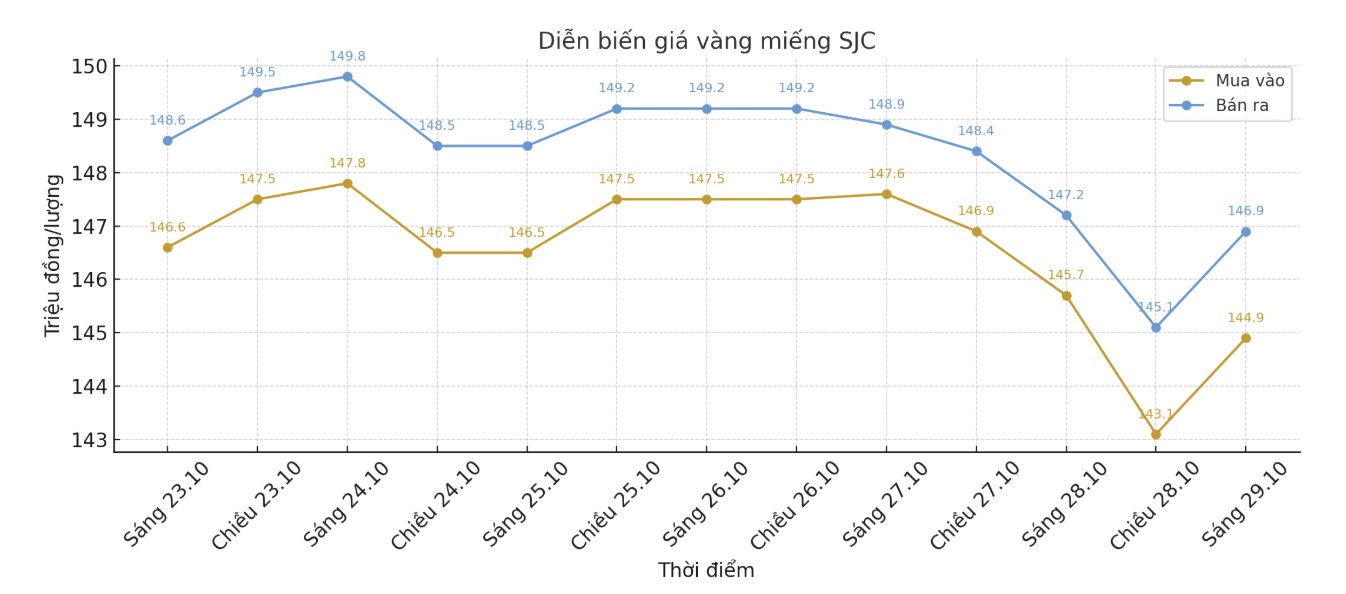

Updated SJC gold price

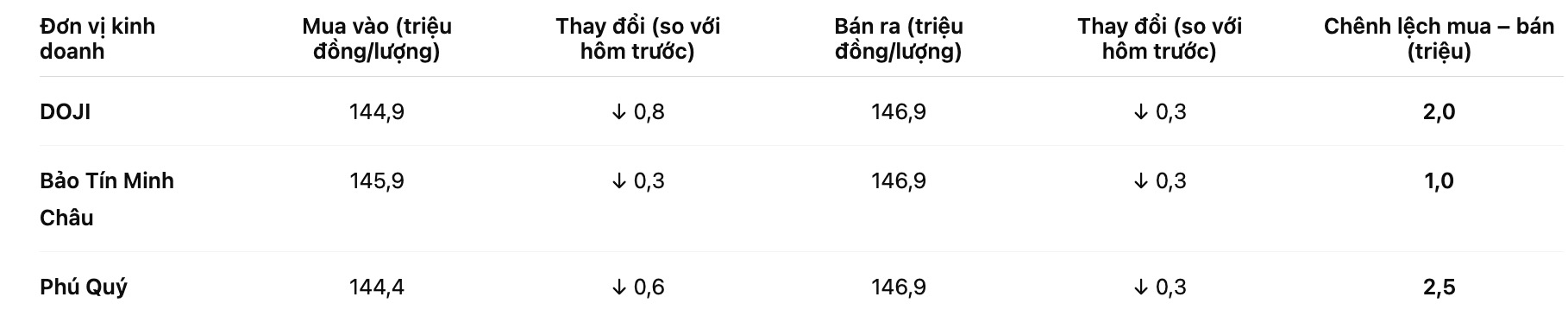

As of 9:00 a.m., DOJI Group listed the price of SJC gold bars at VND144.9-146.9 million/tael (buy - sell), down VND800,000/tael for buying and VND300,000/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 145.9-146.9 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling prices is at 1 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at VND 144.4-146.9 million/tael (buy - sell), down VND 600,000/tael for buying and down VND 300,000/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

