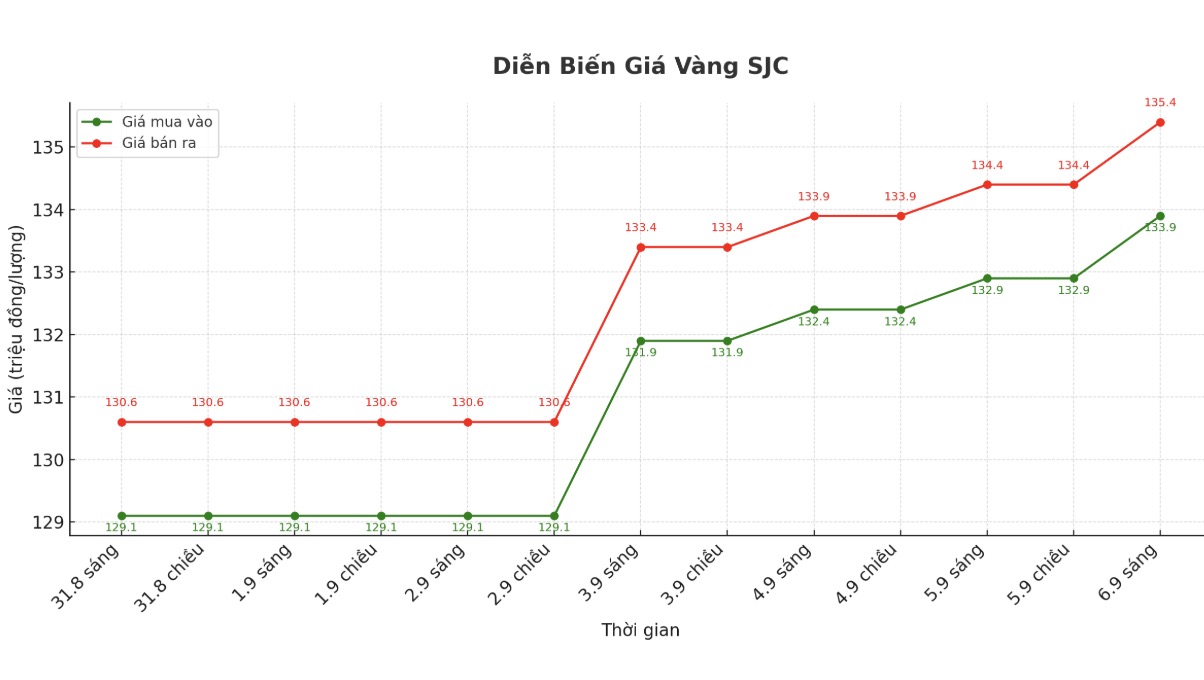

Updated SJC gold price

As of 9:00 a.m., DOJI Group listed the price of SJC gold bars at 133.9-135.4 million VND/tael (buy in - sell out), an increase of 1 million VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Bao Tin Minh Chau listed the price of SJC gold bars at 133.9-135.4 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 132.9-135.4 million VND/tael (buy in - sell out), an increase of 1 million VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

