Updated SJC gold price

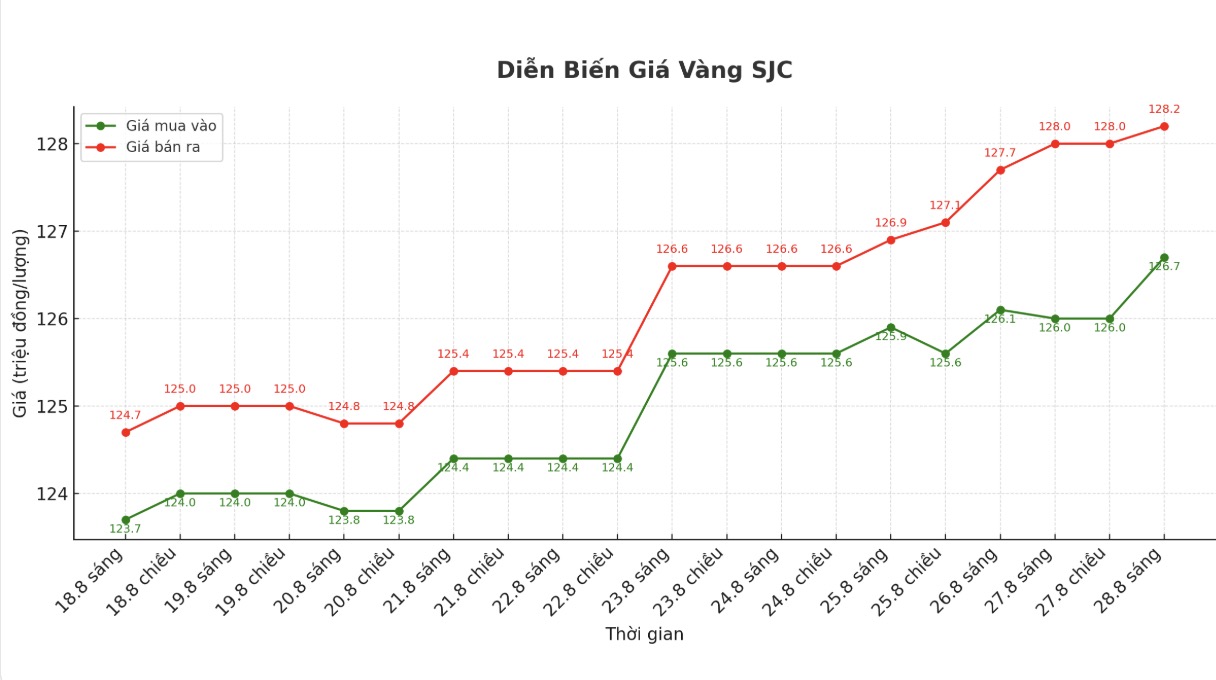

As of 9:10 a.m., DOJI Group listed the price of SJC gold bars at 126.7-128.2 million VND/tael (buy - sell), an increase of 700,000 VND/tael for buying and an increase of 200,000 VND/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 126.7-128.2 million VND/tael (buy - sell), an increase of 700,000 VND/tael for buying and an increase of 200,000 VND/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 125.7-128.2 million VND/tael (buy - sell), an increase of 300,000 VND/tael for buying and an increase of 200,000 VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

9999 round gold ring price

As of 9:10 a.m., DOJI Group listed the price of gold rings at 120-123 million VND/tael (buy - sell), an increase of 400,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 120-123.2 million VND/tael (buy - sell), an increase of 200,000 VND/tael for buying and an increase of 400,000 VND/tael for selling. The difference between buying and selling is 3.2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 119.8-122.8 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