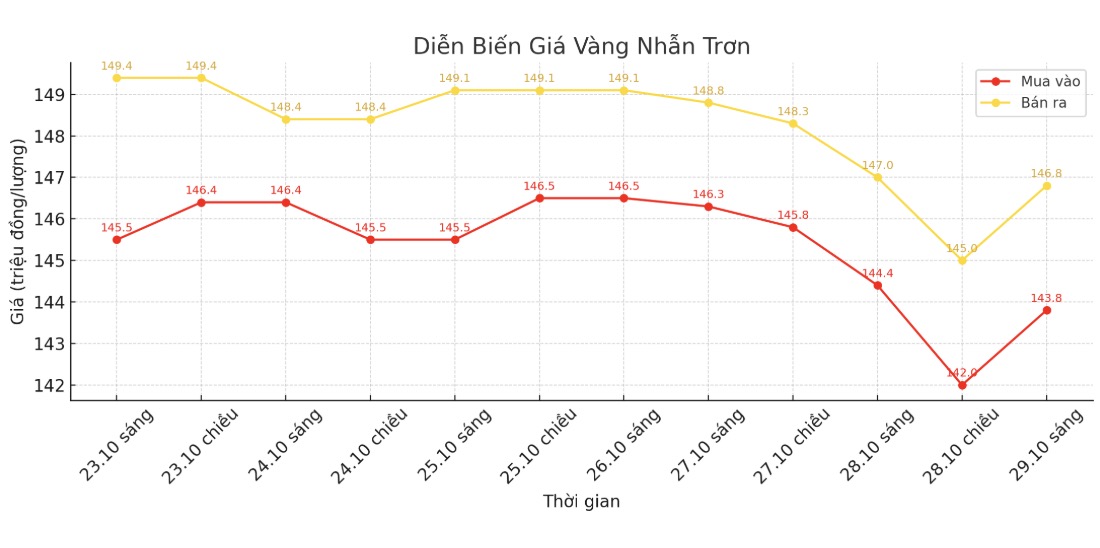

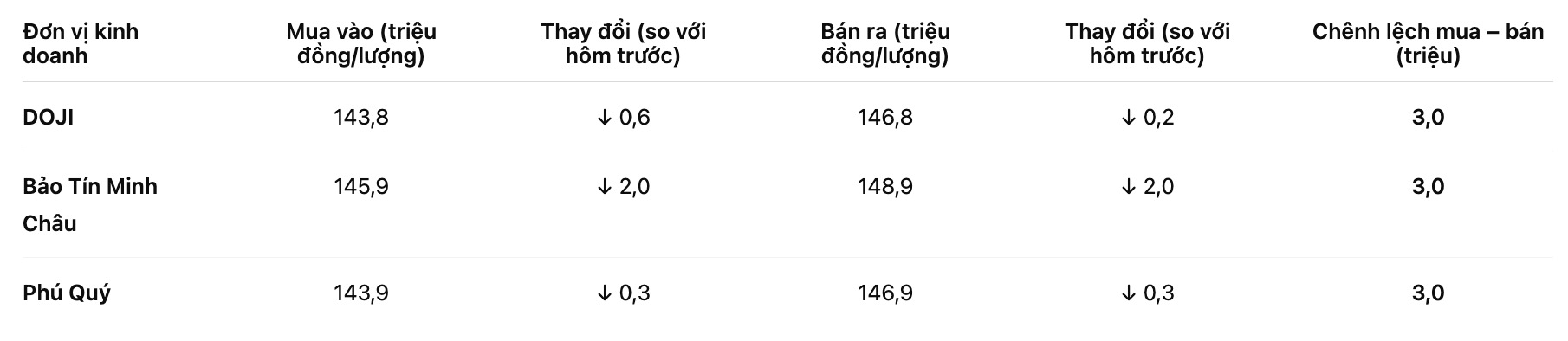

9999 round gold ring price

As of 9:00 a.m., DOJI Group listed the price of gold rings at 143.8-146.8 million VND/tael (buy - sell), down 600,000 VND/tael for buying and down 200,000 VND/tael for selling. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 145.9-148.9 million VND/tael (buy - sell), down 2 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 143.9-146.9 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

