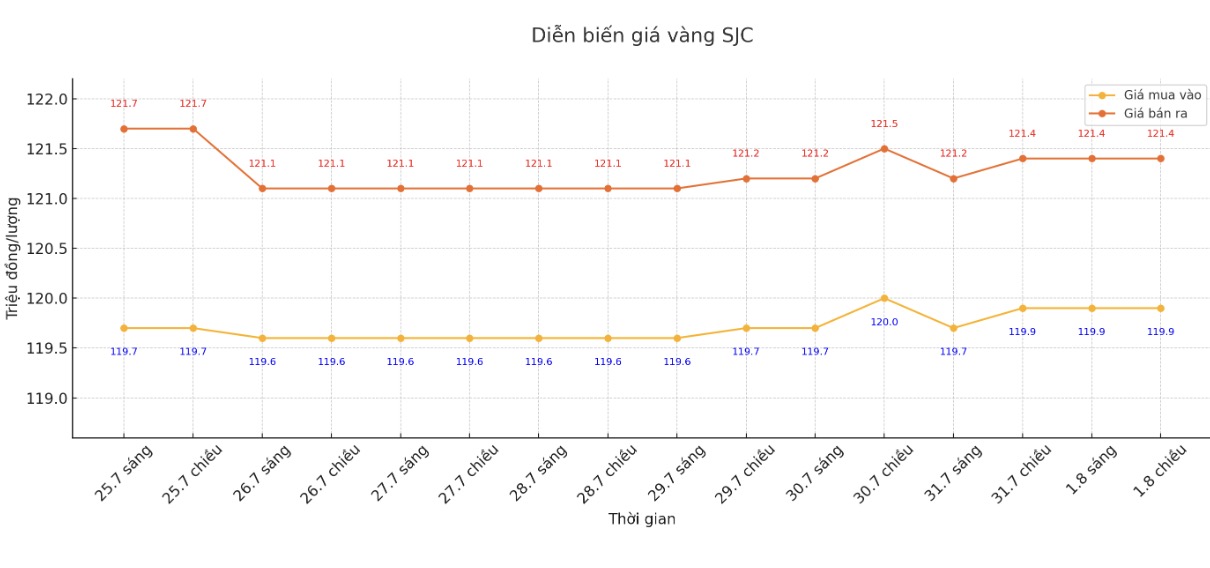

SJC gold bar price

As of 5:18 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 119.9-121.4 million/tael (buy in - sell out); unchanged in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

DOJI Group listed at 119.9-121.4 million VND/tael (buy - sell); unchanged in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 119.9-121.4 million VND/tael (buy in - sell out); unchanged in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at VND 119.4-121.4 million/tael (buy - sell); down VND 500,000/tael for buying and kept the same for selling. The difference between buying and selling prices is at 2 million VND/tael.

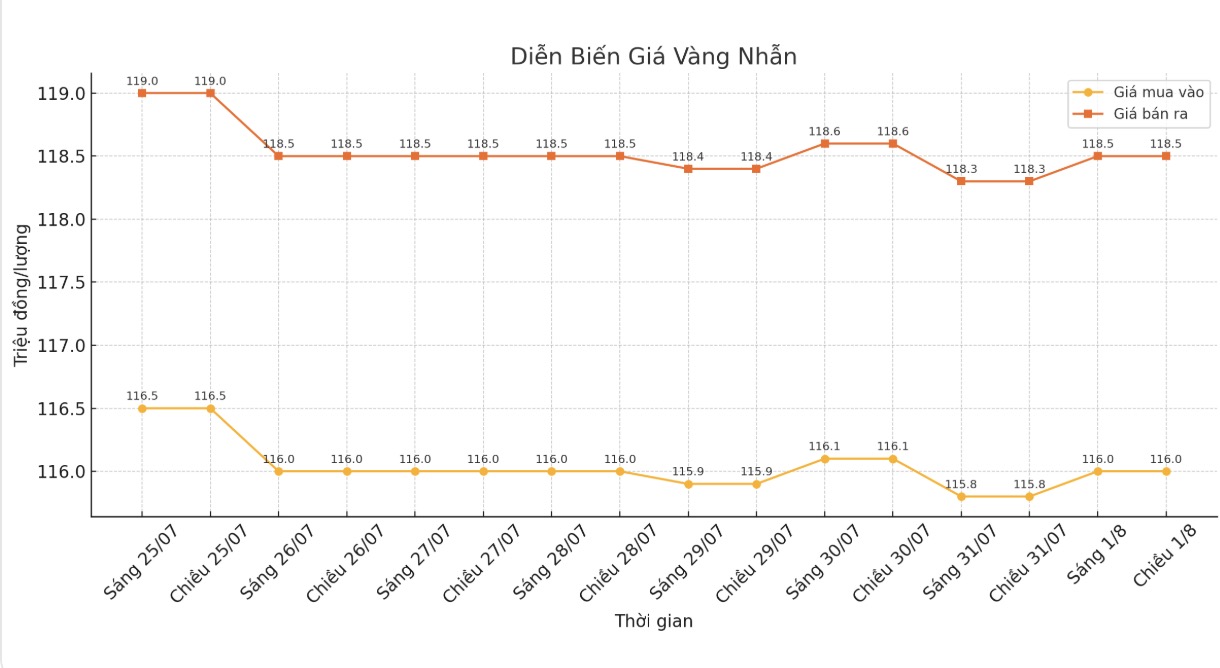

9999 gold ring price

As of 5:18 p.m., DOJI Group listed the price of gold rings at 116-118.5 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.2-119.2 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.9-117.9 million VND/tael (buy - sell), down 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