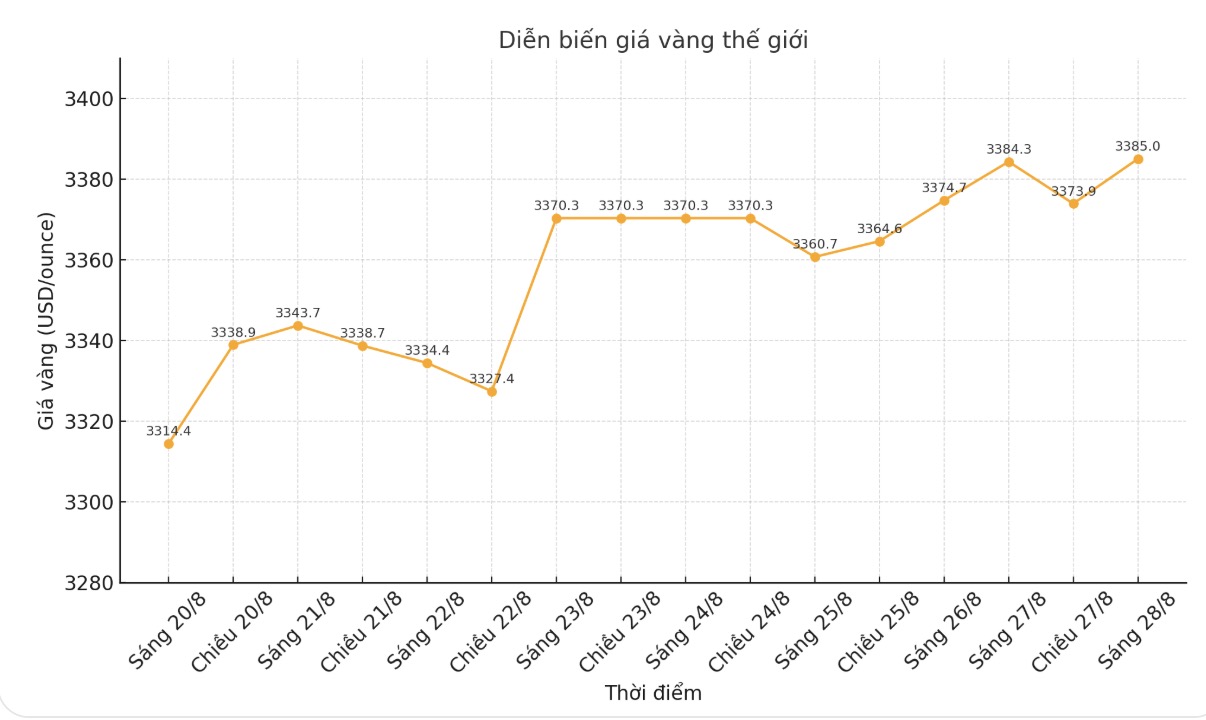

At 9:00 a.m., the world gold price was listed around 3,385 USD/ounce, not much change compared to a day ago.

Gold price forecast

After several consecutive sessions of increasing to a two-week peak, in response to the signals of policy easing from US Federal Reserve Chairman Jerome Powell as well as the increasing pressure of US President Donald Trump on the US central bank, gold prices have turned to decrease.

However, the decrease is quite small as safe-haven demand continues to hold the supporting foundation. The US PCE (used to measure inflation) released on Friday is expected to orient the gold market, with a consensus forecast of 2.6% for the overall index and 2.9% for the core index.

In the coming time, analysts warn that any erosion of the Fed's independence could boost demand for gold as a hedge against policy risks.

In addition, global geopolitical and trade tensions are still persistent and are expected to continue to increase the safe-haven value of precious metals.

According to Schroders (a global asset management corporation headquartered in London - UK), this increase could continue due to inflationary pressures and pessimism towards the USD.

We continue to view gold positively, seeing it as a tool for diversification in the context of volatile policies, fragile budgets and declining confidence in US government bonds as well as the US dollar, Schroders experts said. Golds portfolio insurance role remains intact.

Schroders also noted that the global stock market is underrated for risks, especially in terms of growth and inflation. This makes the investment environment susceptible to "shock" in the coming months.

Tavi Costa, partner and micro- Strategist at Crescat Capital, said that a rare convergence in gold demand from both Eastern and Western economies is prompting a significant price increase for this precious metal.

Speaking at the 2025 PDAC Conference in Toronto, the expert said that historical comparisons suggest that the possibility of a strong re-evaluation of gold is well-founded.

Costa highlighted his company's latest report, which looks at the possibility of gold prices rising to unusually highs if the US revalues its gold reserves against the amount of government bonds in circulation.

Costa also pointed out that central banks have hoarded gold at a 50-year high since the global financial crisis, while US gold reserves are currently at a 30-year low. According to Costa, this difference could put pressure on the US to reconsider its gold policy.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...