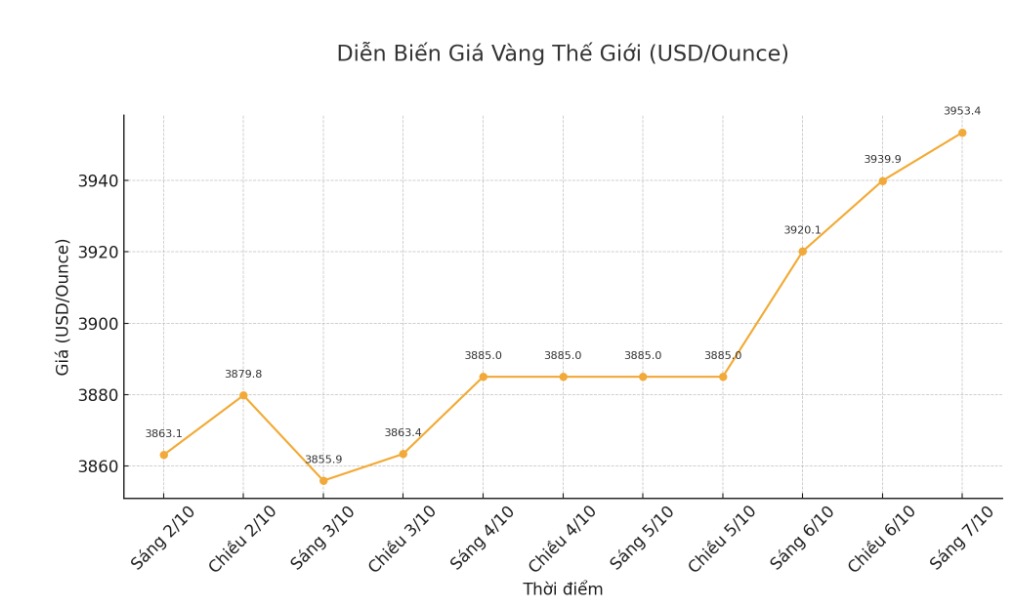

The commodity research group of Bank of America (BofA) is one of the first units to forecast the target of 4,000 USD/ounce since the beginning of this year, saying that as long as investment demand increases slightly, gold can reach this level.

However, as the target is gradually becoming a reality, BofA technical analyst Paul Ciana said that gold prices have reached most of their upside potential and are showing signs of overbought.

Many technical signals at different time frames suggest that golds rally may be wearing down as it approaches $4,000 an ounce, he said. If correct, it is likely that in the fourth quarter, there will be a period of sideways or adjustment.

Regarding risk management, investors should raise the loss stopping point, protect or reduce their buying position. For traders who are trending in reverse, they can consider buying and selling options in the next 4-6 weeks.

The assessment was made when spot gold prices were at 3,960 USD/ounce, up nearly 2% on the day. Since the beginning of the year, the precious metal has increased by about 50%, marking the strongest increase since 1979.

Paul Ciana said this year's gains are similar to previous strong gold rallies, but noted that those periods often come with significant price cuts.

According to him, from the bottom of 2015 to 2020, gold prices increased by 85% before falling sharply by 15% in 2022, and the current increase has helped prices skyrocket by 130%. However, this growth cycle is still smaller than the explosive periods in the early 2000s and the 1970s.

During the 1970-1980 period, gold prices increased by a total of 1.725%, with one correction in between. Then, from 1980 to 1999, the market declined by about 59%.

From 1999 to 2011, prices increased by 640%, also there was an adjustment in the middle of the cycle. The decline that followed caused gold to lose 38% of its value until 2015, Ciana said.

Regarding prospects, this expert believes that if the current up cycle is equivalent to 400% after 2015, gold prices could surpass 5,000 USD/ounce; and if it repeats the increase in the 2000s, the price could reach the 7,000 USD/ounce area.

Although he did not rule out that scenario, he warned that the current rally is "old" and could be vulnerable to a mid-cycle correction, similar to strong increases in the past.

A notable technical signal is the 7-week consecutive increase in gold. According to him, in all 11 previous similar cases, gold prices fell within the next 4 weeks.

Ciana is also closely monitoring long-term moving averages. He said gold prices are currently about 21% above the 200-day average - a level where price peaks often appear.

In addition, gold is also 70% above the 200-week average - a situation that only happened three times in 2006, 2008 and 2011. Compared to the 200-month average, the current difference is 140%.

On the downside, Ciana has determined the first support level to be around $3,790/ounce and warned that the risk could expand to $3,525/ounce.

See more news related to gold prices HERE...