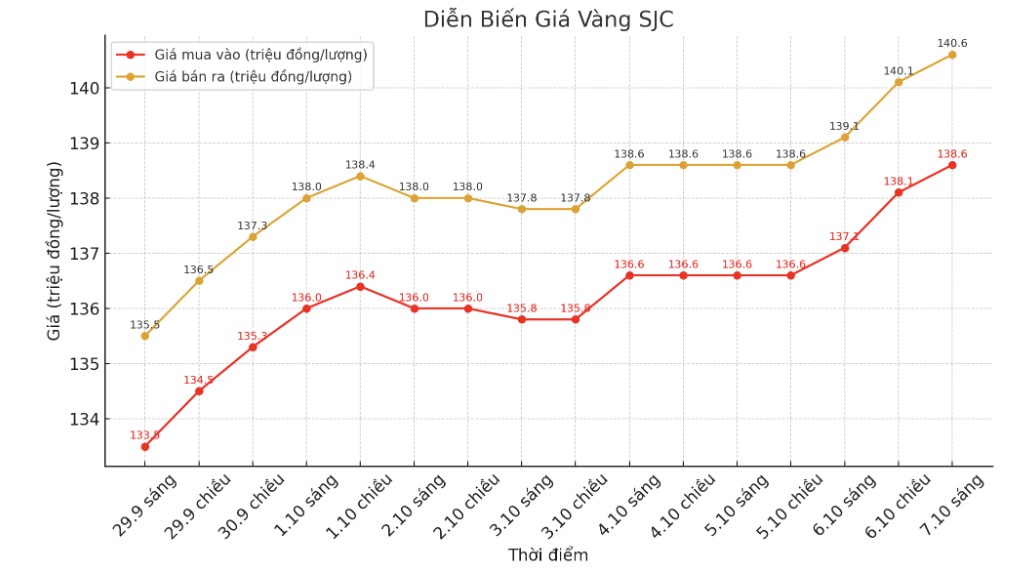

Updated SJC gold price

As of 10:15, the price of SJC gold bars was listed by DOJI Group at 138.6-140.6 million VND/tael (buy - sell), an increase of 1.5 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 138-140.6 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling prices is at 2.6 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 138.1-140.1 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

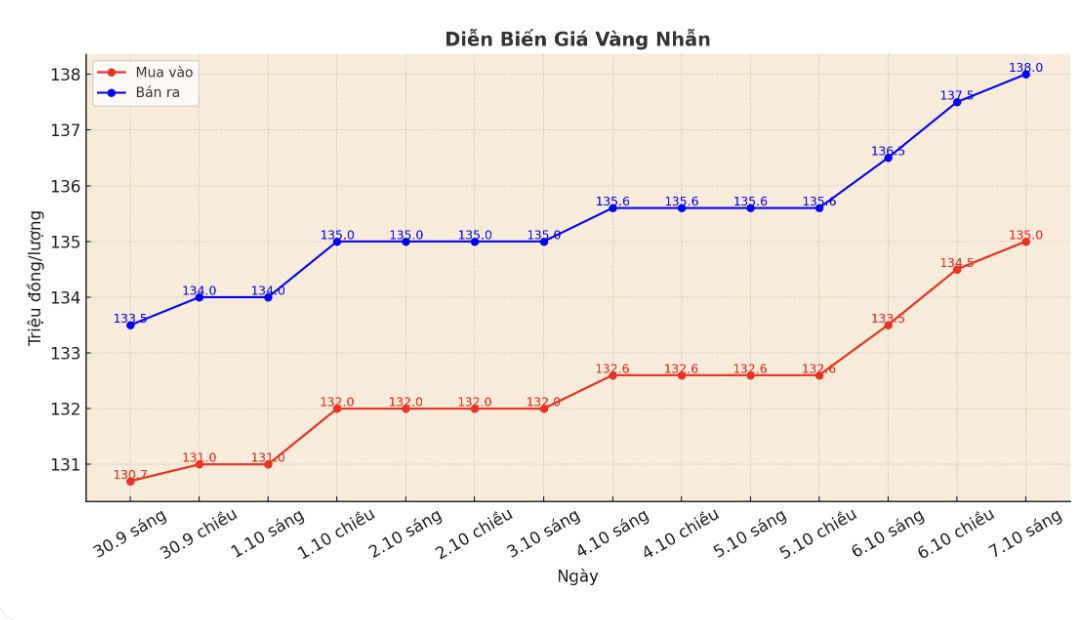

9999 round gold ring price

As of 10:15, DOJI Group listed the price of gold rings at 135-138 million VND/tael (buy - sell), an increase of 1.5 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 135.3-138.3 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 135.1-138.1 million VND/tael (buy - sell), an increase of 1.6 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

