Updated SJC gold price

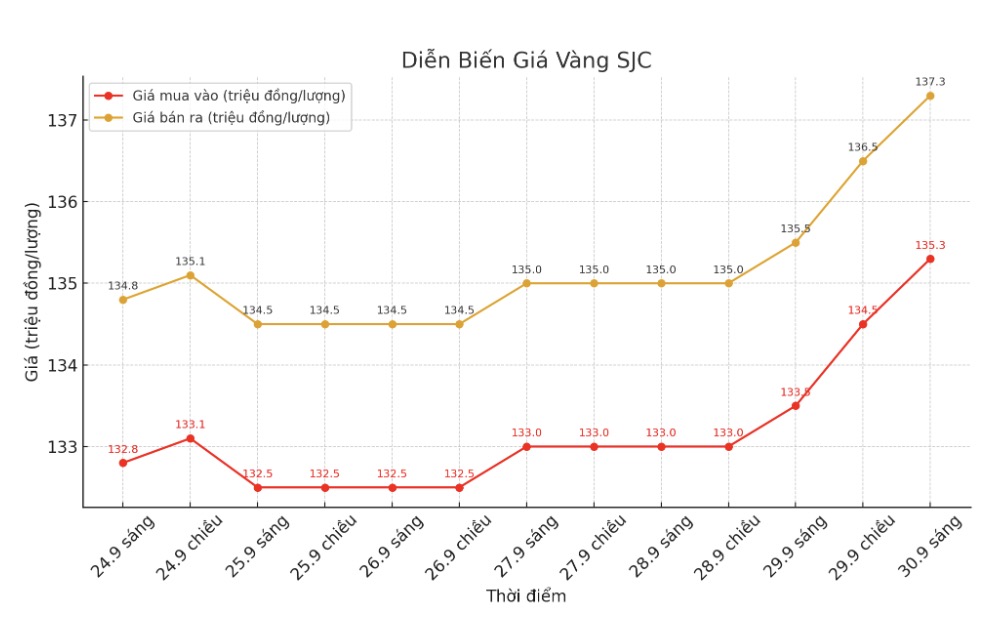

As of 9:08 a.m., the price of SJC gold bars was listed by DOJI Group and Bao Tin Minh Chau at 135.3-137.3 million VND/tael (buy in - sell out), an increase of 1.8 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 134.8-137.3 million VND/tael (buy in - sell out), an increase of 1.8 million VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

9999 round gold ring price

As of 9:15 a.m., DOJI Group listed the price of gold rings at 130.7-133.5 million VND/tael (buy - sell), an increase of 1.6 million VND/tael for buying and an increase of 1.5 million VND/tael for selling. The difference between buying and selling is 2.8 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 131.3-134.3 million VND/tael (buy - sell), an increase of 1.7 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 130.8-133.8 million VND/tael (buy - sell), an increase of 1.8 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

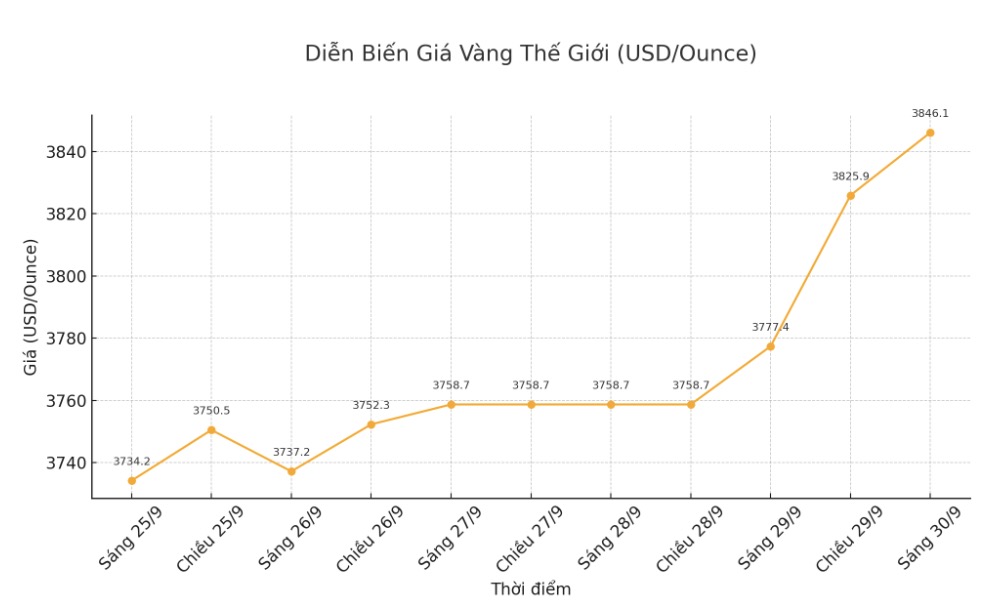

At 9:14, the world gold price was listed around 3,846.1 USD/ounce, up 68.7 USD compared to a day ago.

Gold price forecast

World gold prices increased, silver prices hit a 14-year high as safe-haven demand stood out in the context of the US government's risk of closing in the middle of the week.

US congressional leaders will meet with President Donald Trump at the White House today to discuss a temporary spending bill before the deadline to avoid government closures on October 1.

In another development, precious metals analysts at Heraeus said that China and India are recording strong gold imports even as prices hit record highs, while depleted silver inventories are driving upward, and the limited supply of platinum is likely to continue to support further price increases.

This week, many organizations and Wall Street experts still predict that world gold prices will continue to increase. That is because the US Federal Reserve (FED) plans to cut interest rates twice more in the rest of 2025 and continue to cut interest rates next year to support economic growth.

According to the FedWatch tool of financial services company CME, traders are now betting on a 90% chance of a rate cut in October and a 65% chance of another rate cut in December.

Adrian Day - Chairman of Adrian Day Asset Management said: "Gold prices will increase this week. The economic story in the US is gradually changing, although newly released reports on consumer spending and inflation do not support that. In fact, retail sales data adds reason to the Fed's reluctance to cut interest rates further in October, which could disappoint the market - which had already priced another cut. However, the trajectory of the US economy and the speed of interest rate cuts are clearly no longer as important to gold as other factors.

The trend away from the US dollar as a global reserve asset is the most important factor, and that is still continuing. We could see a breakthrough soon, said Adrian Day.

Meanwhile, Kevin Grady - Chairman of Phoenix Futures and Options said that market momentum is currently leaning strongly towards gold prices.

I think the message remains: its all about interest rates, and there will be many cuts. That is what the market is looking for and also what gold is reacting to. In addition, the weakening USD is also pushing gold up, he said.

Technically, December gold futures are still leaning towards buyers in the short term. The next upside target for buyers is to close above the important resistance level of $4,000/ounce. The downside target for the bears is to push prices below the solid support zone of $3,700/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...