Gold prices increase simultaneously

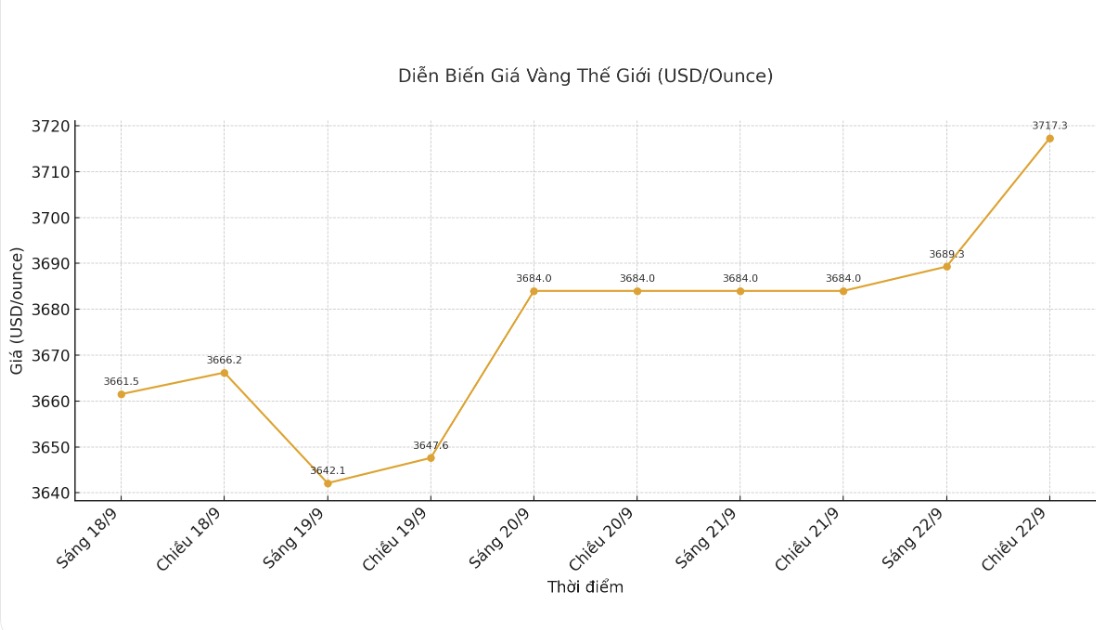

As of 3:00 p.m. on September 22, the world gold price skyrocketed to 3,717.3 USD/ounce, up 33.3 USD compared to a day ago. The strong increase helped the world gold price reach an all-time high in the first trading session of the week.

In the context of the sharp increase in world gold prices, domestic gold businesses also adjusted the gold price to increase.

