Investors and those interested in gold and precious metals today have to update gold prices by the hour. This precious metal has been continuously adjusted to increase in price and broke a series of record records.

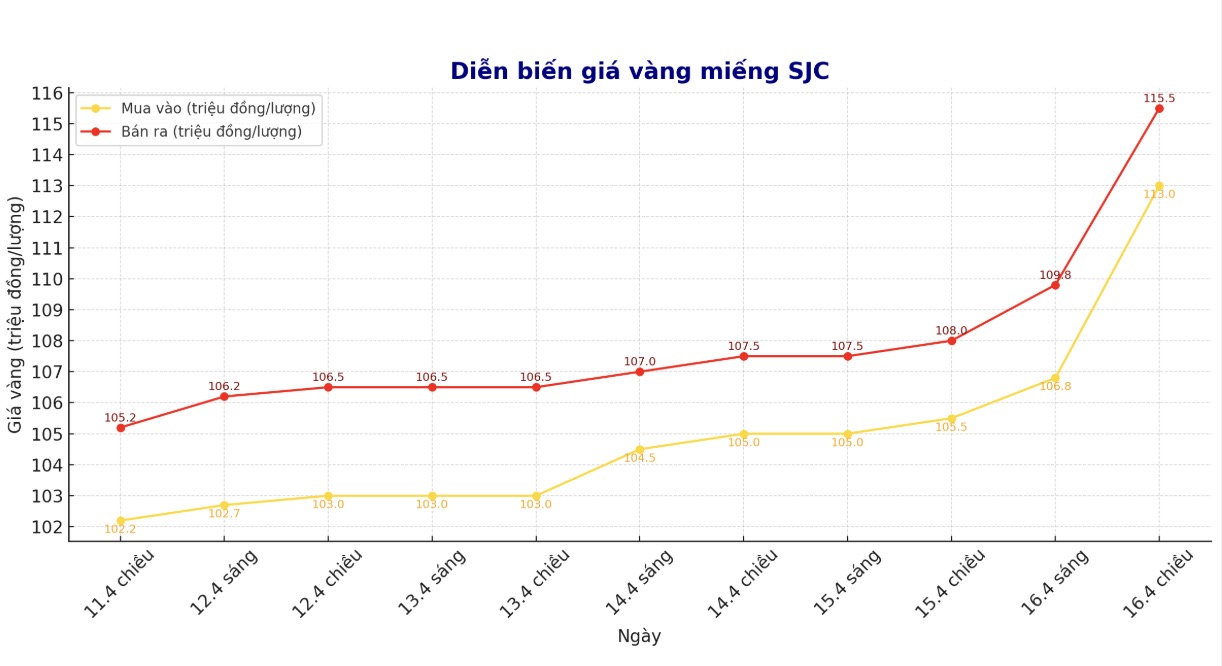

Yesterday afternoon, the price of gold bars closed at 105.5 - 107.8 million VND/tael (buy - sell), while the price of gold rings was at 104.1 - 107 million VND/tael (buy - sell).

This morning, gold businesses continued to adjust prices up strongly. SJC gold bar price increased by 1.8 million VND/tael for buying and 2.3 million VND/tael for selling, to 106.8 - 109.8 million VND/tael (buy - sell).

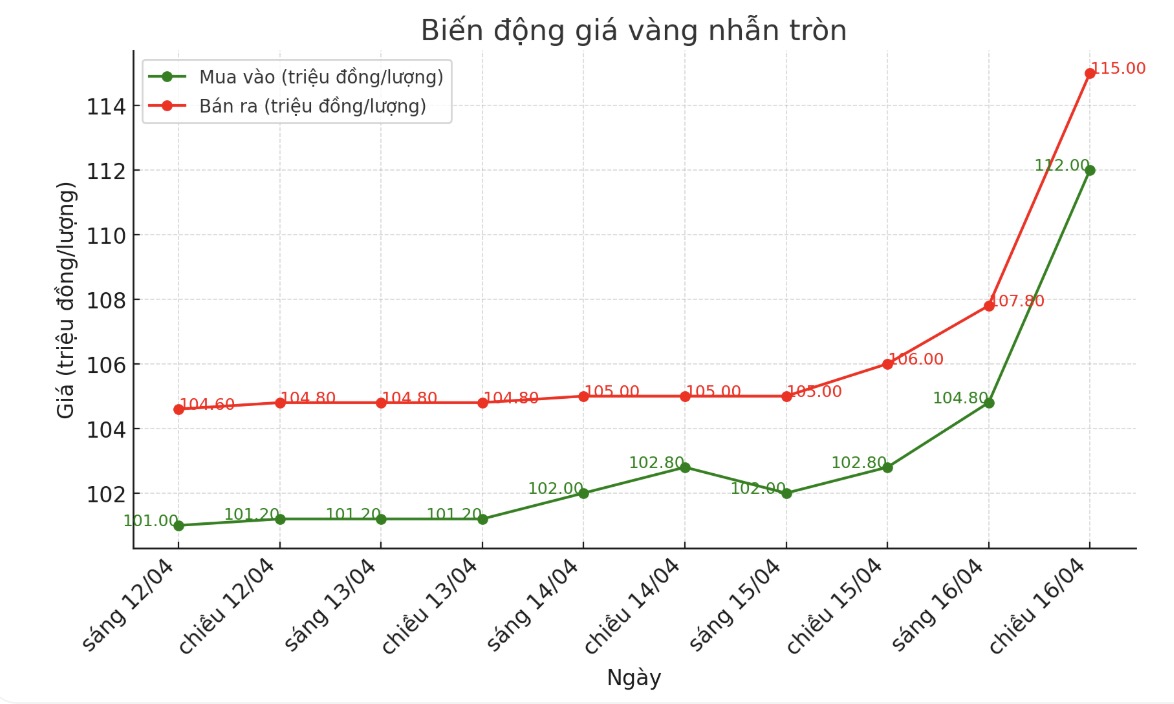

Gold ring prices increased even more strongly, with an increase of 3.9 million VND/tael for buying and 3.6 million VND/tael for selling, bringing domestic gold prices to a new record high, reaching 106.5 - 109.5 million VND/tael (buy - sell).

