Updated SJC gold price

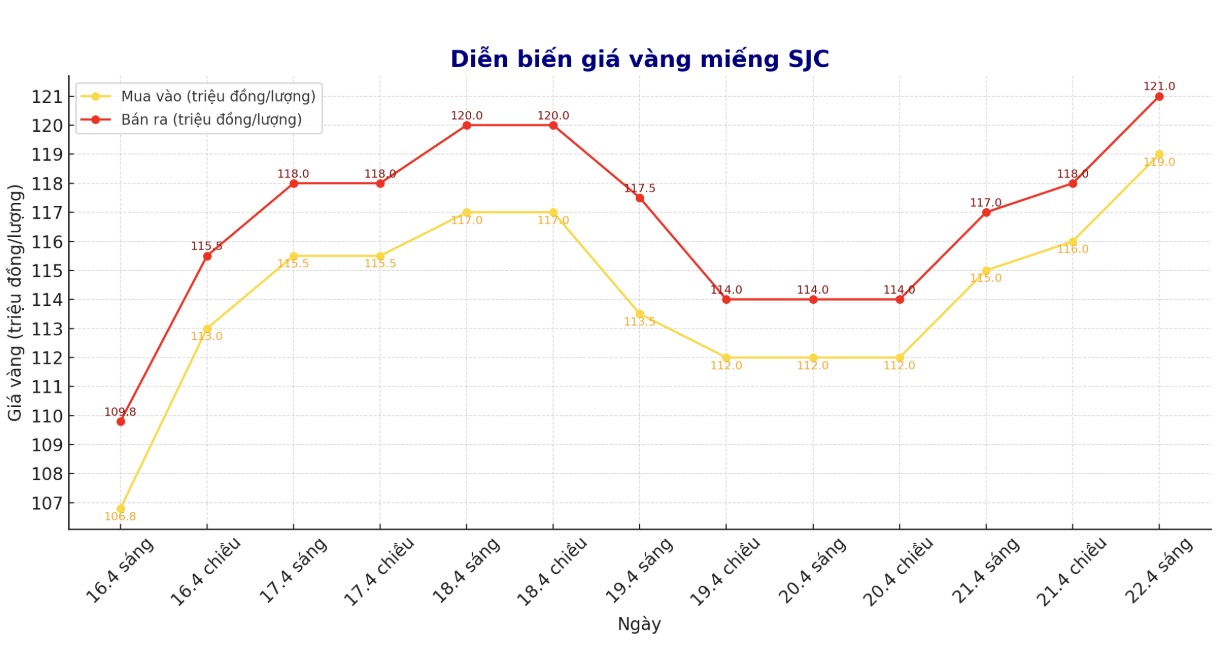

As of 9:15 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND119-121 million/tael (buy - sell), an increase of VND4 million/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, DOJI Group listed the price of SJC gold bars at 119-121 million VND/tael (buy - sell), an increase of 4 million VND/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 119-121 million VND/tael (buy - sell), an increase of 4 million VND/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

