In order to refer to international experience in gold management and make appropriate policy recommendations for Vietnam, Lao Dong reporter had an interview with Professor. Tran Tho Dat - Chairman of the Science and Training Council, National Economics University.

Decree 232/2025/ND-CP is considered a major turning point in gold market management. In your opinion, what is the most important meaning of this decree for the Vietnamese economy?

- In my opinion, the greatest significance of Decree 232/2025 is to " released" the gold market from monopoly and institutionalization, turning gold into a normal investment - financial channel, thereby both ensuring macroeconomic stability and creating new momentum for economic growth.

The new Decree opens up a direction of connecting the domestic gold market with the world market, reducing the monopoly on gold bar production, moving towards liberalising gold import - export and gradually forming modern financial instruments such as term contracts and gold certificates.

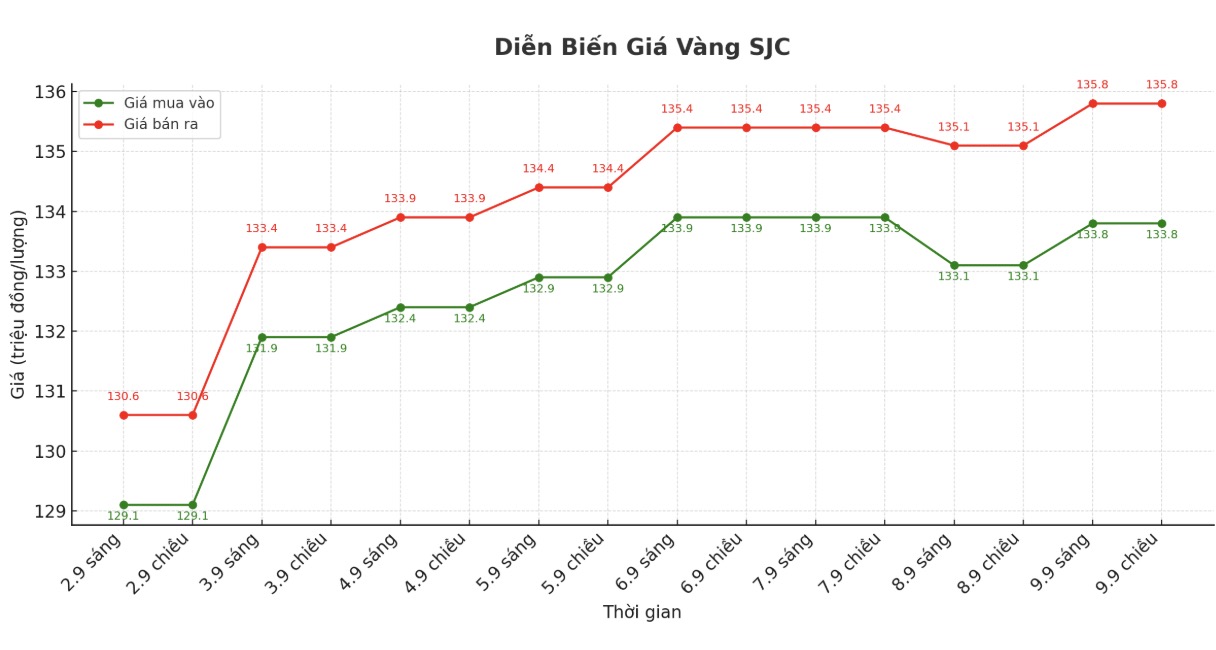

This not only helps reduce the unusual gap between domestic gold prices (especially SJC gold) and international prices, but also contributes to limiting smuggling, speculation and "golding" the economy.

Regarding economic impact, the decree is expected to open up a more effective direction for mobilizing a large amount of physical gold resources among the population to serve socio-economic development, instead of being "frozen" in the safe.

At the same time, bringing gold back to its true nature as commodities, rather than as an underground currency, would reduce risks to macroeconomic stability, especially exchange rates, interest rates and the foreign exchange market.

If implemented synchronously, this policy will not only improve the transparency and competitiveness of the gold market, but also help Vietnam integrate more deeply into the international financial market, strengthen investor confidence and contribute to creating a more stable and modern economy.

With international research experience, what can Vietnam learn from the gold management models of major markets in the world to apply to the current context?

- International experience shows that each country has different ways of managing the gold market, but all aim for the goal of stabilizing the macro and taking advantage of gold resources for economic development.

The US considers gold a completely free market commodity, free of administrative interference, helping to form a market for derivatives, ETFs and transparent investment instruments. This helps mobilize capital effectively, reduce the pressure of "goldening" and create a safe investment channel for people.

China applies a centralized but flexible management model, the State strictly controls the import, export and trading of gold bars through the Shanghai Gold Exchange, and allows diversification of financial products related to gold. Thanks to that, the market is both transparent and meets diverse needs, reduces smuggling and limits speculation.

India, the country with the largest demand for gold in the world, focuses on domestic gold mobilization policies through interest-on-unds, bond issuance and gold ETFs. Thanks to that, the amount of gold "standing still" among the people is included in the financial system, reducing gold imports, balancing payment balances and supporting currency stability.

These experiences, if adjusted to suit the characteristics of Vietnam, will help the gold market develop healthily, reduce price differences, limit speculation and, more importantly, mobilize large gold resources among the people to serve socio-economic development.

Can you propose specific solutions for Vietnam based on the experiences of these countries?

- From international experience, Vietnam can draw important lessons and convert them into specific recommendations for gold market management.

First of all, as in the US model, gold should be viewed as a common commodity rather than a special financial instrument, thereby reducing rigid administrative management measures.

Vietnam needs to develop gold-based financial products such as term contracts, options contracts and especially gold ETFs to diversify investment channels, create more options for people, while reducing the pressure of physical gold accumulation and improving transparency in the market.

In addition, Chinese experience suggests the establishment of a national gold exchange, under the supervision of the State Bank but operating according to market mechanisms.

Here, all transactions of gold bars and raw gold will be concentrated, creating a transparent price level, directly connecting with world gold prices and at the same time effectively controlling gold import and export activities, limiting smuggling and price difference speculation.

Lessons from India show the importance of mobilizing huge gold resources among the population. Vietnam can implement a program of depositing gold for interest, issuing gold bonds or gold trust certificates, both ensuring the legitimate interests of the people and converting the amount of "standing still" gold in the safe into a source of capital for development investment.

If we know how to combine all three models, the Vietnamese gold market will both maintain macroeconomic stability and effectively promote the huge gold resource for socio-economic development.

Thank you very much!