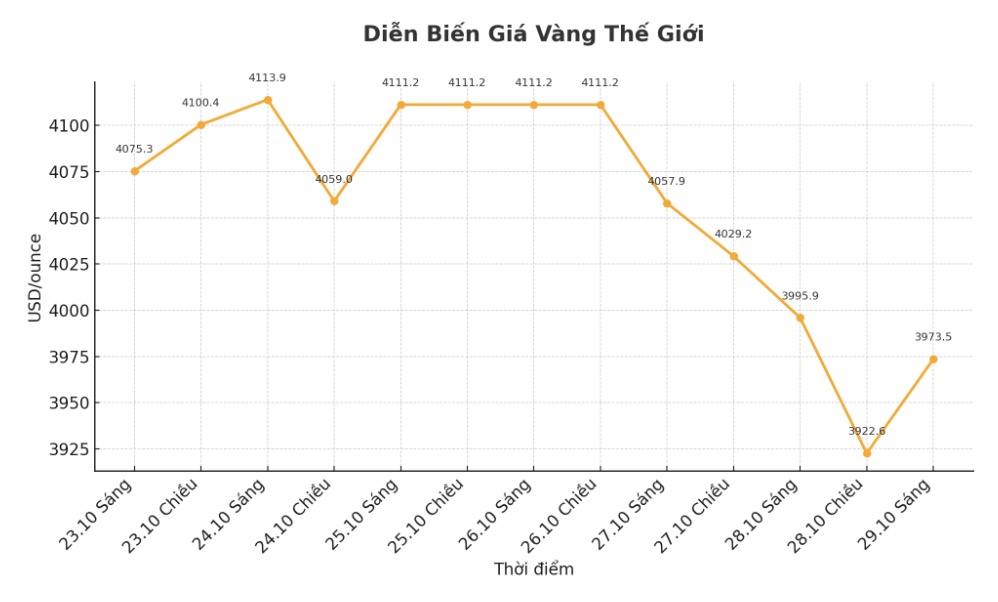

World gold price

At 9:00 a.m., the world gold price was listed around 3,973.5 USD/ounce, down 15.5 USD.

Gold price forecast

Gold prices hit a three-week low in the overnight trading session as the US and China approached a major trade deal, risk-off sentiment returned to the market, pushing US stock indexes to a new record high.

The global stock market last night had mixed movements, while US stock indexes were forecast to open steadily or increase slightly when the trading session in New York began. The S&P 500 and Nasdaq both set new peaks overnight.

The Federal Open Market Committee (FOMC) meeting began this morning and will end on Wednesday afternoon, with a statement and press conference by FED Chairman Jerome Powell.

Analysts expect the Fed to cut interest rates by another 0.25 percentage points for the second consecutive time to support the job market. However, the Fed is divided internally, with some concerned about too much cutting, while others want to ease further, amid the lack of economic data due to a partial US government shutdown.

After two consecutive years of underestimating gold's potential, investors are now racing the trend as they expect gold prices to approach $5,000/ounce at this time next year, according to the survey results at the 2025 World Conference on Precious metals by the London Gold Market Association (LBMA).

In a survey at the conference, delegates predicted that gold prices will increase to 4,980.3 USD/ounce - equivalent to an increase of about 25% compared to the present. This optimistic outlook is given in the context of gold prices having just dropped sharply to below $4,000 after a strong sell-off, previously setting a record of over $4,360/ounce.

Technically, the next upside target for buyers is to close above the strong resistance zone at $4,100/ounce. On the contrary, the target for the sellers is to pull the price below the solid support level at 3,800 USD/ounce.

The nearest resistance zone was at $4,000/ounce, followed by an overnight peak of $4,034.20. The first support was at $3,900/ounce, followed by $3,850/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...