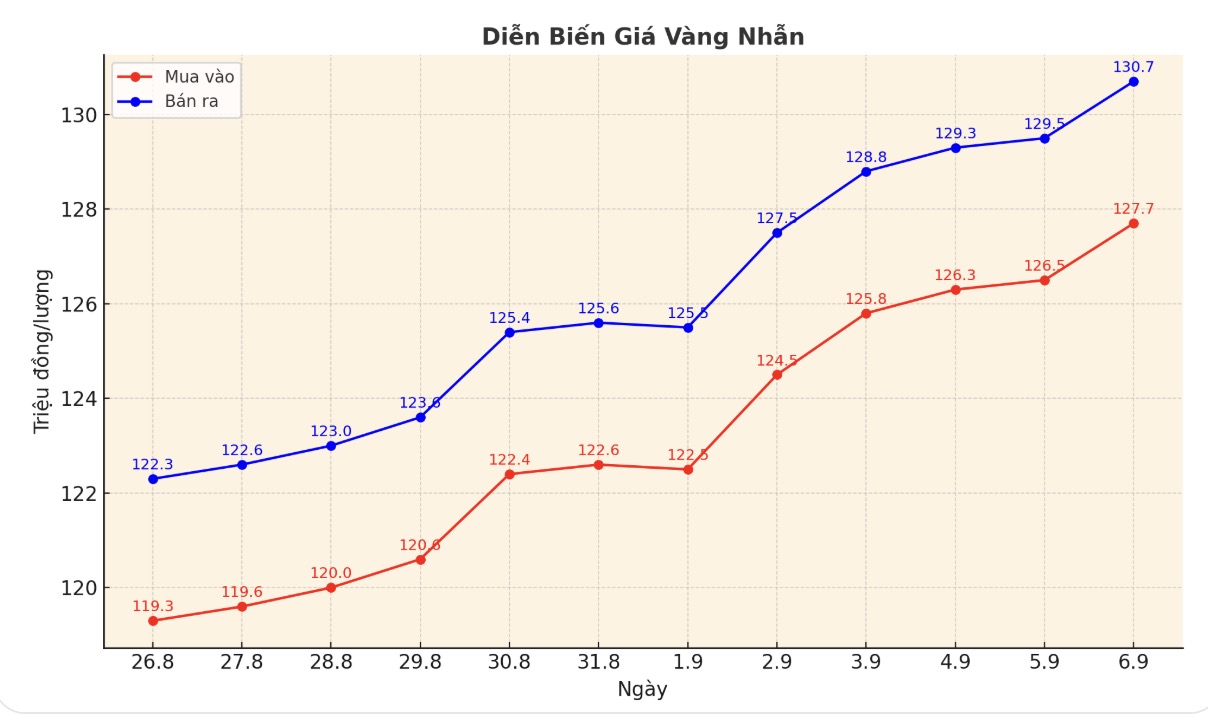

9999 round gold ring price

As of 9:45 a.m., DOJI Group listed the price of gold rings at 127.7/30.7 million VND/tael (buy - sell), an increase of 1.2 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 127.8-130.8 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 127.5-130.5 million VND/tael (buy in - sell out), an increase of 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

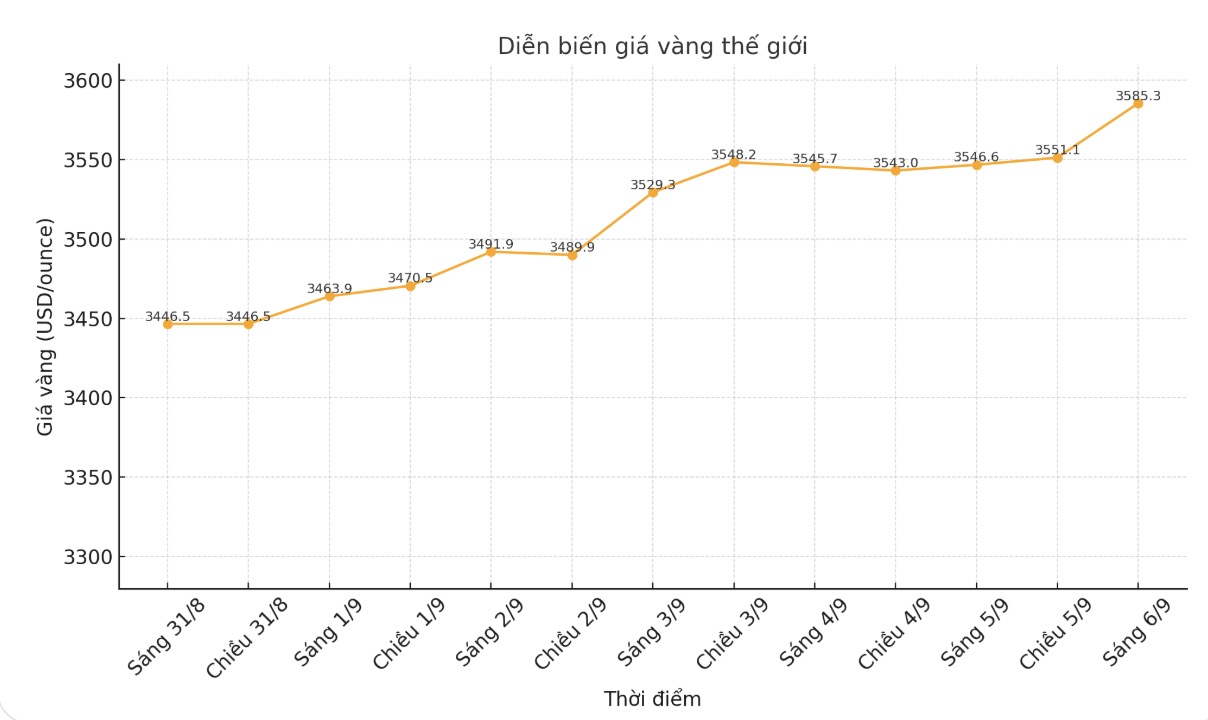

World gold price

At 9:05, the world gold price was listed around 3,585.3 USD/ounce, up 38.7 USD compared to a day ago.

Gold price forecast

World gold prices increased sharply last night after an important US economic report showed signs of weakness.

The August employment report just released by the US Department of Labor shows that the number of non-farm jobs increased by only 22,000, much lower than the expectation of 75,000.

The unemployment rate is at 4.3%, in line with market forecasts. This report reinforces the view of the "puppet" in US monetary policy, who want to lower interest rates faster.

After the report, the market now expects the US Federal Reserve (FED) to cut a total of three cuts of 0.25 percentage points this year.

According to CME Group's FedWatch tool, traders are now almost certain that the Fed will cut interest rates by 25 basis points at the end of the two-day policy meeting, which ends on September 17. Gold - non-interest-bearing assets often benefit from a low interest rate environment.

In the latest report, Suki Cooper - Head of Commodity Research at Standard Chartered Bank predicts that gold prices will average about 3,700 USD/ounce in the fourth quarter.

The recent rally has been driven by a series of factors, including tariff concerns, expectations of monetary easing, the growing US public debt burden and concerns about the Feds independence, she said. Gold's safe-haven appeal continues to increase ahead of the US jobs report and the Fed meeting in September.

Cooper stressed that gold not only set a new record against the US dollar but also appreciated against most other major currencies. This widespread demand will continue to support the long-term uptrend.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...