In the trading session this morning, the domestic gold price had soared and approached the peak of 110 million dong/tael.

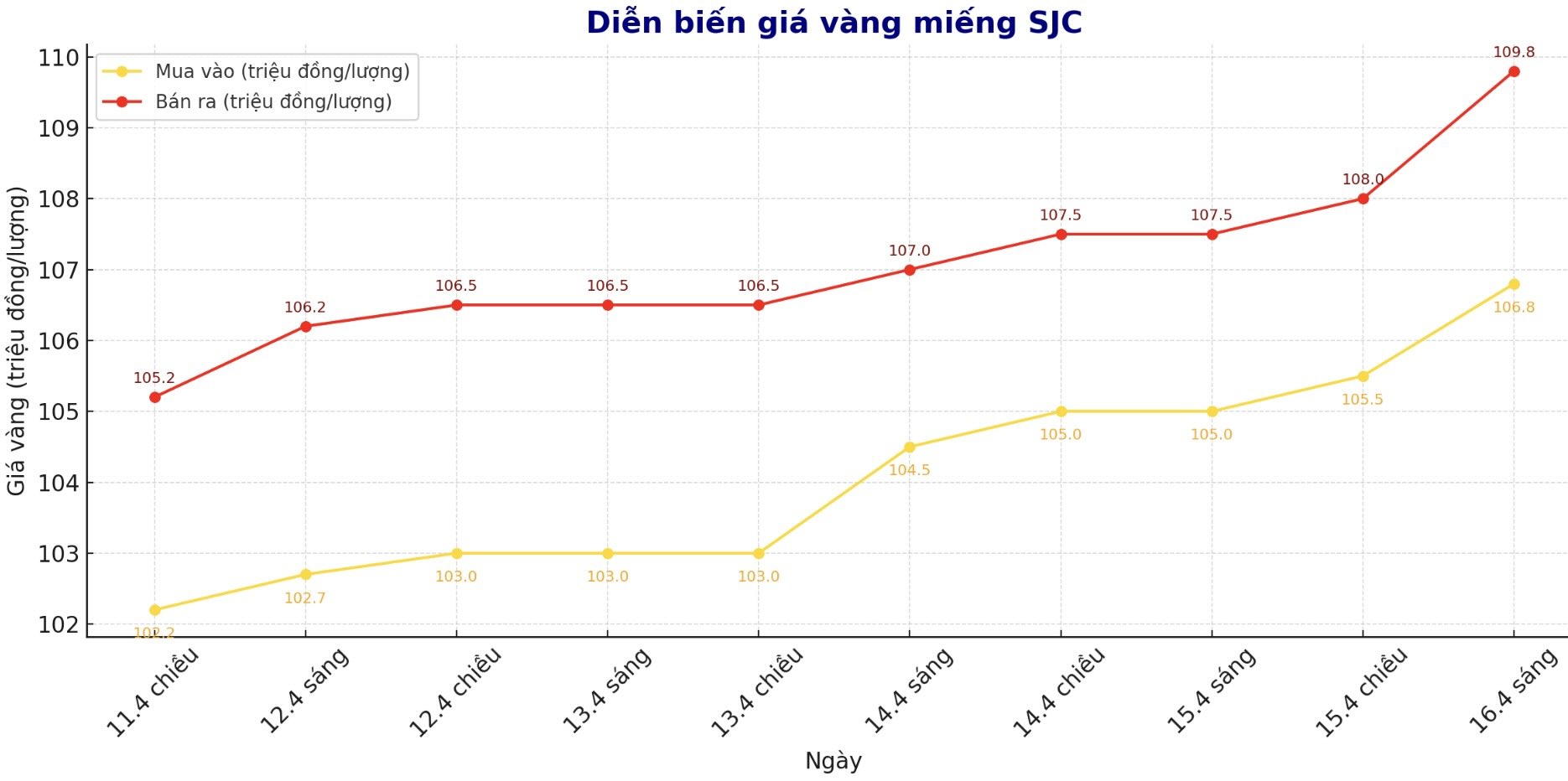

The price of SJC gold bars is large by large gold and silver units such as Saigon SJC, Doji Group, and Bao Tin Minh Chau listed at 106.8 - 109.8 million dong/tael (buying - selling), increasing sharply compared to the beginning of the trading session. This increase is mainly from the strong impact of world gold price and macroeconomic factors.

