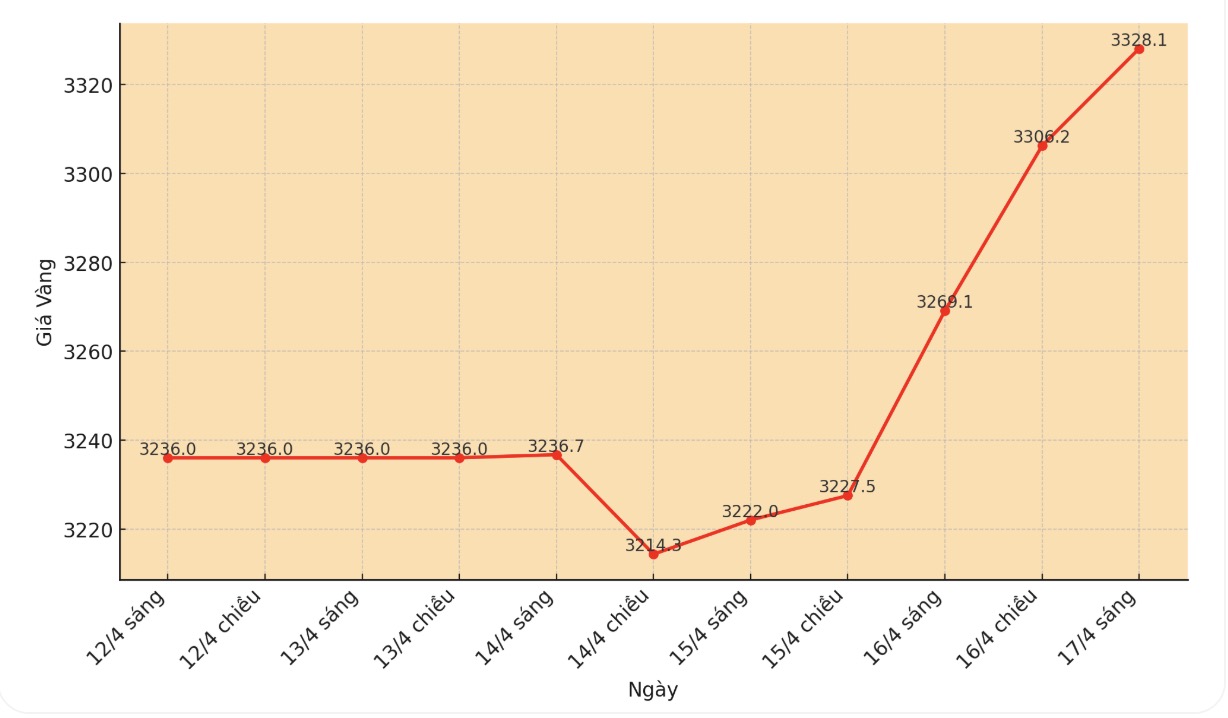

The gold market has seen a strong growth of over $3,300/ounce and continues to hold this price, although US consumers have maintained good purchasing power amid growing concerns about economic recession.

According to the US Commerce Department's report on Wednesday, retail sales increased 1.4% in March, after increasing 0.2% in February. The consumer data was stronger than expected, with economists forecasting a 1.3% increase.

Over the past 12 months, retail sales have increased by 4.6%, the report said.

Core retail sales, which excludes car purchases, rose 0.5% in March, compared to a 0.3% increase in February. The data was also stronger than expected, with the consensus forecast to increase by 0.4%.

The report also showed that the control group - which excludes revenue from auto dealers, construction materials stores, gas stations and office stores - increased by 0.4%, below the expected increase of 0.6%.

Never underestimate the spending power of US consumers, said Adam Button, chief currency strategist at Forexlive.com.

The gold market did not react strongly to the latest economic data, as price dynamics continued to lead the fluctuations of gold prices.

Although US consumers have maintained a fairly stable financial situation, some analysts and economists believe that many recent activities may be the result of shopping before the US President imposes global tariffs in early April.

Looking ahead, some analysts and economists predict that higher prices due to global tariffs could affect consumption.

While many economists still hope the US economy can avoid recession this year, they also acknowledge that risks are increasing.

Jim Wyckoff - senior analyst at Kitco commented that technically, June gold futures investors are currently having a strong advantage in the short term.

"The bulls' next upside price target is to close above the resistance level of $3,400/ounce. The next short-term downside target for the bearer is to push the futures price below $3,150/ounce.

The first resistance was seen at the high of the contract at $3,348.50/ounce and then $3,375/ounce. The first support level was seen at $3,325/ounce and then $3,300/ounce."