Positive forecast

Adrian Day - Chairman of Adrian Day Asset Management - said: "Gold prices will increase". He explained that the increase still belongs to gold, especially in the context of a volatile stock market. The reasons why investors have been buying gold for the past two years remain unchanged.

Gold has had an extremely impressive week, and I still dont see any reason to change the bullish view, said James Stanley, senior market strategist at Forex.com.

He added that gold prices have increased too much, making buying more difficult at the moment, but there is still no clear sign that this increase has ended.

Sean Lusk, co-head of commercial hedging at Walsh Trading, said the market is still in a state of running away for shelter, and gold is benefiting from that fear.

On Thursday, investors take a little profit, thats normal before the long weekend, but well have to see what they do after this slight decline, he said.

Lusk said there is currently a lot of money flowing into gold. Speculators are buying, TV experts are also recommending buying, and central banks continue to hoard gold, he said. We have achieved a 25% increase for the year at $3,301/ounce. The next target is around $3,434/ounce.

However, he was cautious: Im not sure gold can go that far, as the current rally seems to have gone too far. But the stock market is still volatile.

Lusk said that no matter what the final outcome of Donald Trump's tax policies is, Fed Chairman Jerome Powell's recent speech has shown the possibility of the Fed changing policy, and the market should pay attention to this.

Powell has been tougher than people think. He also said that the labor market is still very strong, which makes me believe that they do not see the risk of an economic recession.

I also think so, with the current employment data, there is no sign that the economy is going down. However, the impact of the tariff measures will not be clear until the end of the second quarter, he said.

Lusk predicted that tax policy instability will continue to be a major factor affecting the global market and pushing gold prices up.

If there is no new information such as a trade deal or a US-China talks return, the current trend is certainly still up.

This is just a small adjustment as investors took profits before the weekend break. When prices hit a peak, a slight decrease is normal. But overall, the situation has not changed because tax policies remain unchanged, he said.

The more uncertainty there is, the easier it is for gold prices to increase. When prices drop slightly, people rush to buy - and that is happening. I think gold could take another hit, reaching the target of around $3,440 an ounce, but I think it will be a peak, the expert added.

Neutral forecast

"I am neutral on gold next week," said Colin Cieszynski, chief strategist at SIA Wealth Management. Gold has recently had a strong increase, and may take a few days off as the market shifts from macro issues to corporate financial reports.

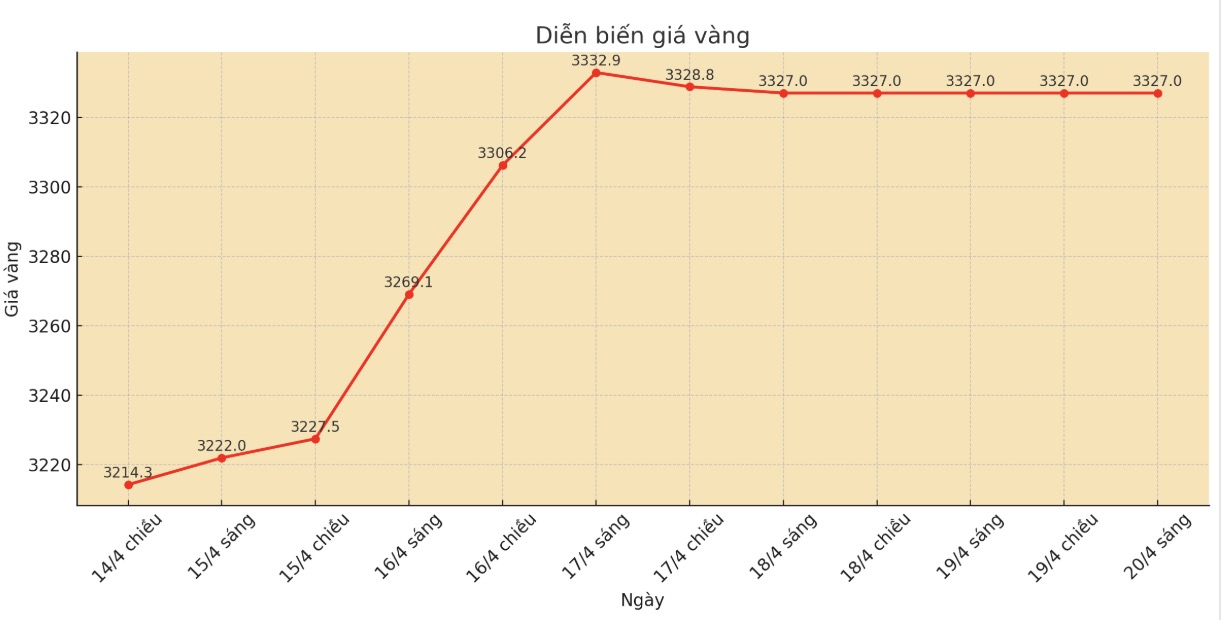

Marc Chandler - CEO at Bannockburn Global Forex - commented: "Gold has reached a record high of nearly 3,358 USD and seems to be accumulating at a time when the market has few transactions due to the holiday season".

According to him, the first support level could be around 3,250 USD/ounce. A correction is needed to maintain an orderly increase. Buying when prices fall is still likely to happen, considering the current context of the macro economy. He believes the $3,500/ounce mark is a reasonable target for the next few weeks.

Forecast of price reduction

Mark Leibovit - VR Metals/Resource Letter Publishing House - warned that gold prices are at a short-term peak and recommended that investors sell counterfeit through opposite ETFs such as ZSL and GLL.

Rich Checkan - President and COO of Asset Strategies International - predicted: " Prices will decrease. I fully expect a profit-taking after gold surpassed $3,300/ounce on Wednesday. This is the time to adjust and build a support zone around this new high.

See more news related to gold prices HERE...