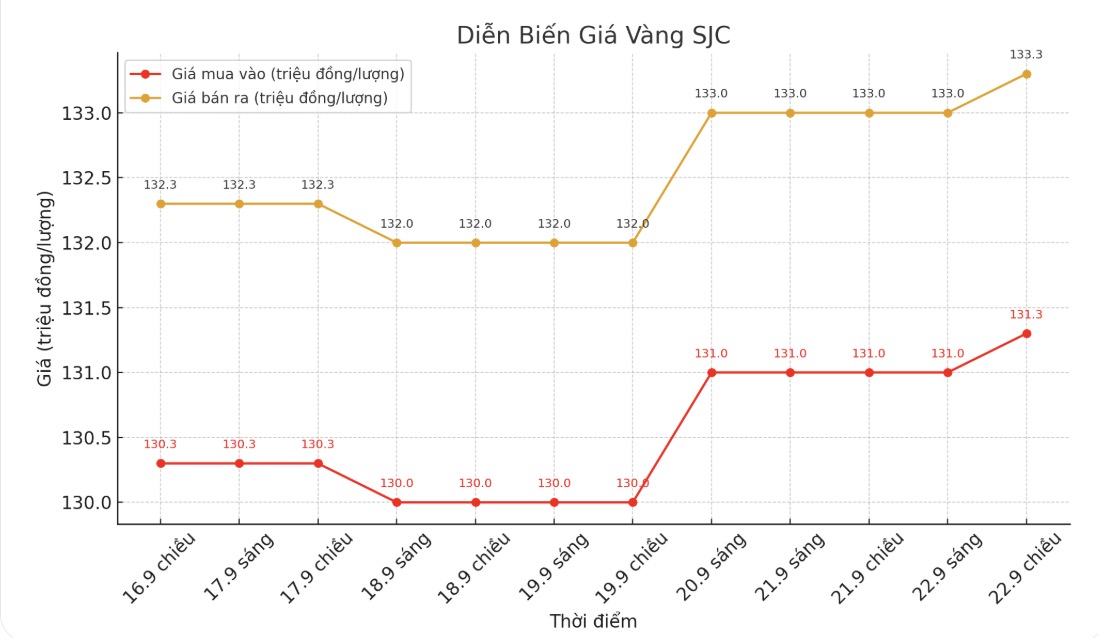

Domestic SJC gold bar prices increased simultaneously with the world price. Specifically, DOJI Group increased by VND300,000 in both directions, to VND131.3-133.3 million/tael.

Bao Tin Minh Chau increased by 600,000 VND, listed 131.6-133.6 million VND/tael. Phu Quy Gold and Stone Group also adjusted the price up by VND500,000, to VND131-133.6 million/tael.

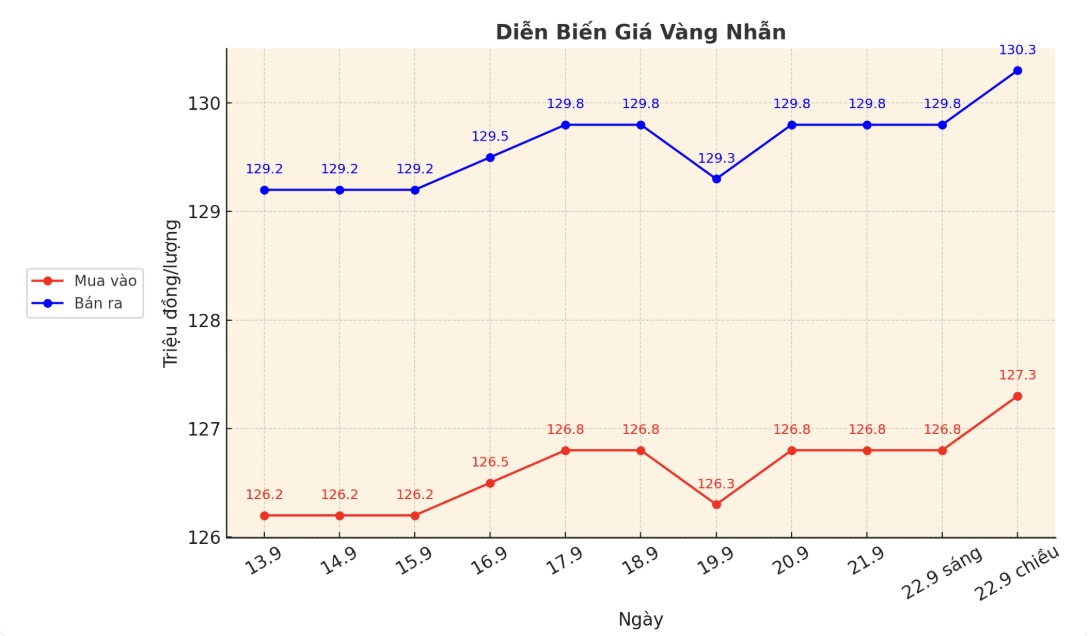

Plain gold rings also recorded a similar increase. DOJI Group and Phu Quy both adjusted the price up by VND500,000, up to VND127.3030.3 million/tael.

Bao Tin Minh Chau increased by 800,000 VND, to 127.8-130.8 million VND/tael. The difference between the buying and selling prices at these enterprises remains stable, respectively around VND2-2.5 million/tael for SJC gold bars and VND3 million/tael for gold rings.

Reasons for gold prices to increase in the first session of the week

World gold prices increased sharply as investors poured money into precious metals after the US interest rate cut last week and signaled that the Federal Reserve (FED) could continue to loosen policy. The market is also waiting for a series of speeches from FED officials and US inflation data released this week.