Updated at 9:00 am this morning, SJC gold price at large gold companies increased by 1.8 million dong/tael in the buying direction and 2.3 million dong/tael in the selling direction, with the price difference of purchasing - selling up to 3 million dong/tael.

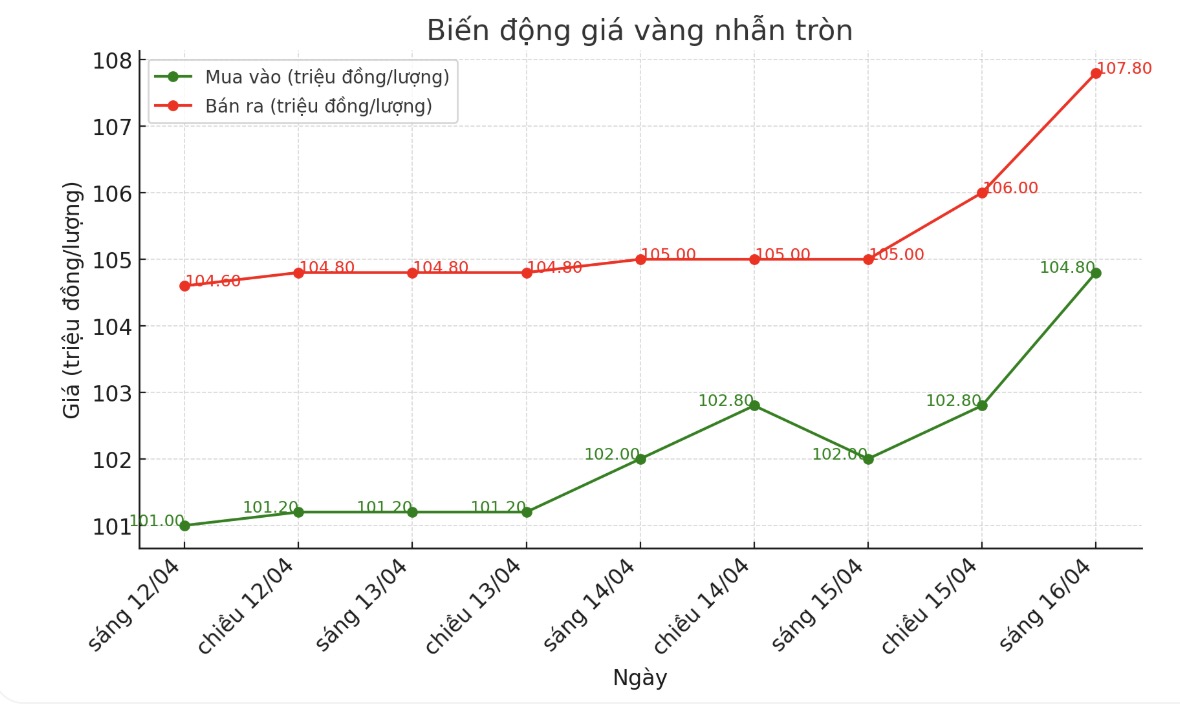

Meanwhile, the price of 9999 round gold also increased sharply, reaching 104.8 - 107.8 million VND/tael (buying - selling) in Doji, and 106.5 - 109.5 million VND/tael at Bao Tin Minh Chau, reflecting the uniform growth on the gold market.

