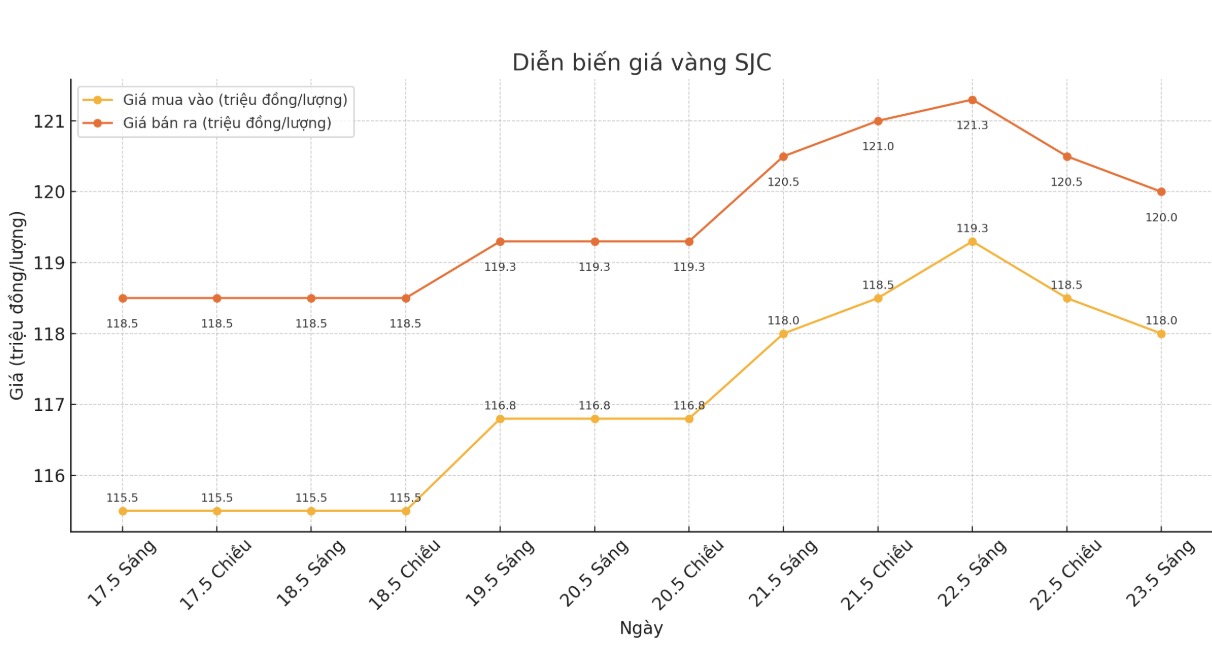

Updated SJC gold price

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND118-120 million/tael (buy in - sell out), down VND1.3 million/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 118-120 million VND/tael (buy in - sell out), down 1.3 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118-120 million VND/tael (buy in - sell out), down 1.3 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 117-120 million VND/tael (buy - sell), down 1.3 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

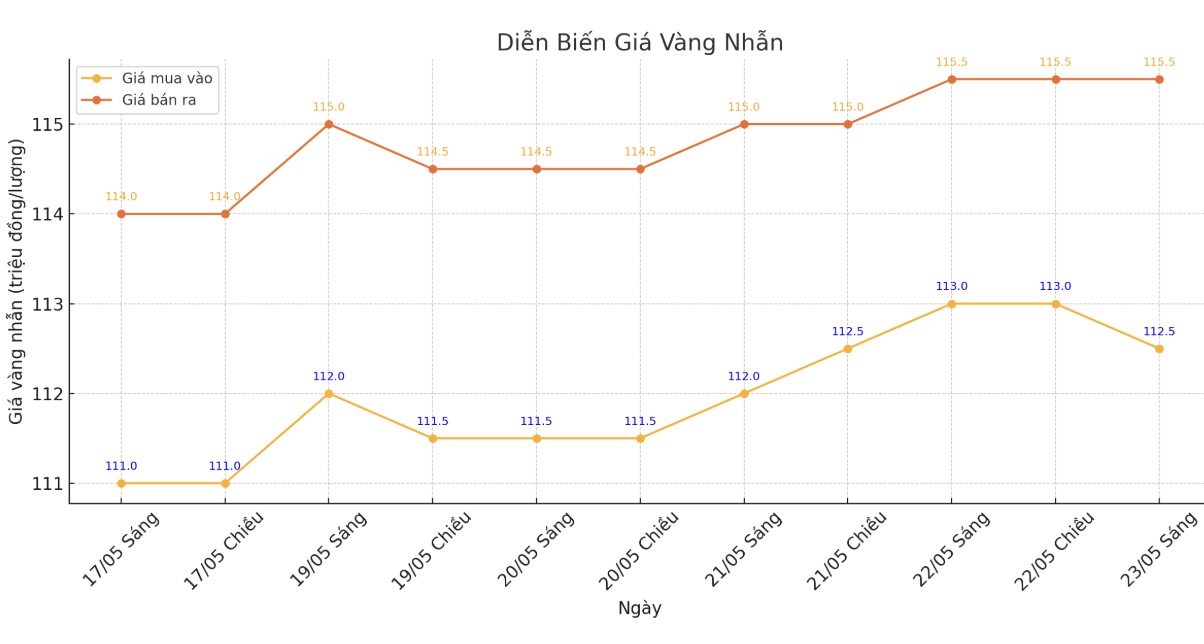

9999 round gold ring price

As of 9:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 112.5-125.5 million VND/tael (buy - sell), down 500,000 VND/tael for buying and kept the same for selling. The difference between buying and selling prices is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114.5-117.5 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 112.5-125.5 million VND/tael (buy in - sell out), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

