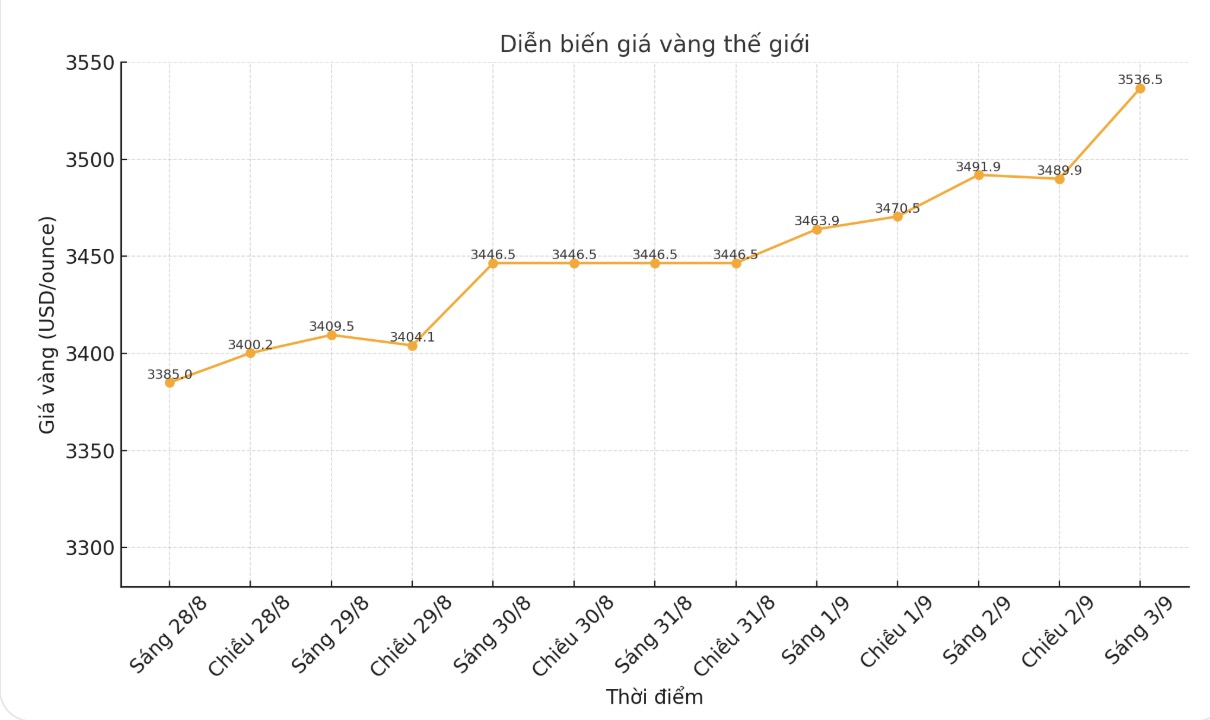

At 16:33 a.m. on September 3 (Vietnam time), gold futures increased sharply by 83.4 USD, reaching a historical peak of 3,602.4 USD/ounce - the most impressive increase on the day since April 21.

December gold futures are currently at $3,599.5, after adding the above increase. Notably, this is the sixth increase in the last seven sessions, reflecting the precious metal's steady upward trend.

The unusual point is that this breakout occurred at the same time as the USD increased by 0.66% on the day. Normally, gold and the USD fluctuate in opposite directions, so this parallelism shows a rare phenomenon that needs to be analyzed more carefully.

Central banks actively hoard gold

Spot gold prices (XAU USD) also hit a new peak, surpassing the 3,530 USD/ounce mark, mainly thanks to the unprecedented wave of buying by central banks around the world.

Macro strategist Tavi Costa (Crescat Capital) said that for the first time since 1996, the proportion of gold in global foreign exchange reserves has exceeded US Treasury bonds.

This is an important turning point, showing that central banks want to reduce their dependence on the USD, while worrying about currency fluctuations, geopolitical tensions or long-term fiscal risks in developed economies.

monetary policy expectations boost optimism

Another driver comes from the Federal Reserve's policy prospects. The market is currently pricing in a 91.7% chance of a 0.25 percentage point interest rate cut this month, up from 86.4% just a day ago and 87.8% last week.

This expectation helps explain why gold and the USD may increase at the same time. Low interest rates reduce the cost of holding gold - a non-yielding asset.

In addition, the FED's interest rate cuts often reflect economic instability, further strengthening gold's position as a safe haven.

See more news related to gold prices HERE...