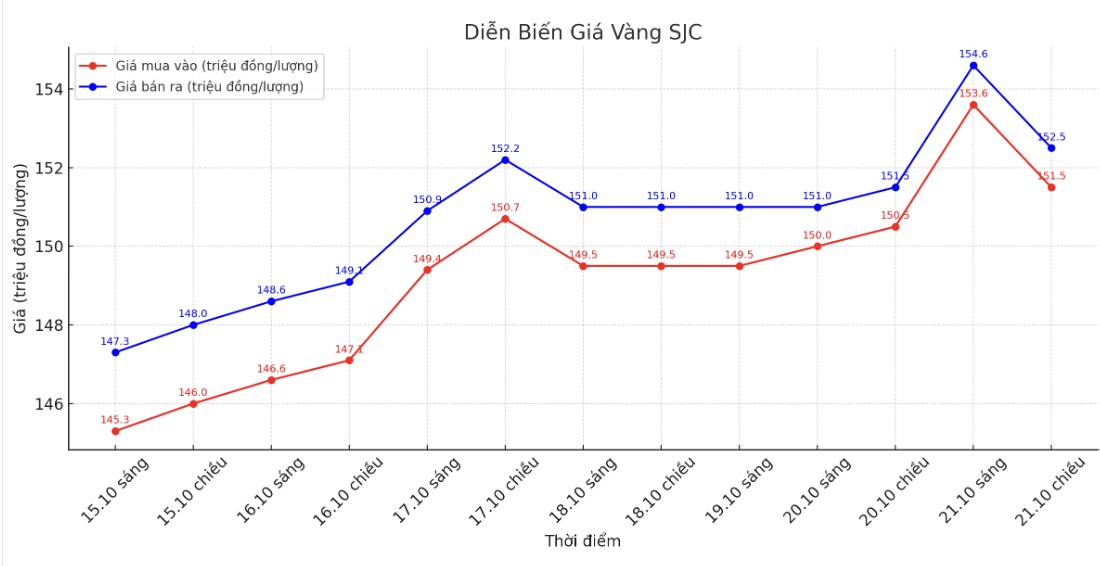

SJC gold bar price

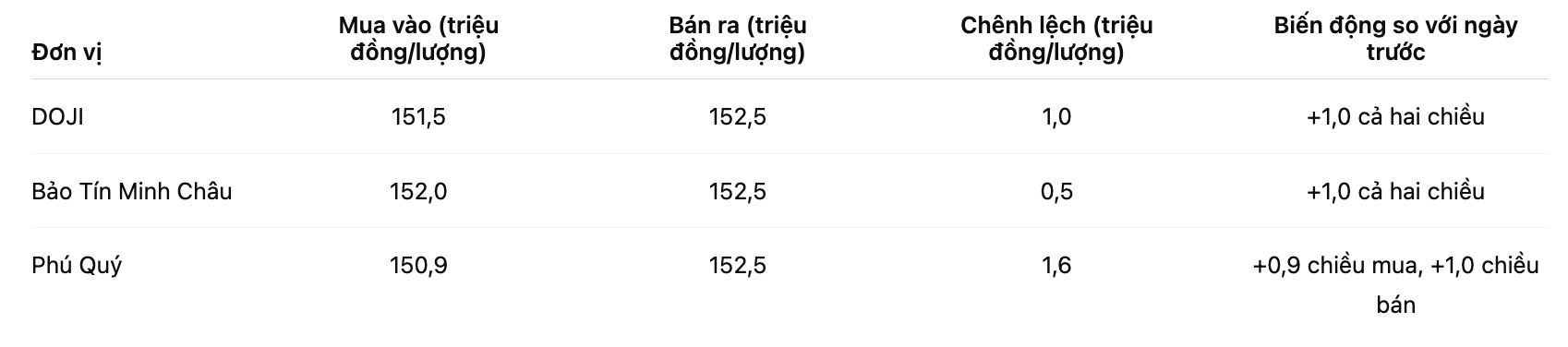

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at 151.5-152.5 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling prices is at 1 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 152-152.5 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling prices is at 500,000 VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 150.9-152.5 million VND/tael (buy - sell), an increase of 900,000 VND/tael for buying and an increase of 1 million VND/tael for selling. The difference between buying and selling prices is at 1.6 million VND/tael.

