Gold prices fell slightly in the trading session on Friday, under pressure from the stronger USD and investors' year-end portfolio restructuring activities. However, the precious metal is still on track for a week of gains, as cooling US inflation data raised expectations of the US Federal Reserve (Fed) cutting interest rates.

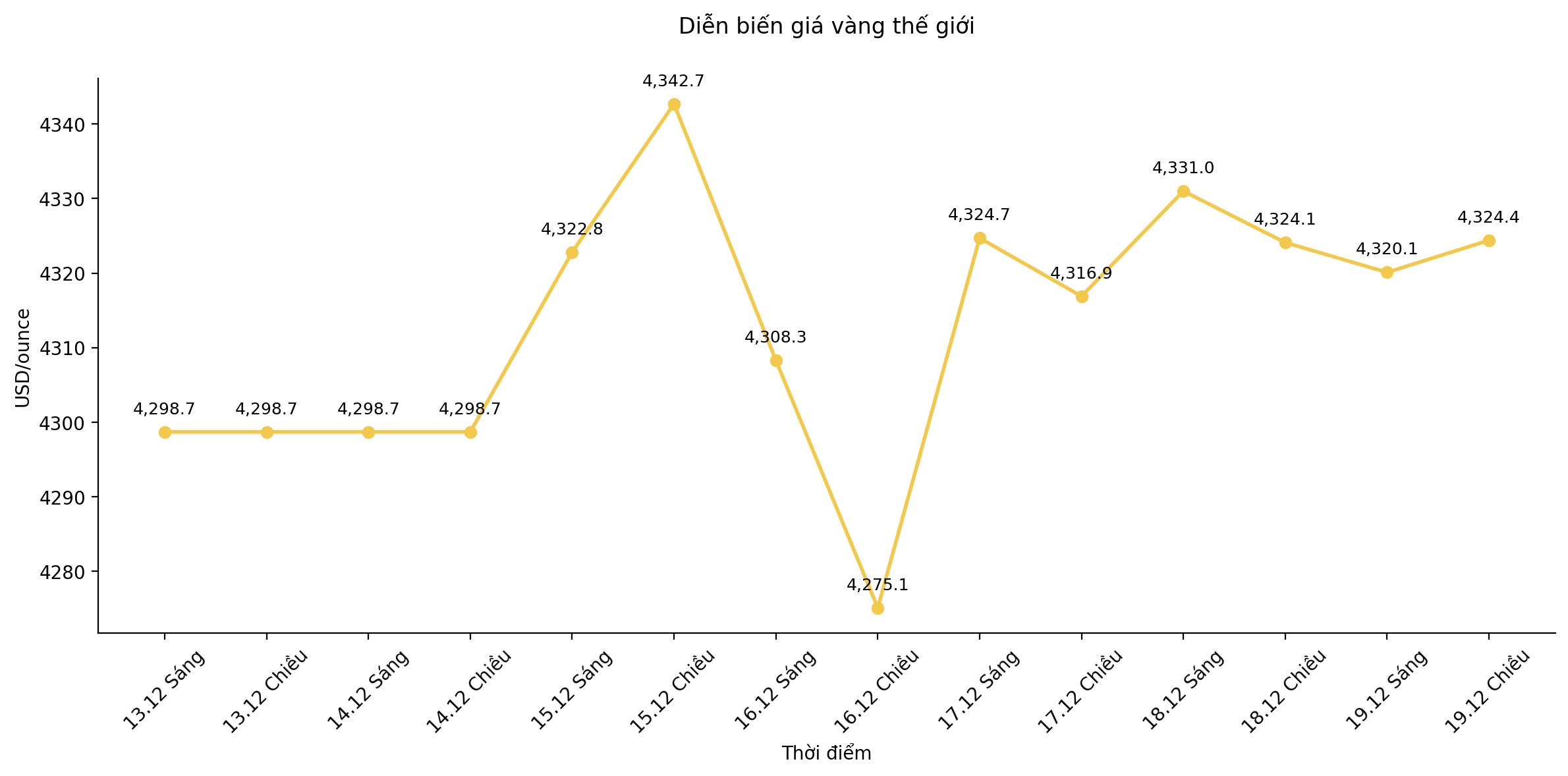

In this afternoon's trading session, spot gold prices fell 0.1%, down to $4,326.29/ounce, but still increased by about 0.6% for the whole week, after bouncing back to the price range near the historical peak set in October. US gold futures fell 0.2%, trading around $4,354.80 an ounce.

In other precious metals, spot silver rose 0.7% to $65.90 an ounce, expected to end the week up about 6%, after hitting a historic peak of $66/ounce in Wednesday.

Since the beginning of the year, silver prices have increased by 128%, far exceeding the increase of about 65% of gold, thanks to strong industrial demand and increased investment cash flow.

The US dollar rose to its highest level in more than a week, making greenback-denominated gold more expensive for investors holding other currencies, thereby putting short-term pressure on prices.

Gold prices are under slight pressure in today's session, mainly due to year-end positioning and declining market liquidity before the holiday, said Mr. Zain Vawda - Analyst at MarketPulse (OANDA). However, he said that recent US economic data weaker than expected are improving the outlook for interest rate cuts next year.

The data showed that the US consumer price index (CPI) in November increased by 2.7% over the same period, lower than the forecast of 3.1% by economists according to the Reuters survey.

Austan Goolsbee, president of the Chicago branch Fed, said that if this cooling inflation trend is maintained, the Fed could expand the room for interest rate cuts next year. After the CPI report, the interest rate futures market has slightly increased the possibility of the Fed cutting interest rates at its January meeting.

In the latest report, Goldman Sachs forecasts gold prices could increase by about 14%, to $4,900/ounce by December 2026, in the baseline scenario, thanks to high central bank demand and cyclical support from the Fed's interest rate cuts.

In the remaining precious metals group, platinum prices rose 1.5% to $1,944.71/ounce, after hitting a more than 17-year high in the previous session. palladium prices fell slightly by 0.1%, to $1,694.75/ounce, after reaching a nearly three-year high at the beginning of the session.