The two major banks UBS and ANZ have just raised their gold price target to above the important threshold of 3,000 USD/ounce, showing the confidence of financial institutions in the upward momentum of the precious metal as geopolitical tensions and trade wars increase.

A report from the Investment Office of Swiss bank UBS on March 18 said: "Gold, a defensive asset that is benefiting from geopolitical instability, trade tensions and new expectations of the US cutting interest rates due to concerns about slowing economic growth".

The report reads: "US Treasury Secretary Scott Bessent said in an interview on Sunday that the current economic pressure is a period of "transition", but did not rule out the risk of recession.

Regarding the geopolitical situation, the Trump administration of US President Donald Trump last weekend escalated airstrikes targeting Houthi forces in Yemen in response to attacks on international maritime routes.

UBS also noted that capital flows into gold ETFs have accelerated in recent weeks, mainly due to investors seeking defensive assets against increased risks, strong demand from central banks and uncertainty about the Fed's policy.

Faced with increasing risks, we have raised our gold price forecast to $3,200/ounce (from $3,000/ounce) for all terms. We still prioritize gold and see corrections as an opportunity to increase our buying position. At the same time, we maintain the view that allocating about 5% of the USD portfolio to gold is the optimal long-term view, UBS wrote.

ANZ Bank also raised its short-term gold price forecast (0-3 months) to $3,100/ounce, while forecasting a 6-month increase to $3,200/ounce, according to a report released on the morning of March 19.

We maintain a positive view, thanks to strong momentum from geopolitical tensions, trade wars, loose monetary policies and strong demand for gold from central banks, ANZ said.

In the gold market, concerns about import tariffs have tightened liquidity in the London spot market, as supply flows into the US, ANZ said in a report. This has created price differences, increasing the gap between Comex futures and London spot prices.

ANZ believes that the flow of gold across the Atlantic will also affect silver prices. This supply disruption could take some time to stabilize, causing silver prices to continue to fluctuate, the analysts wrote.

The bank expects silver to fluctuate between $34-36/ounce.

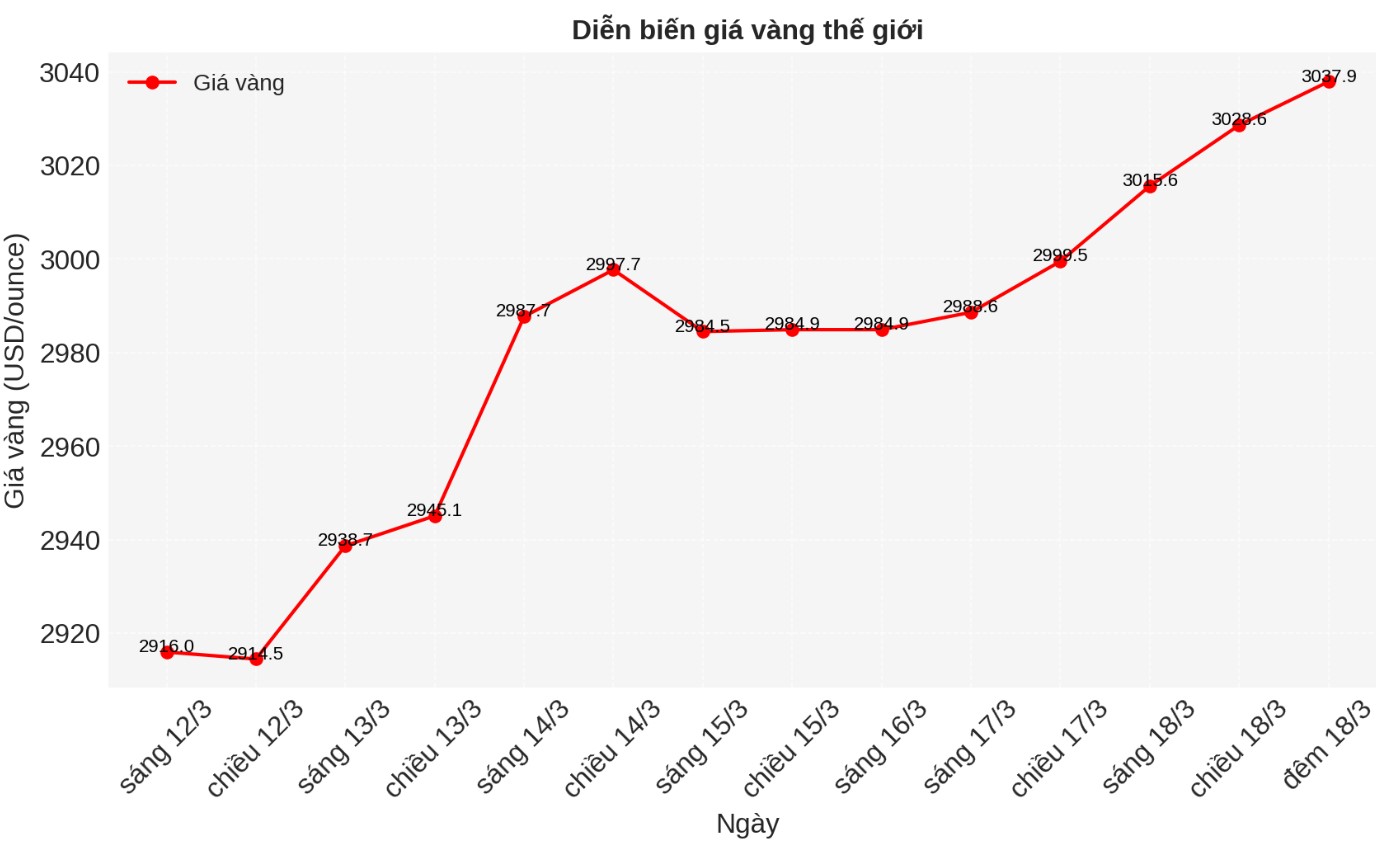

Spot gold prices rose to a new record high of $3,038.35/ounce when the North American market opened on March 19 and continued to remain above $3,000/ounce.

Gold prices increased sharply last night, at one point jumping to 3,038.5 USD/ounce. Silver prices also rose to 34.24 USD/ounce on the spot market on March 19, before trading at 33.883 USD/ounce, up slightly by 0.06% in the session.

See more news related to gold prices HERE...