The gold market is setting new highs in the last session of the week, after the latest data showed that consumer confidence in the US declined, while inflation expectations continued to decline.

The University of Michigan said on Friday that the final result of the December Consumer Confidence survey reached 52.9 points.

This figure is lower than the forecast of the economists, when the market consensus expected a rate of 53.5 points, after the preliminary figure of 53.3 points. However, the result is still higher than the 51 point mark for November.

"Consulent confidence in the monthly data confirmed, only increased by less than two points compared to November, is within the range of errors.

While the low-income group recorded an improvement, the psychology of the high-income group remained almost unchanged. Conditions for purchasing durable goods fell for the fifth consecutive month, while expectations for personal finances and business conditions increased in December, said Joanne Hsu, director of Consumer survey.

Ms. Hsu added that expectations for the labor market to improve slightly this month, despite the overwhelming majority, 63% of consumers, still believe that the unemployment rate will continue to increase next year.

Despite some signs of improvement at the end of the year, consumer confidence is still nearly 30% lower than in December 2024, when personal spending issues continue to dominate people's views on the economy, Ms. Hsu emphasized.

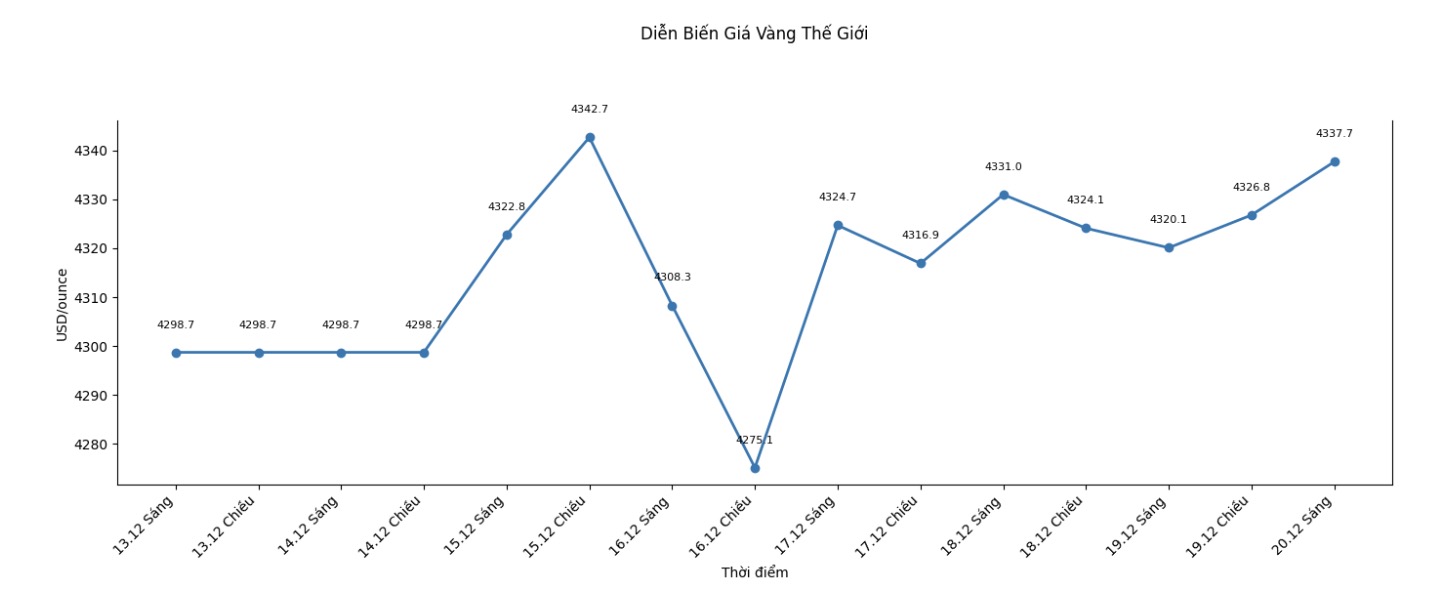

Gold prices increased sharply to a session high right after the data was released at 10:00 am (EST). Spot gold was last traded at $4,343.17 an ounce, up 0.24% on the day.

The December index also showed signs of cooling down price pressure, as both short-term and long-term inflation expectations fell.

Inflation expectations for the coming year fall for the fourth consecutive month to 4.2%. This is the lowest level in 11 months, but still higher than the 3.3% recorded in January. Long-term inflation expectations fell from 3.4% last month to 3.2% in December, equivalent to January 2025. For comparison, these indicators ranged between 2.8 - 3.2% last year and were below 2.8% in the period 2019 - 2020" - Ms. Hsu said.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.