As of the time of writing (19:10 on 16/4), domestic gold prices continued to record impressive increases, breaking a new peak. The price of SJC gold is currently listed at 113 - 115.5 million VND/tael (buy - sell), while gold rings have reached 112 - 115 million VND/tael (buy - sell).

Although prices may change in some trading units, in general, the gold market in today's trading session recorded a strong increase.

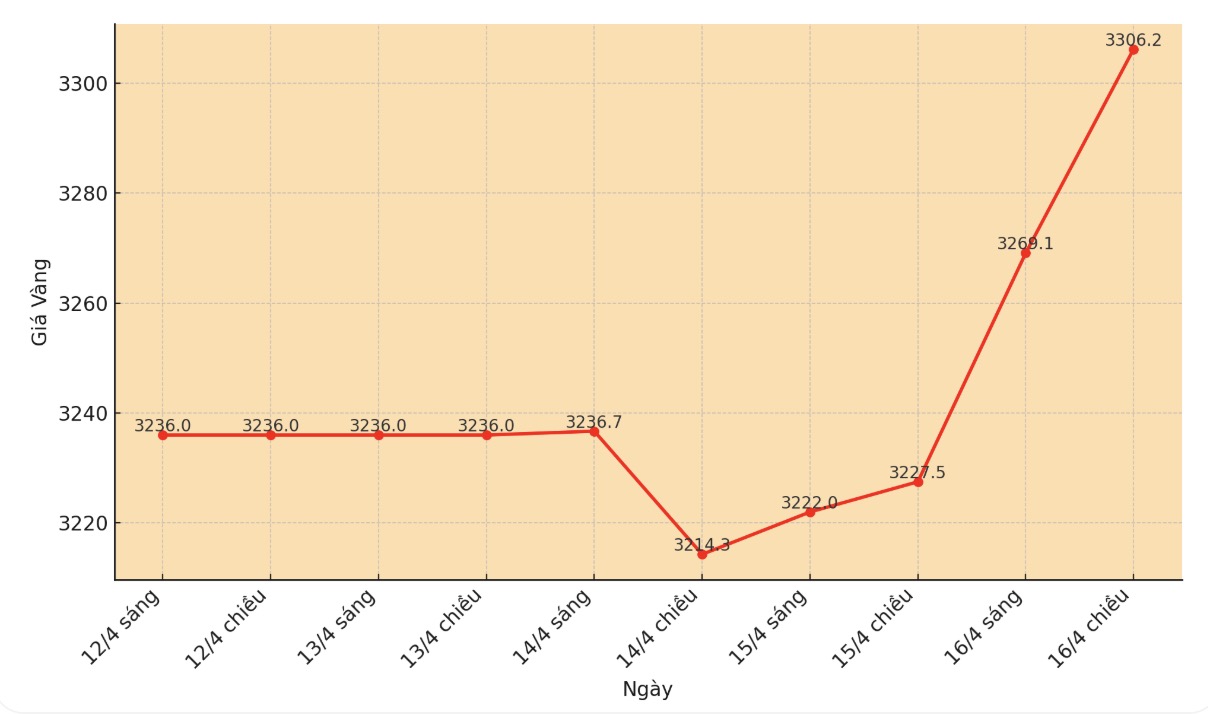

The domestic gold price increase is mainly affected by the world gold market. On the chart, it can be seen that this precious metal is recording remarkable growth. If yesterday afternoon (September 15), the world gold price was trading at 3,217.3 USD/ounce, then by 8:45 am this morning (Vietnam time), the price had increased to 3,264 USD/ounce. At the time of writing, gold prices had surpassed the peak of 3,300 USD/ounce, trading at 3,306.2 USD/ounce.

This growth in world gold is supported by escalating trade tensions between the US and China. According to Reuters, Nvidia (NVDA.O) announced on Tuesday that it will suffer a loss of 5.5 billion USD after the US government limits exports of H20 artificial intelligence chip to China.

China has also asked its airlines to stop accepting Boeing (BA.N) orders in response to the US imposing a 145% tariff on Chinese goods.

"There is growing uncertainty about tariffs, US government enforcement, tariffs affecting goods through intermediary countries, which could hurt the global supply chain, all of which support gold prices," said Nicholas Frappell, global market manager at ABC Refinery.

Gold has long been considered a safe haven, attracting capital flows from many different sources, affecting gold prices at short, medium and long-term levels. Speculative and hoarding psychology also play an important role.

Experts say that as other investment channels, such as savings and real estate, become less attractive, gold becomes the priority choice for investors. The habit of hoarding gold of Vietnamese people also contributes to pushing gold prices higher, creating a significant difference in supply and demand.

In the domestic market, gold supply is limited due to import management policies, the requirement to approve national gold brands and State control, making the market less connective. Scurrent supply while strong demand pushes gold prices higher. Synthesizing these factors, gold prices are expected to continue to increase in both domestic and international markets.

However, investors also need to be cautious when the difference between buying and selling prices is too high. This difference can make it difficult to optimize profits, especially when gold prices fluctuate strongly.

The difference between buying and selling prices is too high, causing investors to bear larger costs when making transactions, which can affect investment decisions, especially for those who are new to the market. Therefore, investors need to consider carefully when deciding to participate in the gold market in this context.