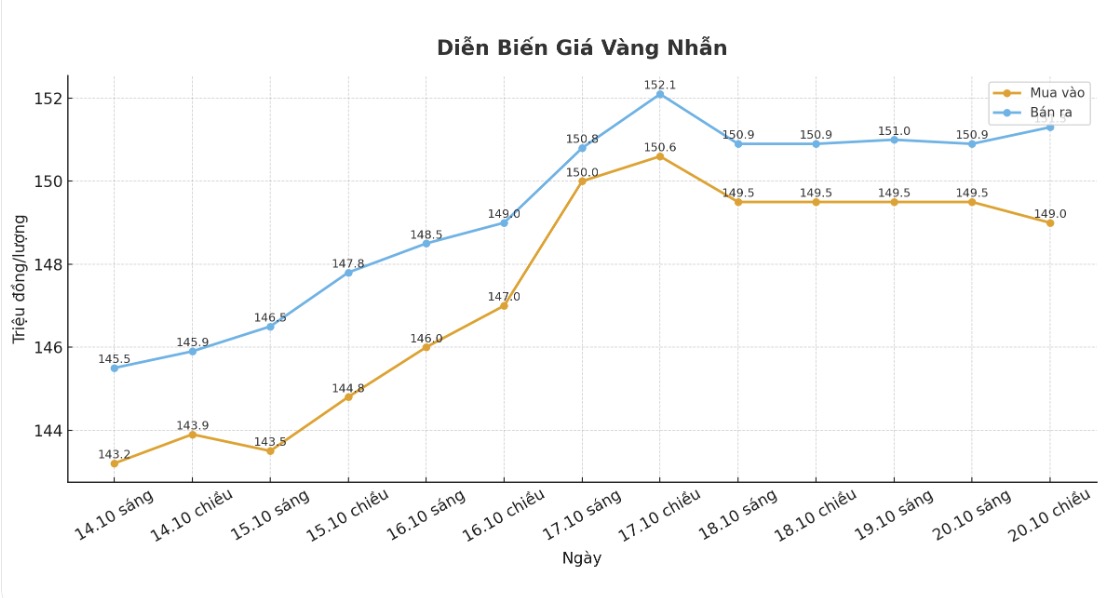

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 149.8-152.4 million VND/tael (buy - sell), an increase of 800,000 VND/tael for buying and an increase of 1.1 million VND/tael for selling. The difference between buying and selling is 2.6 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 156.5-159.5 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 149.5-152.5 million VND/tael (buy - sell), an increase of 500,000 VND/tael for both buying and selling. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

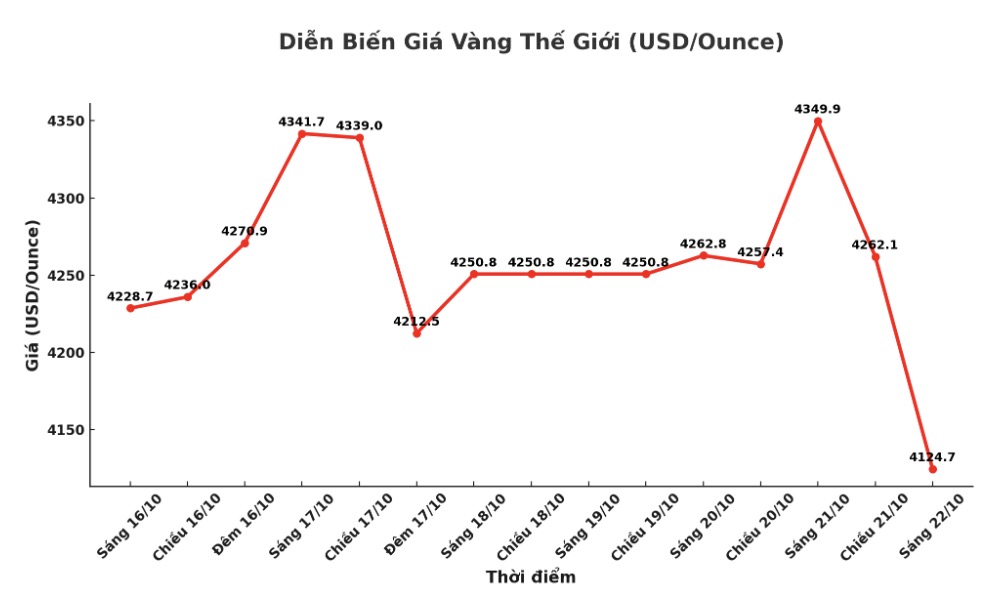

World gold price

Recorded at 6:00 a.m., the world spot gold price was listed at 4,124.7 USD/ounce, down 221.9 USD.

Gold price forecast

Gold prices are under intense selling pressure, the market recorded a panic of selling to cut losses and meet deposit calls from short-term speculators on the futures exchange.

Jim Wyckoff - senior analyst at Kitco commented that a more positive risk-taking sentiment this week also puts the safety of safe-haven metals at a disadvantage. US stock indexes recovered strongly, approaching the recent record peak.

Meanwhile, TD Securities commodity analysts said: This adjustment is simply a profit-taking. In our opinion, the positions are currently at extreme levels: algorithms have stopped buying, risk balance funds and volatility control funds have all reached their limits, macro funds have almost fully disbursed, central bank purchasing power has decreased significantly quarter-on-quarter, individual investors have participated at the highest level in a decade, while China has temporarily stopped buying. The profit-taking process will continue.

expert Fawad Razaqzada of City Index and FOREX.com believes that today's sell-off is too late, given the scale of this year's price increase. Many people may wonder why they have to wait so long? After a series of continuous increases, investors have finally begun to take profits, whether proactive or passive, he said. Profit-taking and buying positions have created real selling pressure after a long period of price movement in one direction only.

Technically, Mr. Razaqzada said he is monitoring support levels of $4,100, $4,080 and $4,060/ounce. If it breaks through these levels, gold could retreat to the psychologically important level of $4,000/ounce, he said.

Ole Hansen, head of commodity strategy at Saxo Bank, wrote on social media that gold prices could fall to $3,973 without affecting the long-term uptrend. He added that silver could fall to $47.8/ounce in the current context.

Technically, December gold contracts are weakening rapidly and strongly. The next upside target for buyers is to close above the solid resistance level at the peak of the contract also a record 4,398 USD/ounce. Meanwhile, the sellers aim to pull the price below the important support level of 4,000 USD/ounce.

The nearest resistance zone is at 4,200 USD/ounce and 4,250 USD/ounce; supported at 4,093 USD/ounce and 4,000 USD/ounce respectively.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...