Gold prices increased due to concerns about the independence of the US Federal Reserve (FED) soothing and strong US economic data.

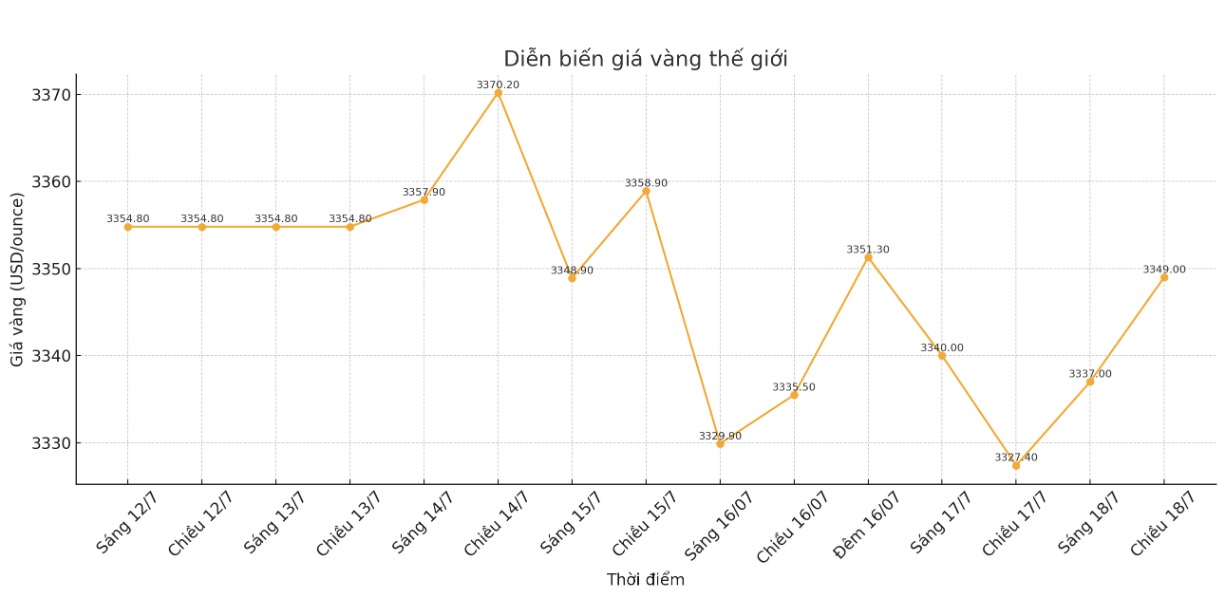

At 15:34 (Vietnam time), spot gold prices increased by 0.3% to 3,349.49 USD/ounce, after falling 1.1% in the previous session. Over the whole week, the precious metal has fallen 0.2%.

US gold futures fell 0.3% to $3,354.70 an ounce.

The USD index fell 0.4% on the day but was still heading for the second consecutive week of increase. A strong US dollar typically makes gold more expensive for buyers holding other currencies.

Earlier, during the week, some sources said that US President Donald Trump was ready to fire FED Chairman Jerome Powell, but Donald Trump later denied the plan despite continuing to criticize current interest rate policy.

Meanwhile, US data showed that retail sales in June increased more strongly than expected, while the number of initial unemployment claims was also more positive than expected.

UBS commodity analyst Giovanni Staunovo commented: Investors are still concerned about the independence of the Fed. Currently, that risk has decreased and US economic data remains solid, limiting gold's increase. However, Mr. Trump wants the FED to cut interest rates aggressively... which is helping the market maintain the price base".

Gold is often considered a safe haven asset in times of uncertainty and thriving in a low interest rate environment.

Meanwhile, Adrian Ash - Research Director at Bullion Vault - commented: Although gold may face difficulties in the short term if there is no specific policy shock, the long-term uptrend is still solid thanks to central bank buying and more real cash flow for physical gold. In the precious metals market, the focus is gradually shifting from gold to silver, platinum and paladi - industrial and growth options.

In the other metals market, spot platinum prices rose 1% to $1,472.2/ounce, the highest level since August 2014. Paladi rose 1.4% to $1,297.78/ounce, its highest since August 2023. Silver prices moved sideways at $28.12 an ounce.