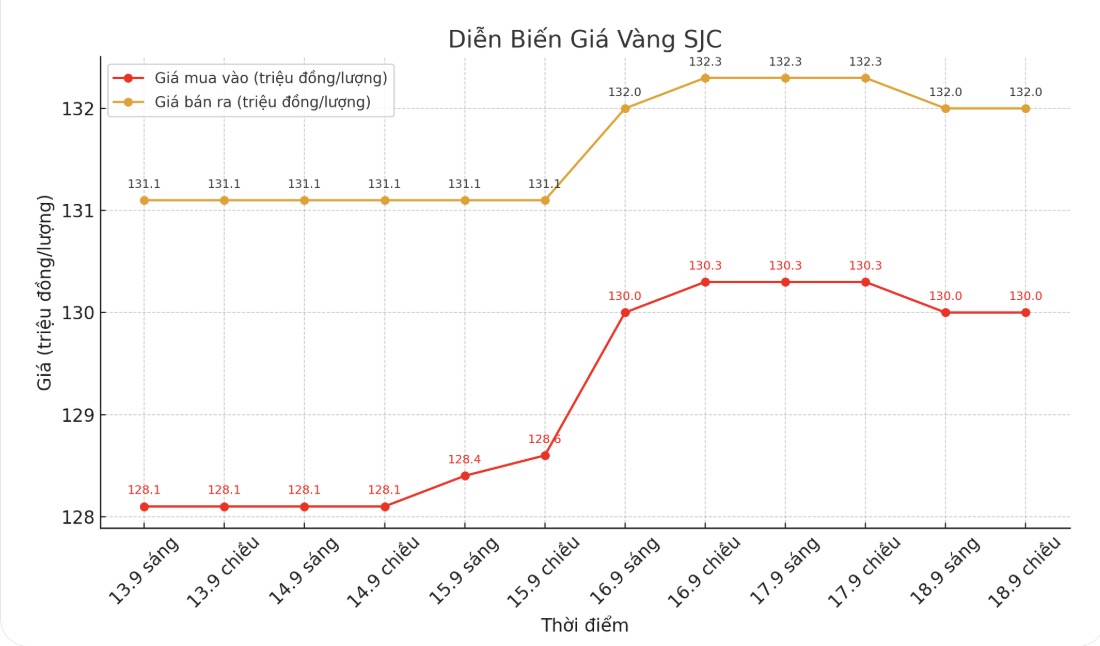

SJC gold bar price

As of 6:00 a.m. on September 19, the price of SJC gold bars was listed by DOJI Group at VND130-132 million/tael (buy in - sell out), down VND300,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of SJC gold bars at 130-132 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 129-131.7 million VND/tael (buy - sell), down 800,000 VND/tael for buying and down 600,000 VND/tael for selling. The difference between buying and selling prices is at 2.7 million VND/tael.

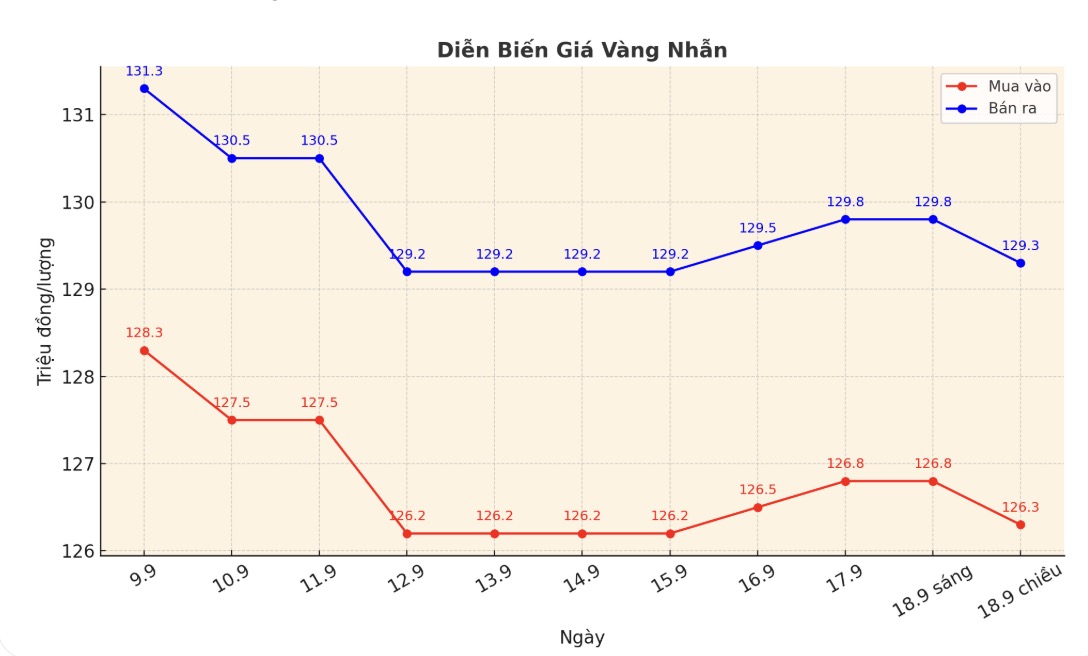

9999 gold ring price

As of 6:00 a.m. on September 19, DOJI Group listed the price of gold rings at 126.3-129.3 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 127-130 million VND/tael (buy - sell), down 600,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 126.2-129.2 million VND/tael (buy - sell), down 600,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

