The gold price increase is driven by the psychology of finding a safe haven amid global economic and geopolitical instability and expectations that the US Federal Reserve (FED) will continue to lower interest rates.

Gold was once considered a safe asset in times of uncertainty, and in 2025, it continued to show its appeal as prices have increased by 53% since the beginning of the year, after an increase of 27% in 2024.

Independent metals trader Tai Wong commented: "If the belief in this trend is too strong, the market will continue to move towards the next round of 5,000 USD/ounce, especially when the FED is likely to continue to lower interest rates".

He also said that although there may be technical stops such as extended ceasefire agreements in the Middle East or Ukraine, fundamental factors such as huge public debt, the trend of diversifying reserves and a weak USD will still maintain the leading role in gold prices in the medium term.

The gold rally is supported by many factors: Expectations of interest rate cuts, political and economic instability, net buying by central banks, capital flows into gold ETFs and a weakening USD.

Meanwhile, the US government has entered the seventh day of a temporary shutdown, delaying the release of key economic data. Investors now have to rely on non-governmental data to predict the timing and scale of the Fed's interest rate cut.

The market is betting on the possibility of the FED cutting 25 basis points at this month's meeting, and another 25 basis points in December. High levels of uncertainty often prompt gold prices to increase, and that is happening again, said Tim Waterer, Chief Analyst at KCM Trade.

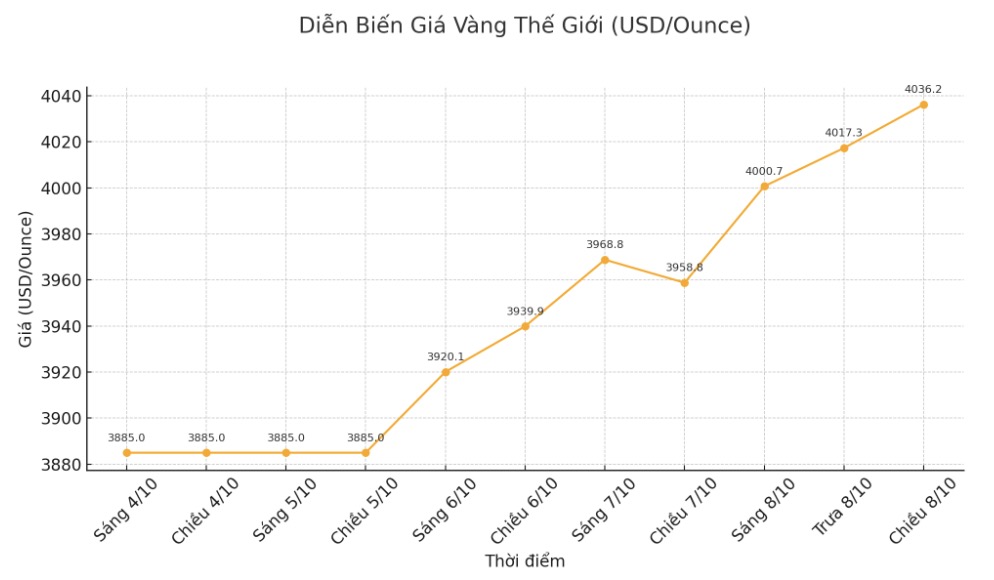

L lower interest rates in the US and continued government shutdowns are supporting gold, but profit-taking pressure around $4,000 could pose a short-term correction risk.

Analysts also believe that the "fear of missing out" (FOMO) mentality is contributing to pushing gold prices further. Political fluctuations in France and Japan have also caused demand for precious metals to increase sharply.

According to expert Kyle Rodda (Capital.com): "The latest price increase stems from Ms. Sanae Takaichi's victory in the election last weekend and the possibility of Japan expanding its budget spending, promoting the current "run it hot" investment trend".

Analysts predict that strong capital flows into gold ETFs, central bank purchases and expectations of US interest rate cuts will continue to support gold prices in 2026. Both Goldman Sachs and UBS have raised their gold price forecasts in recent reports.

In other precious metals, spot silver rose 1.3% to $48.44 an ounce, platinum rose 2.4% to $1,657.33 an ounce, and palladium rose 2.3% to $1,368.68 an ounce.

See more news related to gold prices HERE...