Gold increases sharply thanks to political and economic shocks

Sprott Asset Management expert Paul Wong said that the financial market is concerned about the risk of "stagflation" as concerns arise that the Fed may suffer political impact and inflation due to widespread tariffs.

He said this could be a signal opening a period of fiscal dominance, in which gold could become the top store of value asset to replace the US dollar.

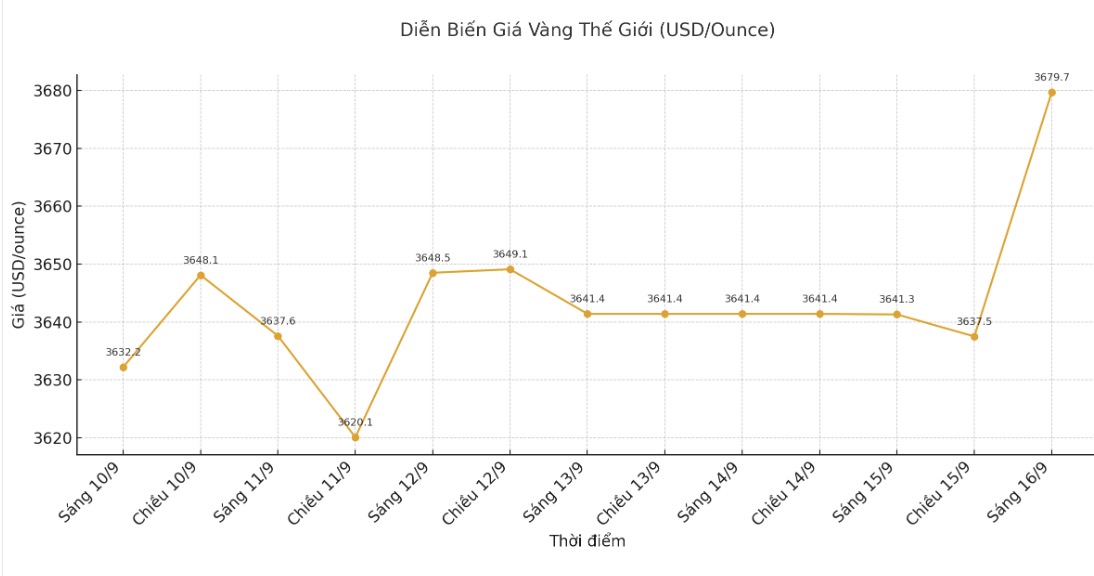

In the latest report, Wong said the 31.38% increase in gold prices as of the end of August 2025 - the highest since 1979 - was " driven by market tensions". He said that economic and financial policy developments in the US are the main reasons for gold's breakthrough and the weakening of the USD.

This past summer, the FED has shifted from a state of holding interest rates unchanged to a state of easing. This development along with the wave of increasing tariffs has increased the risk of stagnant inflation and market instability.

According to Wong, gold prices are also supported by the FED's interest rate cut signal at the September meeting, weaker-than-expected labor market data and persistent inflation.

Risk of the USD reducing its role

Wong specifically highlighted the impact of the dismissal of Fed Governor Lisa Cook on the charge of mortgage fraud. Never before has a US president sacked a Fed board member since 2013, he analyzed. If the dismissal is carried out, the White House can create a 43 majority in the Council, paving the way for long-term monetary policy control.

According to Wong, if the Fed is strongly affected by political factors, the agency could be oriented towards the government's short-term economic targets, using a $6.6 trillion balance sheet to promote cheap credit, loosen regulations and increase money supply, thereby increasing the risk of asset bubbles and inflation.

Factors such as applying high import taxes push up commodity prices, cutting interest rates while inflation is still hot will cause real interest rates to drop sharply - the traditional environment is beneficial for gold.

Wong pointed to the US bond yield curve (the 2-year and 30-year yield gap) being sharply declining, implying long-term inflation risks and the possibility of the Fed having to take measures to control the yield curve (YCC). If nominative yields are pressured below inflation, monetary assets such as the US dollar and bonds will lose their real value, pushing cash flow into tangible assets such as gold, he stressed.

Wong believes the US is entering a period of fiscal dominance, as monetary policy must serve the Ministry of Finance's borrowing needs, leading to prolonged negative interest rates. The decrease in the USD will make gold more attractive.

He argued: The three core functions of the USD, which are value storage, payment methods and calculators, are all challenged, with the function of value storage being able to shift to gold, neutral reserve assets favored by central banks.

In a hot-running economy with high inflation, large debts and monetary policy restoring fiscal, the US dollar and US bonds are at risk of falling off. Therefore, gold is breaking out and has the prospect of increasing even more strongly, said Wong.