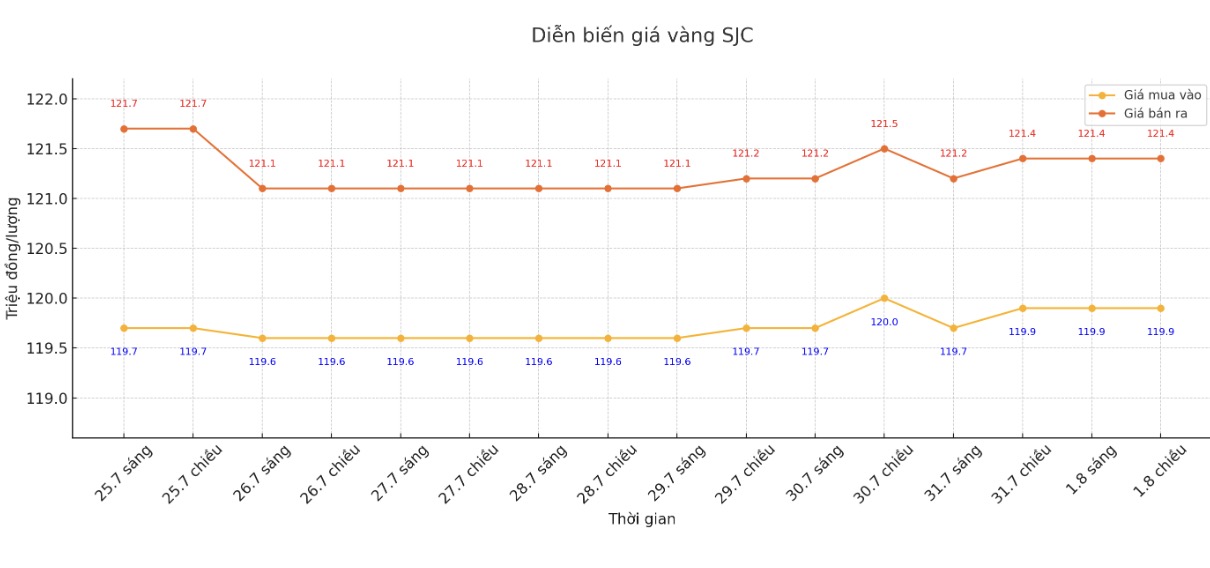

SJC gold bar price

As of 6:00 a.m. on August 2, the price of SJC gold bars was listed by Saigon Jewelry Company at VND 119.9-121.4 million/tael (buy in - sell out); unchanged in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

DOJI Group listed at 119.9-121.4 million VND/tael (buy - sell); unchanged in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 119.9-121.4 million VND/tael (buy in - sell out); unchanged in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at VND 119.4-121.4 million/tael (buy - sell); down VND 500,000/tael for buying and kept the same for selling. The difference between buying and selling prices is at 2 million VND/tael.

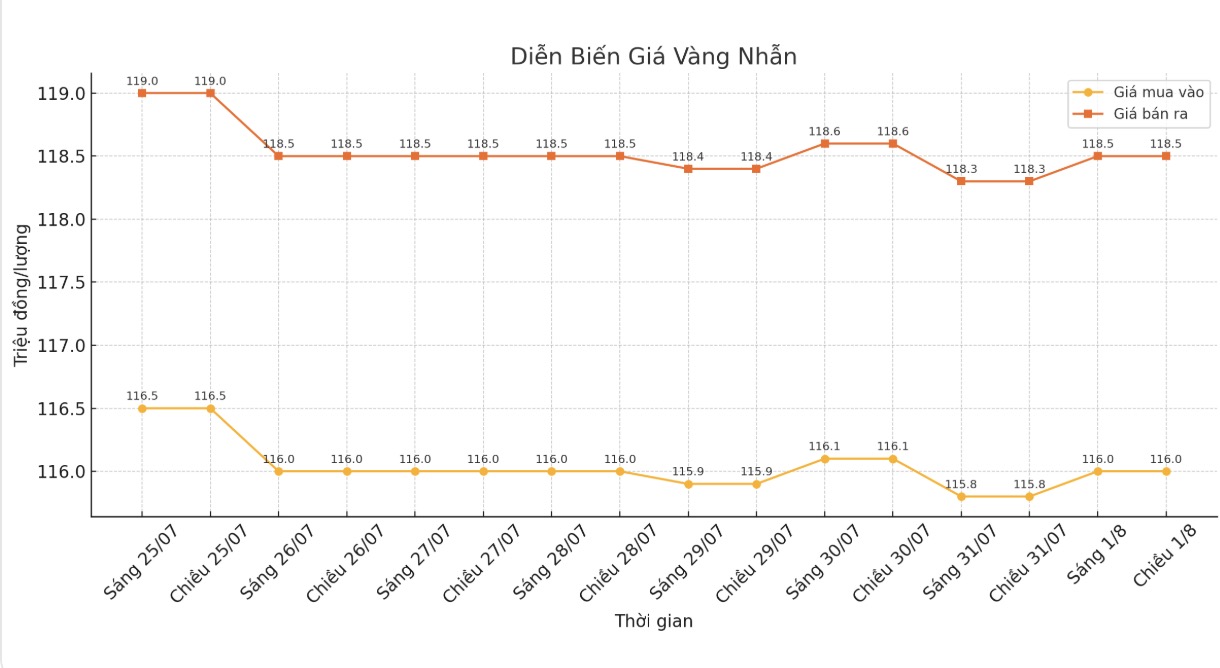

9999 gold ring price

As of 6:00 a.m. on August 2, DOJI Group listed the price of gold rings at 116-118.5 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.2-119.2 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.9-117.9 million VND/tael (buy - sell), down 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

