Gold prices rose to record levels in the trading session on Monday, as investors poured into the precious metal following last week's US interest rate cut and signaled that the Federal Reserve (FED) could continue to loosen policy.

The market is also waiting for a series of speeches from FED officials and US inflation data released this week.

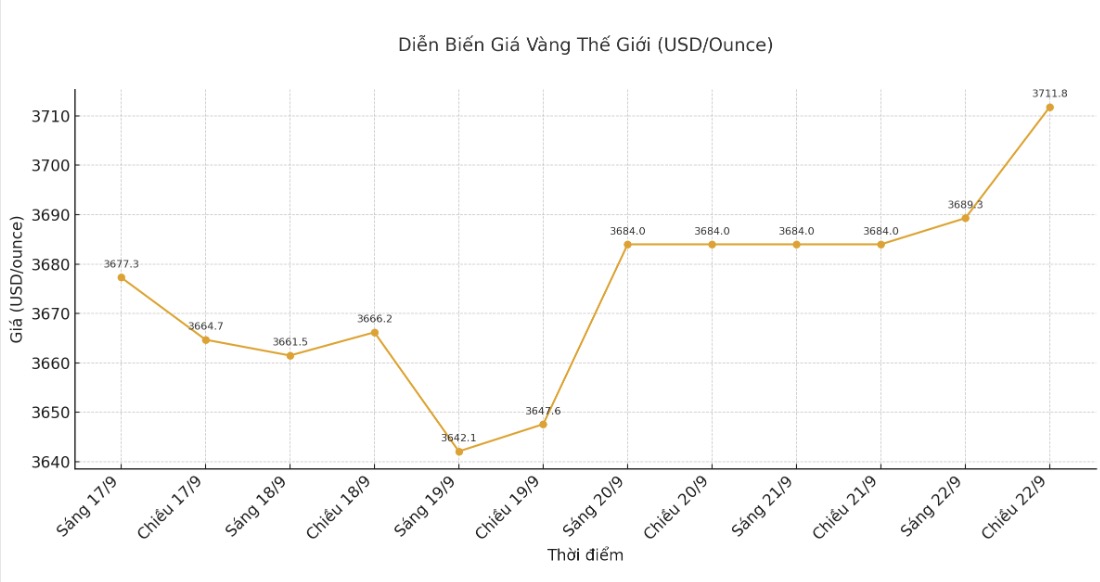

Spot gold rose 0.7% to $3,709.29 an ounce at 6:37 a.m. GMT, after hitting a record high of $3,711.55 an ounce. US December gold futures increased 1% to $3,743.40.

Gold is consolidating its upward momentum, with traders paying attention to the possibility of prices continuing to break out from now until the end of the year, driven by the forecast that the FED will continue to lower interest rates - Tim Waterer, Head of Market Analysis at KCM Trade, commented, and said that central banks maintaining buying also continues to support the upward momentum of gold.

The US core personal consumption expenditure (PCE) price index - the FED's preferred inflation measure - is expected to be released on Friday, along with comments from at least 12 FED officials, including Chairman Jerome Powell, on Tuesday, will provide additional signals on monetary policy prospects.

If macro data continues to reinforce the loose Fed view, gold could see new highs this week, Waterer added.

The Fed cut interest rates by 0.25 percentage points on Wednesday, but still warned about inflationary pressures. According to the CME FedWatch tool, investors are expecting the Fed to make two more cuts of 0.25 percentage points in October and December, with a probability of 93% and 81%, respectively.

In a low interest rate environment, gold often performs well. Since the beginning of the year, gold prices have increased by nearly 42%, thanks to economic and geopolitical instability, central bank purchases and the trend of loosening monetary policy.

Spot silver prices rose 1.3% to $43.64 an ounce, remaining around a 14-year peak. platinum rose 1.2% to $1,420.48/ounce and palladium rose 1.2% to $1,163.24/ounce.

See more news related to gold prices HERE...