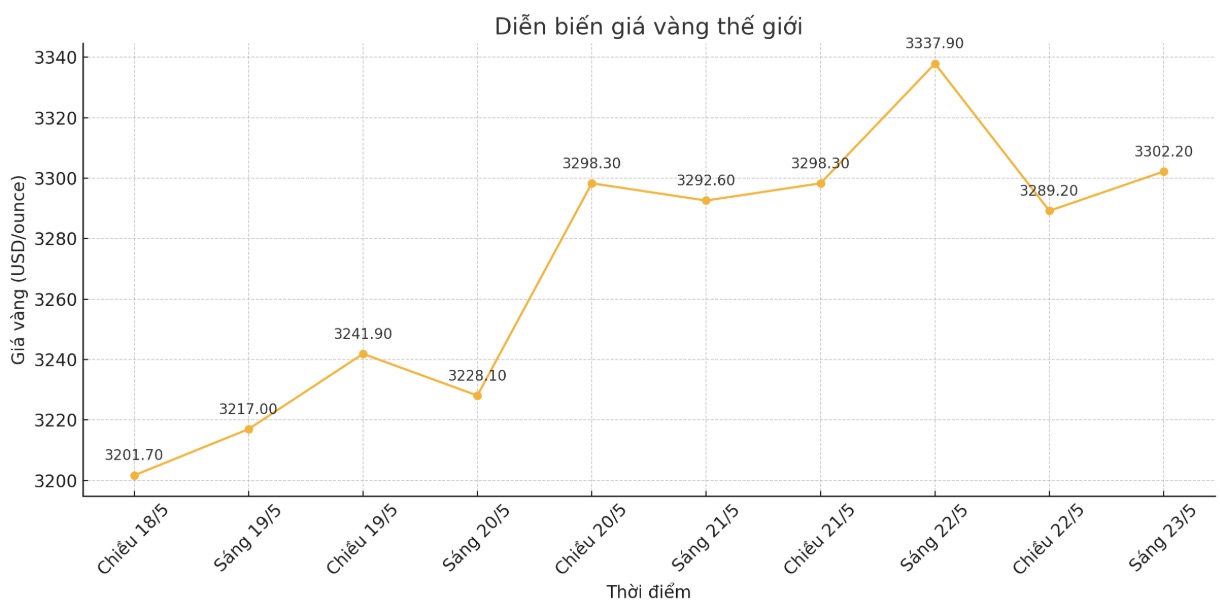

World gold price

At 9:00 a.m., the world gold price listed on Kitco was around 3,302.2 USD/ounce, down 35.7 USD/ounce.

Gold price forecast

On Kitco, gold prices decreased slightly due to profit-taking pressure from short-term contract investors. However, safe-haven cash flow remains positive as the global bond market becomes more volatile.

Golds decline is driven by profit-taking and the US dollars recovery being limited by safe-haven demand as investors are losing confidence in government bonds, said Jim Wycoff - Kitco Metals.

He added that investor concerns increased after US President Donald Trump's major tax bill was passed by only one vote.

According to the Office of the National Assembly's Budget Office, the bill is expected to add about $3.8 trillion to the federal government's $36.2 trillion debt over the next decade. Last week, Moody's downgraded its US national credit rating by one level, raising concerns about the country's growing debt to $36 trillion.

In the context of political and financial instability, gold is expected to continue to play the role of a safe haven asset sought after by investors.

The latest data shows that US business activity accelerated in May, amid the " cooling" US-China trade war. However, Donald Trump's comprehensive tariffs on imported goods have increased prices for businesses and consumers.

OANDA market phuulse analyst Zain Vawda said that trade deals from the US government are expected to be announced in the coming weeks and will play an important role in shaping gold prices for the rest of the year.

In the long term, Suki Cooper - Precious metals analyst at Standard Chartered (a multinational bank headquartered in London, UK) said that the wave of buying through Asian ETFs is the latest important driver for gold prices to increase. However, US economic stimulus measures and easing geopolitical tensions could see gold prices fall by about 10% by the end of the year.

Technically, June gold futures buyers are dominating the short term. The next target for buyers is to push prices above the threshold of 3,400 USD/ounce. Meanwhile, the sellers are aiming to push the price below the 3,123.3 USD/ounce zone.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...