Despite the recent rise in the US dollar and interest rates, gold prices still show potential to rise to $3,000 an ounce, according to Ronald-Peter Stoeferle, CEO at Incrementum AG.

Speaking at the Future Minerals Forum in Riyadh, Stoeferle highlighted a shift in the global gold market, with demand increasingly driven by emerging markets.

“The center of the gold world is no longer in Zurich, London or New York,” Stoeferle said. “It is moving to Dubai, Shanghai, Mumbai and even Saudi Arabia.”

He noted that Dubai now accounts for 25% of global gold trade, making it the world's second largest gold market.

Stoeferle also pointed to a difference in views on gold in emerging markets, where the precious metal is seen as a “sound currency” rather than just a trading instrument.

Cultural attachments to gold, like those in India, Türkiye and China, help sustain demand for physical gold even as prices fall. “Nearly two-thirds of physical gold demand now comes from emerging markets,” he said.

It's worth noting that gold has held up well in the current economic climate. Stoeferle pointed out that the US dollar index has risen 4.8% over the past three months. Traditionally, this is a negative for gold, but this time, it hasn't. "Normally, this would be a bad scenario for gold," Stoeferle said. "But gold is holding up very well."

He believes that the gold price rally is only halfway through, as there is still a large amount of capital from Western financial investors that has not yet participated in this rally.

“Any small dip is immediately bought,” he stressed, reinforcing his belief in the upcoming growth momentum. In addition, according to Incrementum AG’s forecasting model, gold prices could approach $3,000 an ounce this year.

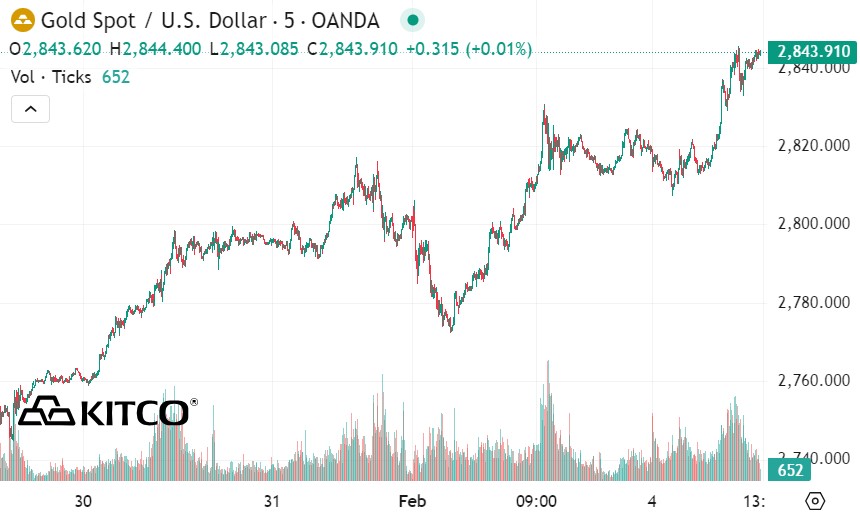

Gold futures for April delivery are trending higher and holding a strong near-term advantage. If bulls continue to control the market, the next target is to push prices above $2,900 an ounce. Conversely, if bears gain the upper hand, they will try to push prices below the weekly low of $2,760.2 an ounce.

In the immediate future, gold's first resistance level is at $2,874.50/ounce, followed by $2,900/ounce. Meanwhile, important support levels are at $2,850/ounce and $2,837.40/ounce.

Important economic data this week

Wednesday: ADP jobs report, US ISM services PMI.

Thursday: Bank of England monetary policy decision, US weekly jobless claims.

Friday: US nonfarm payrolls report, University of Michigan preliminary index of consumer sentiment.