Gold is consolidating its upward momentum, with traders paying attention to the possibility of prices continuing to break out from now until the end of the year, driven by the forecast that the FED will continue to lower interest rates - Tim Waterer, Head of Market Analysis at KCM Trade, commented, and said that central banks maintaining buying also continues to support the upward momentum of gold.

If macro data continues to reinforce the loose Fed view, gold could see new highs this week, Waterer added.

The Fed cut interest rates by 0.25 percentage points on Wednesday, but still warned about inflationary pressures. According to the CME FedWatch tool, investors are expecting the Fed to make two more cuts of 0.25 percentage points in October and December, with a probability of 93% and 81%, respectively. In a low interest rate environment, gold often performs well.

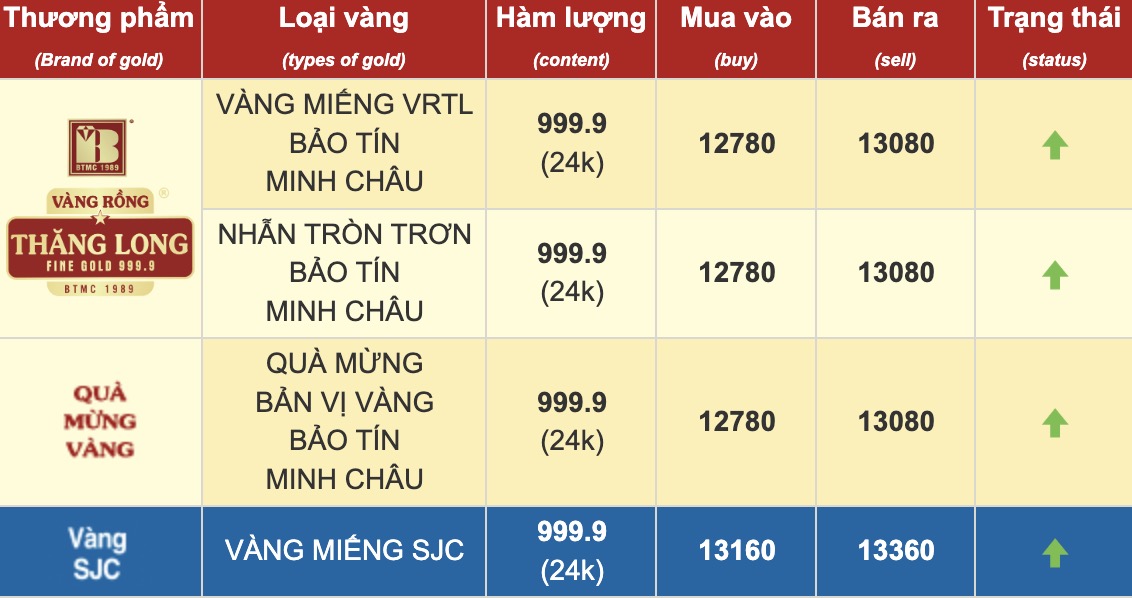

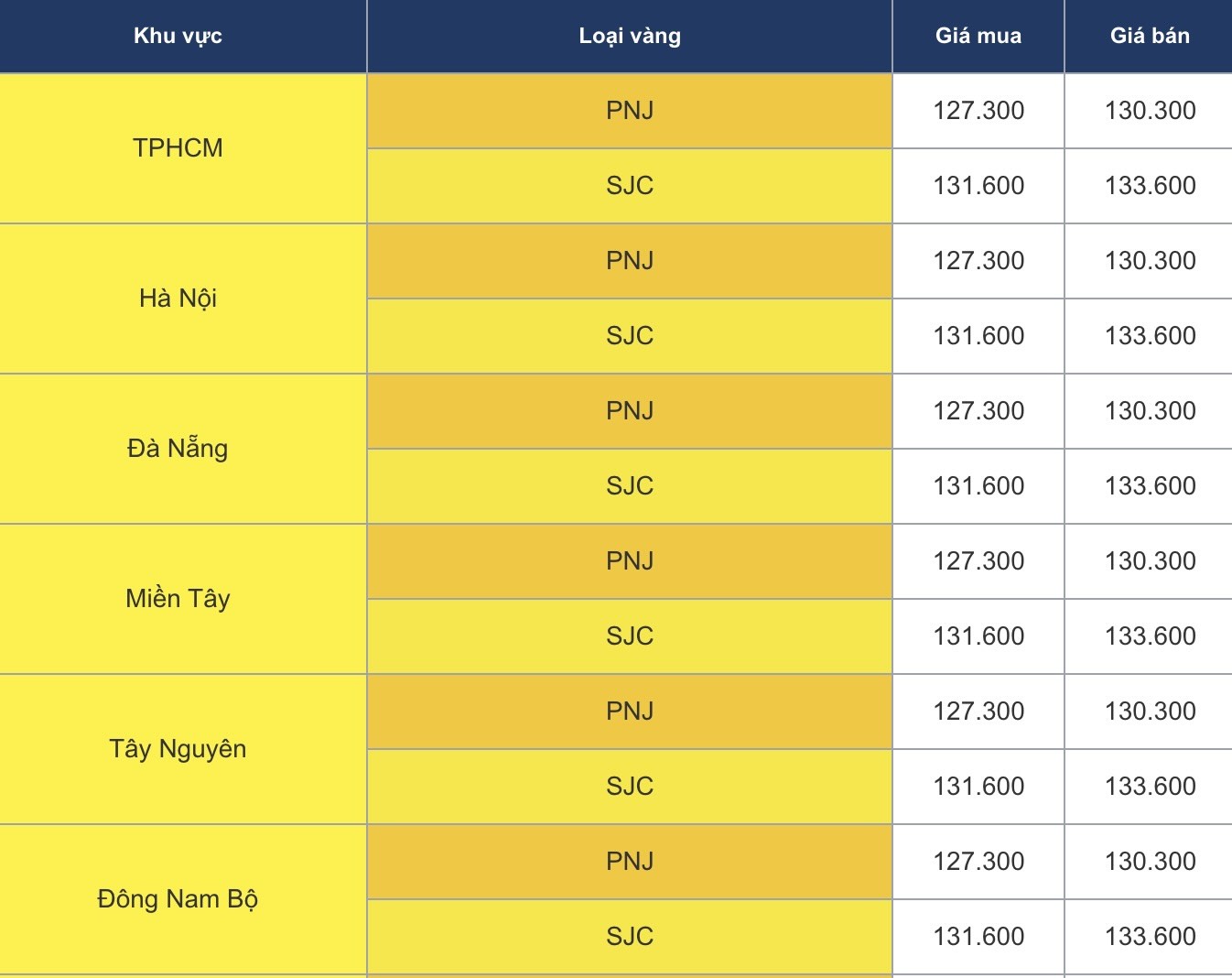

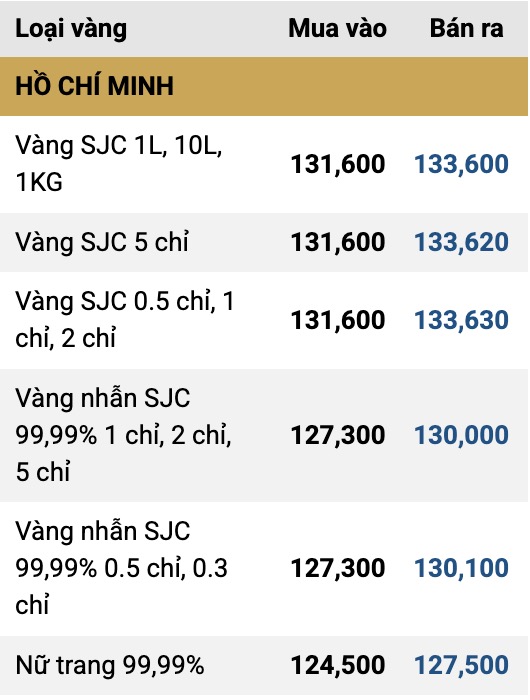

Below is the gold price update on the website of each business unit, recorded at 3:00 p.m. on September 22:

Economic calendar affecting world gold prices this week

Monday: Stephen Miran speaks at the New York Economic Club.

Tuesday: US S&P Flash PMI.

Wednesday: US new home sales.

Thursday: Swiss National Bank monetary policy decision, US final Q2 GDP, US long-term orders, US weekly jobless claims, US existing home sales.

Friday: US personal consumption expenditure (PCE) price index, University of Michigan consumer confidence index (adjusted).

See more news related to gold prices HERE...