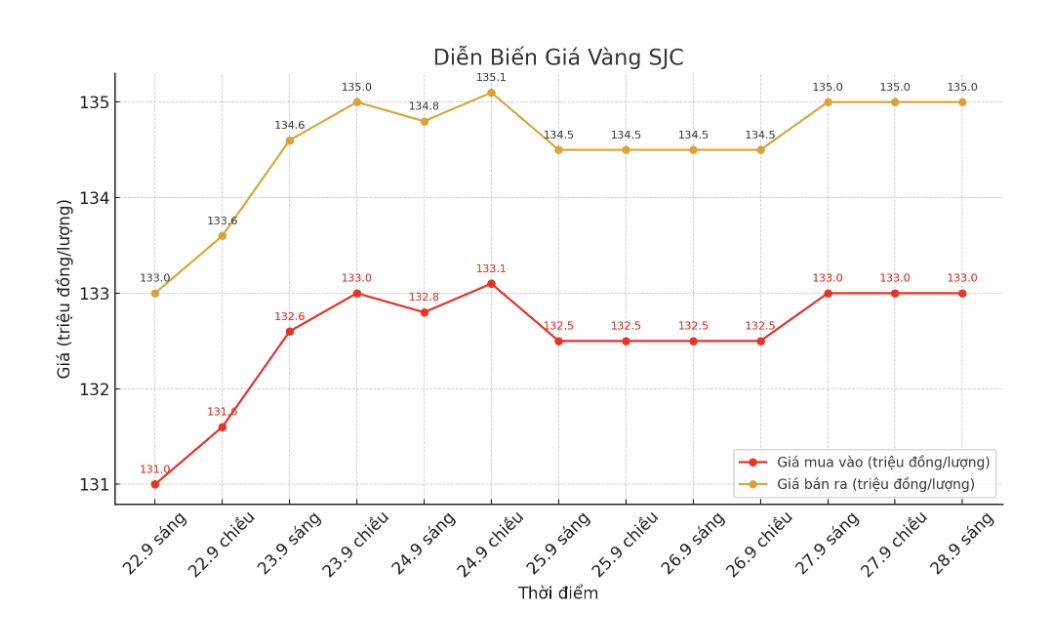

SJC gold bar price

At the end of the trading session of the week, Saigon Jewelry Company SJC listed the price of SJC gold at 133-135 million VND/tael (buy - sell).

Compared to the closing price of the previous trading session (September 21, 2025), the price of SJC gold bars at Saigon Jewelry Company SJC increased by 2 million VND/tael in both directions. The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 133-135 million VND/tael (buy in - sell out).

Compared to a week ago, the price of SJC gold bars was increased by 2 million VND/tael by Bao Tin Minh Chau in both directions. The difference between the buying and selling prices of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

If buying SJC gold at Saigon Jewelry Company SJC and Bao Tin Minh Chau on September 21 and selling it today (September 28), buyers will break even.

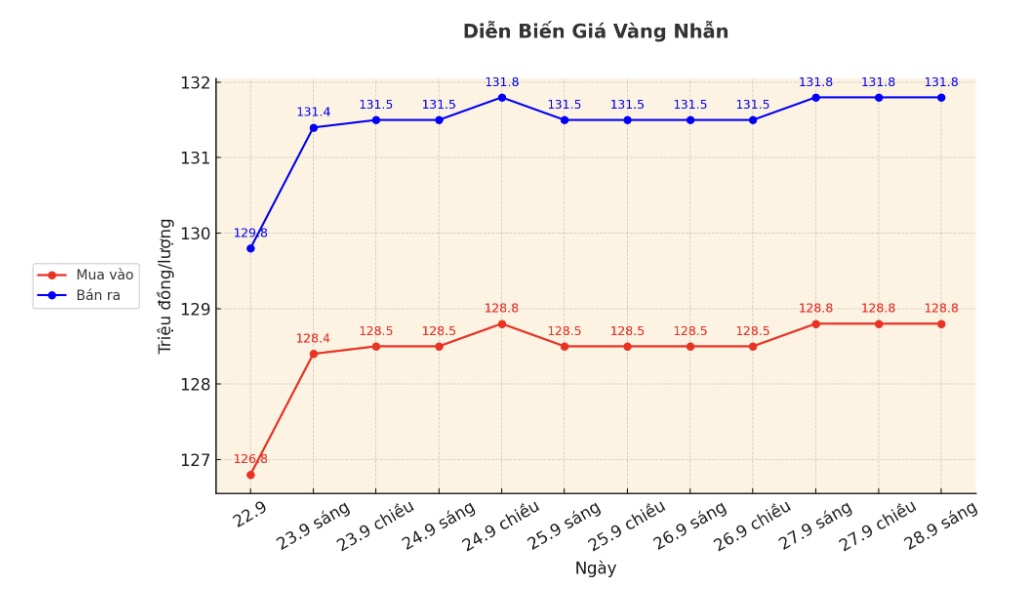

9999 gold ring price

Bao Tin Minh Chau listed the price of gold rings at 129.1-132.1 million VND/tael (buy - sell); increased by 1.9 million VND/tael in both directions. The difference between buying and selling is at 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 128.8-131.8 million VND/tael (buy - sell), an increase of 2 million VND/tael in both directions compared to a week ago. The difference between buying and selling is 3 million VND/tael.