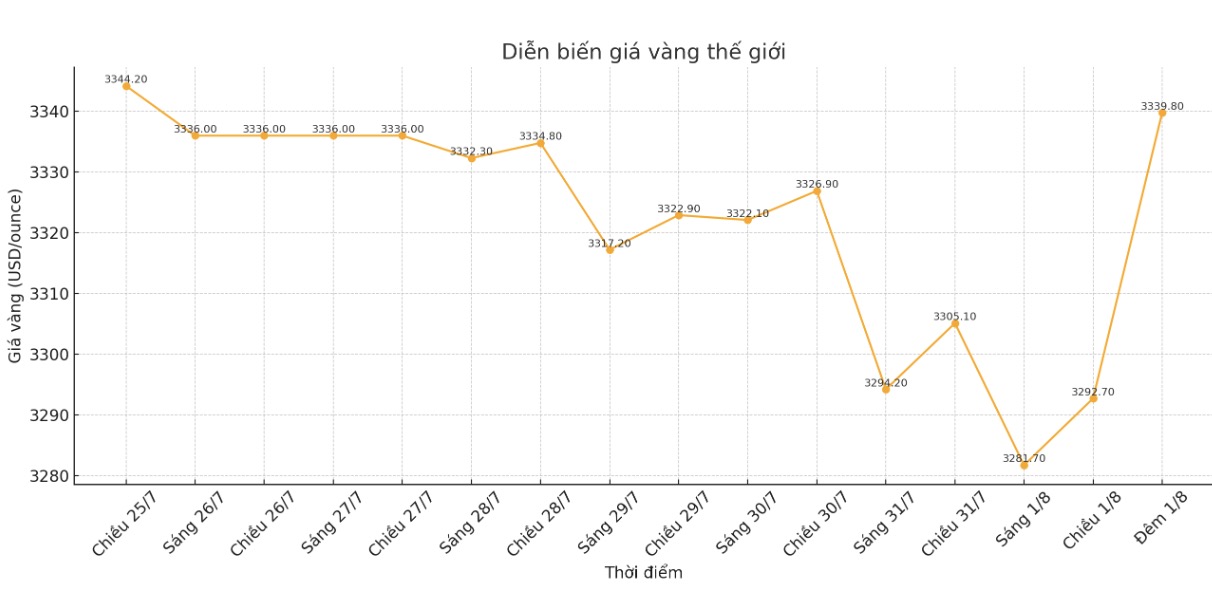

World gold price

The world gold price was listed at 11:30 p.m. on August 1 at 3,339.8 USD/ounce, up 46.2 USD compared to 1 day before.

Gold price forecast

Gold prices increased sharply in the first trading session of Friday in the US, after the US Department of Labor released a gloomy economic report, leaning towards those who support loose monetary policy. December gold contract increased by 48.6 USD to 3,397.2 USD/ounce.

The US July employment report is considered the most important indicator of the month, showing that the number of non-farm jobs increased by only 73,000,000, much lower than the forecast of about 100,000 jobs.

The unemployment rate increased slightly from 4.1% to 4.2%. Notably, revised figures for May and June showed up to 258,000 jobs were cut compared to the initial report, making the 73,000 figure for July even weakest. The market is now predicting a 75% chance that the Federal Reserve will cut interest rates at its September meeting.

Todays report is important, but more than the employment data, I think we need to focus on the unemployment rate, Priya Misra, portfolio manager at JP Morgan, said.

According to her, for the FED to have a reason to cut interest rates, there needs to be clear evidence that the labor market is weakening - something that has now been confirmed.

In another development, US President Donald Trump has announced a series of new tariffs imposed on dozens of countries. The basic tax rate for many countries remains at 10% as the tax rate in April.

In the outside market, the USD Index fell sharply after the employment report. Nymex crude oil is almost flat around 69.25 USD/barrel. The yield on the 10-year US government bond fell sharply to 4.299%, from a higher level before the report was released.

Technically, December gold futures still have a short-term technical advantage. The next target for buyers is to close above the strong resistance level of 3,509 USD/ounce (peak in July). The bears will try to push prices below the strong support level of $3,300/ounce.

The initial resistance was at $3,400/ounce, followed by $3,450/ounce. For now, the weekly bottom is $3,350 and next is $3,331.40 an ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...