9999 round gold ring price

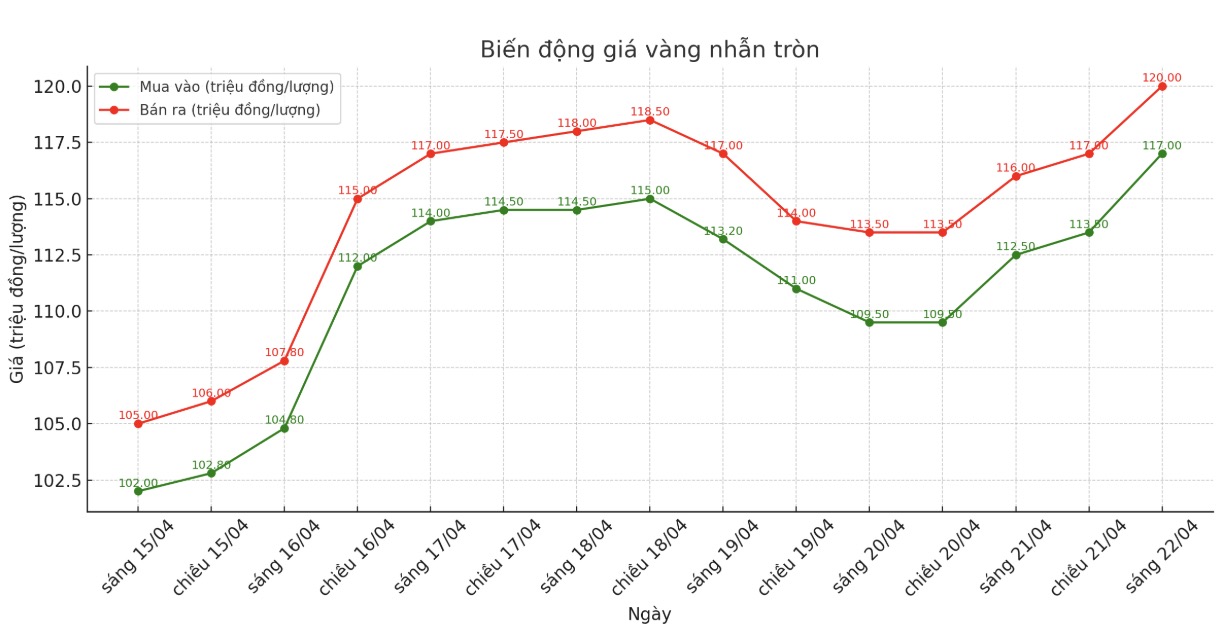

As of 9:15 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 117-120 million VND/tael (buy - sell), an increase of 4.5 million VND/tael for buying and an increase of 4 million VND/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 118-121 million VND/tael (buy - sell), an increase of 5 million VND/tael for buying and an increase of 4 million VND/tael for selling. The difference between buying and selling is 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed to an excessively high level, causing risks for individual investors to increase.

In the context of many fluctuations in the world gold market, the large difference between buying and selling in the domestic market is a clear warning sign. If gold prices turn down, buyers will face a huge loss. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

At 8:50 a.m., the world gold price listed on Kitco was around 3,374.3 USD/ounce, up sharply to 47.3 USD.

Gold price forecast

World gold prices increased sharply, surpassing the historical $3,400/ounce for the first time, as the market fluctuated strongly following President Donald Trump's new criticism of the US Federal Reserve's (FED) policies.

According to Kitco, gold prices continue to increase strongly, investors flock to gold as demand for other traditional safe-haven assets, including the USD and US bonds, weakens.

Investors flock to safe-haven assets, including gold and the Swiss francs. US major stock indexes fell more than 3% as the president continued to attack Fed Chairman Jerome Powell.

This came after a series of criticisms on April 17, when the US President accused the Fed president of "playing politics" for not cutting interest rates. The US president also suggested that he had the right to fire Mr. Powell "very quickly" and looked forward to the day the Fed chairman would leave.

I think the US economy could slow unless interest rates are cut immediately, Trump said on Monday, continuing previous criticism of Powells monetary policy.

"With geopolitical volatility and uncertainty continuing to driven risk-off sentiment, investors are increasingly turning to gold as a strategic haven," said analysts at State Street Global Advisors, a marketing firm at GLD.

"Gold has gained strongly since hitting the 50-day moving average early last week. We consider the recent rally as the result of an adjustment after gold prices rose sharply in late December.

This upside potential makes us believe that gold could surpass $3,500 an ounce," said Alex Kuptsikevich, chief market analyst at FxPro, in a recent note.

Economic data to watch

Wednesday: Preliminary manufacturing and services PMI, new home sales in the US.

Thursday: Long-term goods orders, weekly jobless claims, US home sales.

See more news related to gold prices HERE...