If buying gold rings in the session of September 21 and selling in today's session (September 28), buyers at Bao Tin Minh Chau will lose 300,000 VND/tael. Meanwhile, the loss when buying in Phu Quy is 1 million VND/tael.

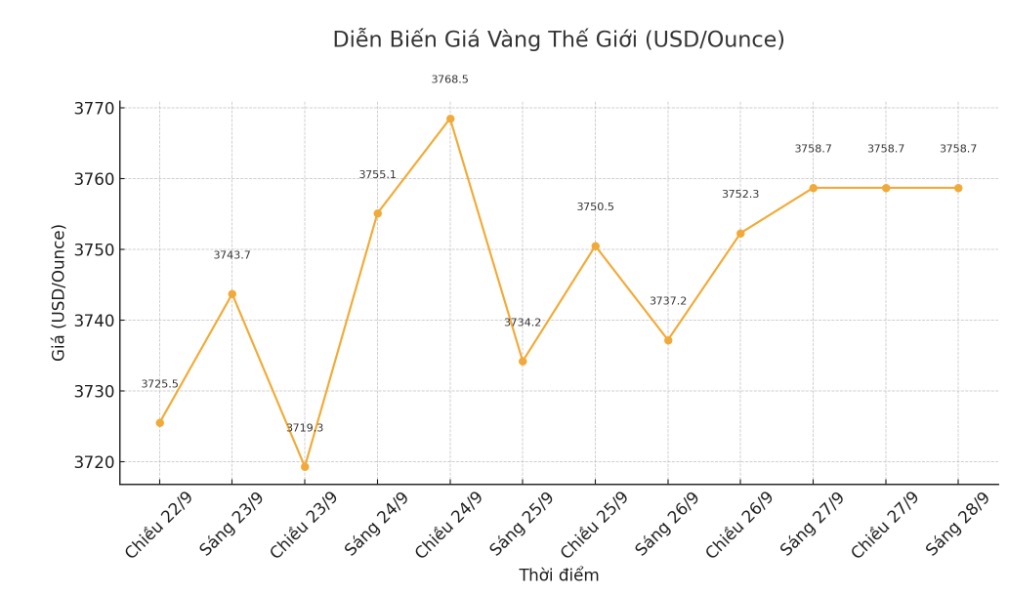

World gold price

At the end of the trading session of the week, the world gold price was listed at 3,758.7 USD/ounce, up 74.7 USD compared to a week ago.

Gold price forecast

The gold survey with Wall Street experts shows unprecedented optimism, after gold prices continued to increase despite many obstacles. While retail investors are also slightly optimistic about the short-term outlook for the precious metal.

This week, 19 experts participated in the survey. Wall Street is particularly confident: 16 experts, equivalent to 84%, predict gold prices will continue to increase next week, no one predicts prices to decrease. The remaining three, or 16%, see prices moving sideways.

Meanwhile, the online poll received 265 votes from individual investors. Although optimism has also increased, the level is still far from the professional level: 166 people, equivalent to 63%, predict that gold prices will continue to increase next week; 56 people (21%) predict prices will decrease; and 43 people (16%) believe that prices will stabilize around the current level.

According to Neils Christensen - an analyst at Kitco News, as many investors and countries lose confidence in the USD, US Treasury bond yields will increase. In this context, gold is still considered the last global monetary asset. Therefore, the latest price increase comes as prices are close to record levels.

Barbara Lambrecht - commodity analyst at Commerzbank - commented that the market may need a new "fire" to push prices above $3,800, for example, a US jobs report disappointed for the third consecutive time. However, she predicted that the US labor market may improve slightly.

Although optimism is dominant, some experts advise investors to be cautious at the current price.

David Morrison - senior analyst at Trade Nation - warned: "The yesterday MacD index is still too much to buy. Gold may need to adjust deeper or move sideways for a while to accumulate more momentum before reaching a new peak. However, I believe gold will soon hit a new record before creating a long-term peak.

Economic data to watch next week

After a week of worsening inflation figures but not enough to deter market interest rate cuts, as well as gold's increase. The focus of the market next week will shift to the labor market.

There will be a report on Pending Home Sales in August on Monday, followed by JOLTS job recruitment data and the consumer confidence index (consumer Confidence) on Tuesday.

On Wednesday morning, the market waited for the ADP (ADP Nonfarm Payrolls) private employment report, along with the manufacturing manufacturing manufacturing PMI (ISM) to be released later. Thursday will see data on the number of weekly jobless claims.

All of this information is seen as a stepping stone for the September non-farm payrolls report released on Friday morning, as investors want to know if the weakening trend of previous months will continue and whether the Fed can continue to cut interest rates in October. The ISM Services PMI will close the week's data series.

See more news related to gold prices HERE...