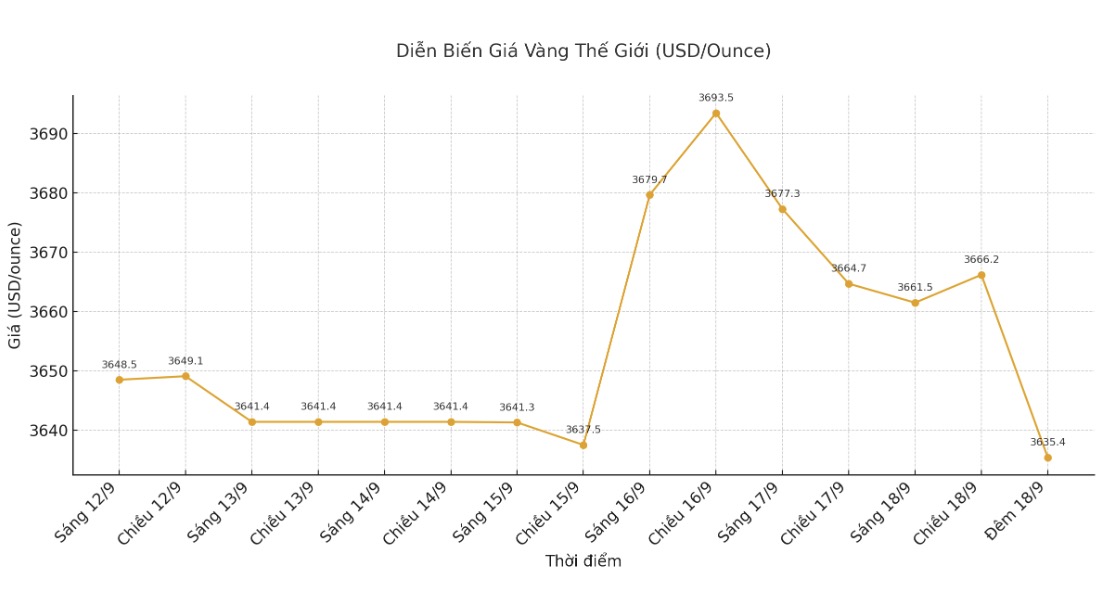

World gold price

The world gold price was listed at 9:30 p.m. on September 18 at 3,677 USD/ounce, down sharply by 41.6 USD.

Gold price forecast

Gold and silver prices fell in early trading in the US on Thursday, as short-term futures investors took profits after gold hit a record high and silver hit a 14-year high on Tuesday.

Both markets are expected to see some downward adjustments. December gold contract decreased by 16.6 USD to 3,701.3 USD/ounce. December delivery silver price decreased by 0.042 USD to 42.11 USD/ounce.

Global stocks mostly rose last night. US stock indexes are heading for higher opening and set a record when the trading session in New York begins.

The Federal Open Market Committee (FOMC) of the US Federal Reserve (FED) cut the operating interest rate by another 0.25 percentage points to 4.00 - 4.25% on Wednesday afternoon, as expected.

However, the Committee members remain divided deeply on how to respond to the slowdown of the US economy. The decision to cut interest rates was almost unanimous, with only Governor Stephen Miran wanting to cut more strongly.

FED Chairman Jerome Powell said the Fed's work will be more difficult as it counts between inflation risks and the labor market. He also emphasized his commitment to maintaining independence: We are determined to maintain independence... Data-based decision-making has penetrated deeply into our culture.

Immediately after that, major US banks such as JPMorgan Chase, Citigroup, Wells Fargo and Bank of America all lowered their underlying lending rates from 7.5% to 7.25%.

In international news, China's Shanghai composite index increased by 0.2% and Shenzhen Component increased by 0.5% on Thursday, partly affected by the global increase after the Fed's decision to lower interest rates.

Optimism is also reinforced by expectations of US-China trade talks and agreements related to TikTok.

Technically, bulls in December gold futures are still dominating. The next upside target is to close the session above the strong resistance level of $3,800/ounce. In contrast, the nearest downside target for the bears is to push prices below the solid support level of $3,600/ounce.

The first resistance level was seen at $3,715/ounce and then the peak this week at $3,744/ounce. The first support level was at the bottom of the night at $3,667.3/ounce and then up to $3,650/ounce.

In outside markets, the USD index increased slightly, crude oil prices moved almost sideways around 64 USD/barrel, and the yield on the 10-year US Treasury note was 4.05%.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...