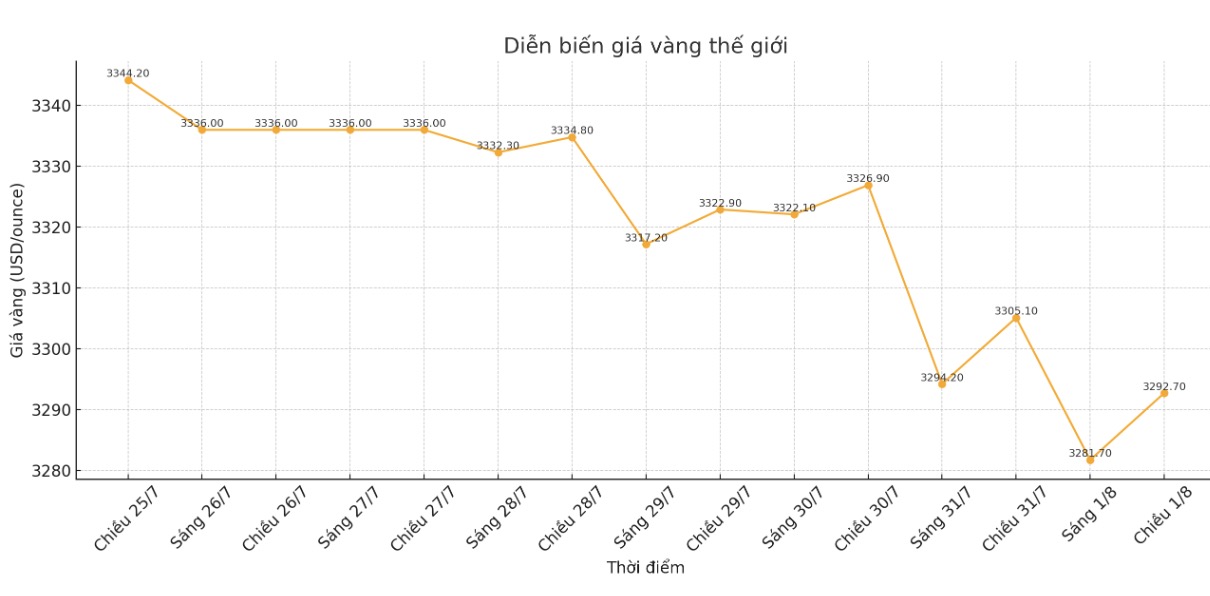

World gold price

The world gold price was listed at 5:18 p.m. at 3,292.7 USD/ounce, down 2.9 USD compared to 1 day ago.

Gold price forecast

After plunging to a one-month low, world gold prices have rebounded, struggling around $3,300/ounce.

This situation occurred despite the latest data showing US inflation increased slightly and the labor market remained stable. These are factors that may delay expectations of the US Federal Reserve (FED) cutting interest rates in the coming time.

According to the US Commerce Department, the core personal consumption expenditure (core PCE) - the Fed's preferred inflation measure - excluding food and energy prices, increased by 0.3% in June, after an increase of 0.2% in May.

Compared to the same period last year, this index increased by 2.8%, higher than the analysts' expectation of 2.7%. bullish inflation also rose 0.3% in June, bringing the whole year's increase to 2.6%.

This data shows that inflationary pressures remain, although not exceeding the forecast. However, the gold market hardly reacted strongly to this report.

Some economic experts believe that the inflation figures are quite in line with expectations, so they do not create pressure for the FED to change its policy immediately. Although still exceeding the FED's 2% target, this increase is not considered large enough to cause concern.

Mr. Tim Waterer - chief market analyst of KCM Trade Financial Services Company - commented that gold prices below 3,300 USD/ounce have created great attraction, encouraging traders to buy. This is especially true in the context of current economic uncertainty, along with threats of additional tariffs from the US President Donald Trump administration.

Mr. Waterer said that the important support level is forming around 3,250 USD/ounce, which is likely to prevent further decline in gold prices. However, he warned that if this threshold is broken, gold prices could fall to $3,200/ounce.

Peter Grant - Vice President and senior metals strategist at Zaner Metals - said: "We are witnessing increased trade uncertainty as the expiration date of the tariffs on August 1 is approaching. It is a slight revival of safe-haven demand."

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...