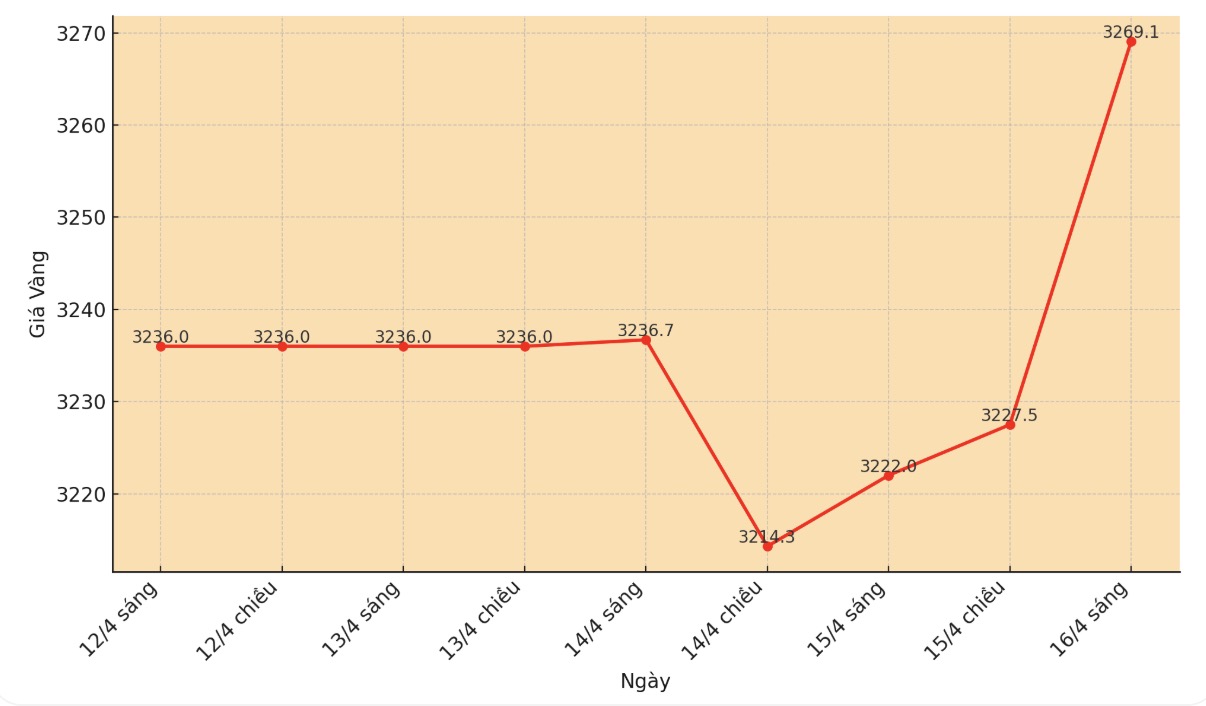

Domestic gold continues to increase sharply thanks to the impact of world gold prices, which are influenced by global political and economic factors. At 9:30 this morning, the world gold price listed on Kitco around $ 3,269.1/ounce, up to 47.1 USD compared to the beginning of the trading session last morning.

According to Reuters, one of the important reasons for pushing gold price is a move from US President Donald Trump, when he ordered a new tax investigation to all important mineral items imported into the US. This is an escalation in the trade dispute between the US and global partners, especially with China, the country dominates the production of many important minerals.

President Trump's decision highlights the long -standing concern of US dependence on other countries, especially China, in providing important minerals to the US economy. This not only causes instability in mineral markets but also increases the attractiveness of gold as a safe shelter.

According to the US Geological Survey, China is the world's leading manufacturer of 30 of the 50 important minerals. In recent months, China has reduced export of these minerals. Trade tensions, combined with the risk of mineral shortage, has made gold a priority choice of investors. This makes gold price more attractive in the context of global instability.

With new moves from the US government and the strong impact from macroeconomic factors, experts predict gold price will continue to maintain a rise in the short term. Along with that, the domestic gold price will continue to have adjustments in the direction of increasing, maintaining high level.

In the context that the gold market has many fluctuations, investors should pay close attention to signals from international trade policies, especially tax -related decisions and their influence on the global economy.