SJC gold bar price loses 100 million VND/tael

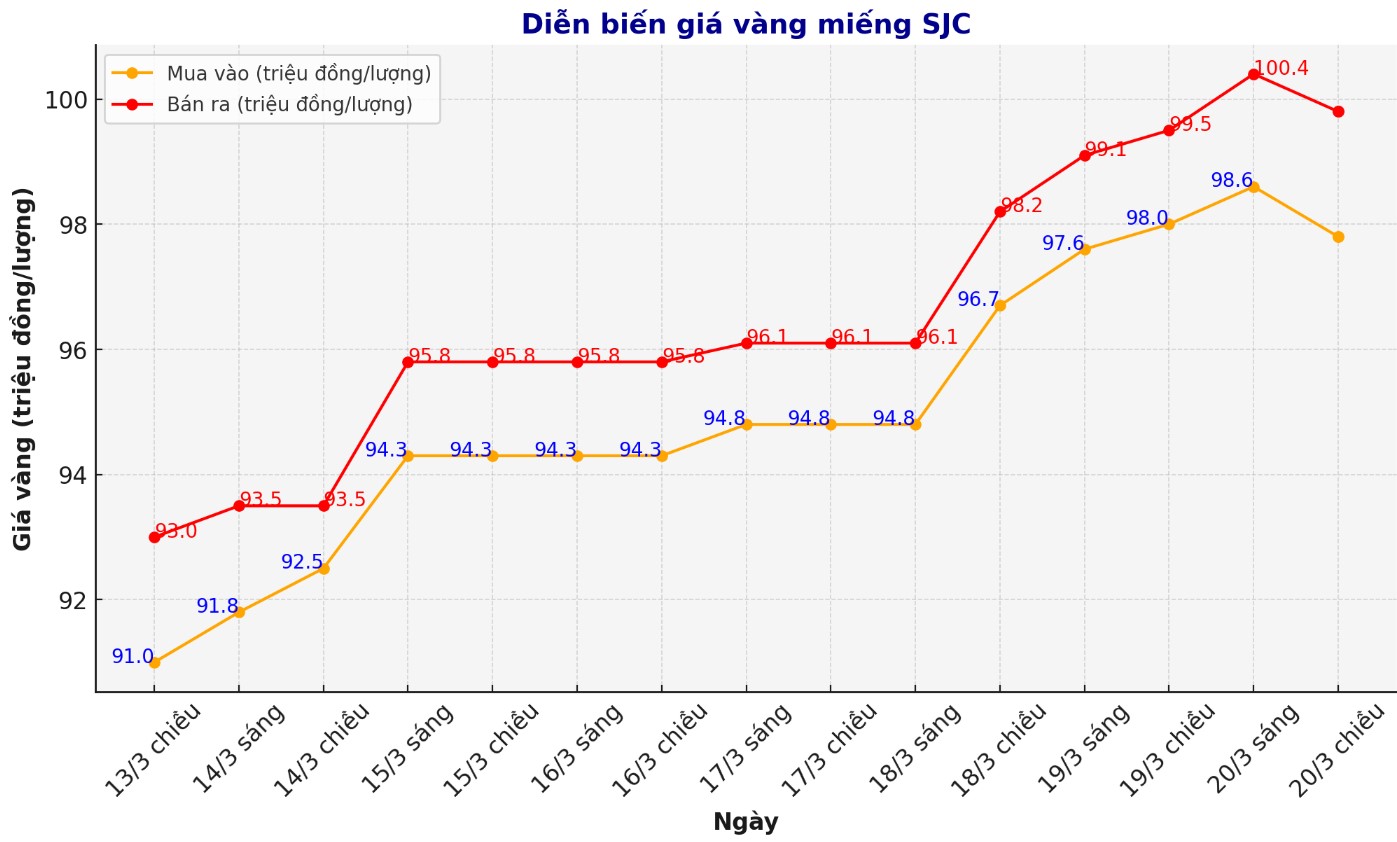

Gold bar prices this morning were adjusted up sharply by many units, exceeding 100 million VND/tael. Recorded at 8:45 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC and DOJI Group at 98.6-100.4 million VND/tael (buy - sell), an increase of 1 million VND/tael for buying and an increase of 1.3 million VND/tael for selling compared to the morning of March 19. The difference between buying and selling prices is at 1.8 million VND/tael.

However, at 4:45 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC and DOJI Group at 97.8-99.8 million VND/tael (buy - sell), down 800,000 VND/tael for buying and down 600,000 VND/tael for selling compared to this morning, March 20. The difference between buying and selling prices is at 2 million VND/tael.

Buying gold bars after a week, good profit

Short-term investment in gold is often not encouraged because of the potential risks due to the difference between buying and selling. However, in the context of the current strong increase in gold prices, many investors are still constantly looking for profit opportunities from gold bars in a short time.

A week ago, on March 13, 2025, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC and DOJI Group at VND92.5 million/tael (buy) and VND94.2 million/tael (sell), with the difference between the buying and selling prices being VND1.7 million/tael.

After a week, the price of SJC gold adjusted up by 5.3 million VND/tael for buying and 5.6 million VND/tael for selling. Investors will make a profit of about 3.6 million VND/tael.

Investors only made a profit of VND3.6 million/tael, while the increase in actual gold prices was higher due to the difference between the buying and selling prices applied by gold listed entities (such as SJC and DOJI). This difference is an important factor affecting investors' profitability when participating in the gold market.

Currently, the difference between the buying and selling prices has increased from 1.7 million VND to 2 million VND/tael. This means that investors will have to sell gold at a lower price than the buying price, leading to a direct impact on profits.

When the gap is too big, even if the price of gold increases, investors may still not make the expected profit, because this profit can be "eaten" by the high difference between buying and selling.

The gold market does not always follow a stable trend. The rapid increase in gold prices in a short period of time can be immediately reversed, causing investors to not react in time and leading to losses. In this case, the high difference between buying and selling prices increases the damage when investors have to sell gold at a time when prices are down.

Therefore, when participating in the short-term gold market, investors need to carefully consider the difference between buying and selling prices to make a reasonable decision.

See more news related to gold prices HERE...