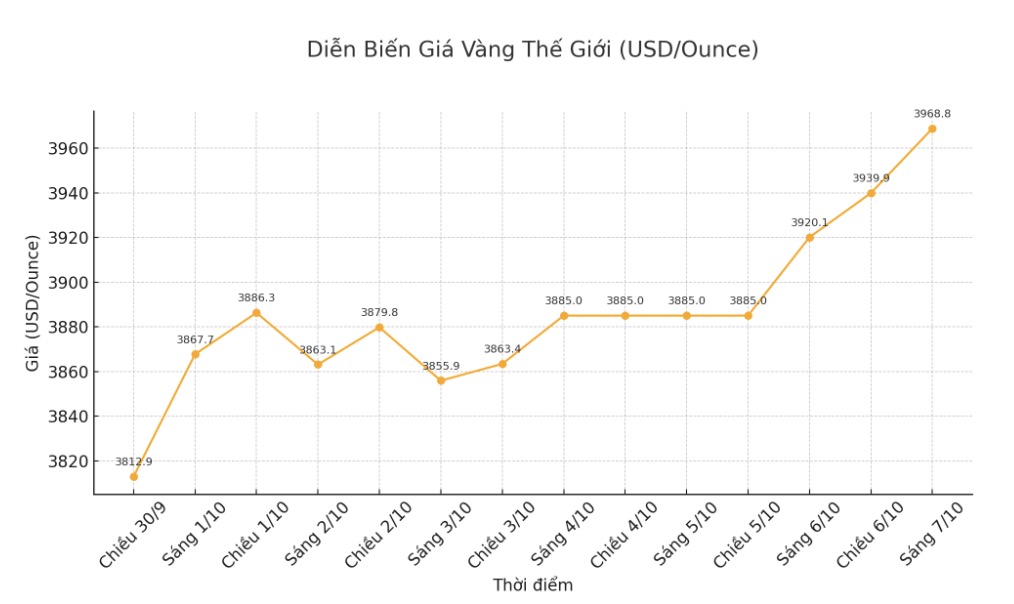

World gold price

At 10:15, the world gold price was listed around 3,968.8 USD/ounce, up 48.7 USD.

Gold price forecast

Expectations of the US Federal Reserve (FED) cutting interest rates this year and the possibility of the US Government continuing to close for a long time are boosting investment demand for precious metals. Gold prices have now risen about 50% since the start of the year.

According to Bloomberg, holdings of gold ETFs continued to increase strongly last week, with individual investor purchases helping the total holding value increase the fastest in more than 3 years.

There is currently no sign that the US government shutdown is about to end. Republican House leaders have asked members not to return to Washington as the government remains paralyzed.

Technically, December gold futures are maintaining a strong near-term technical advantage. The next upside target for buyers is to close above the solid resistance zone of $4,000/ounce.

Despite many supportive factors, one of the most bullish investors on Wall Street has begun to show more caution as the precious metal price approaches the $4,000/ounce mark.

The commodity research group of Bank of America (BofA) is one of the first units to forecast the target of 4,000 USD/ounce since the beginning of this year, saying that as long as investment demand increases slightly, gold can reach this level.

However, as the target is gradually becoming a reality, BofA technical analyst Paul Ciana said that gold prices have reached most of their upside potential and are showing signs of overbought.

Many technical signals at different time frames suggest that golds rally may be wearing down as it approaches $4,000 an ounce, he said. If correct, it is likely that in the fourth quarter, there will be a period of sideways or adjustment.

Regarding risk management, investors should raise the loss stopping point, protect or reduce their buying position. For traders who are trending in reverse, they can consider buying and selling options in the next 4-6 weeks.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...