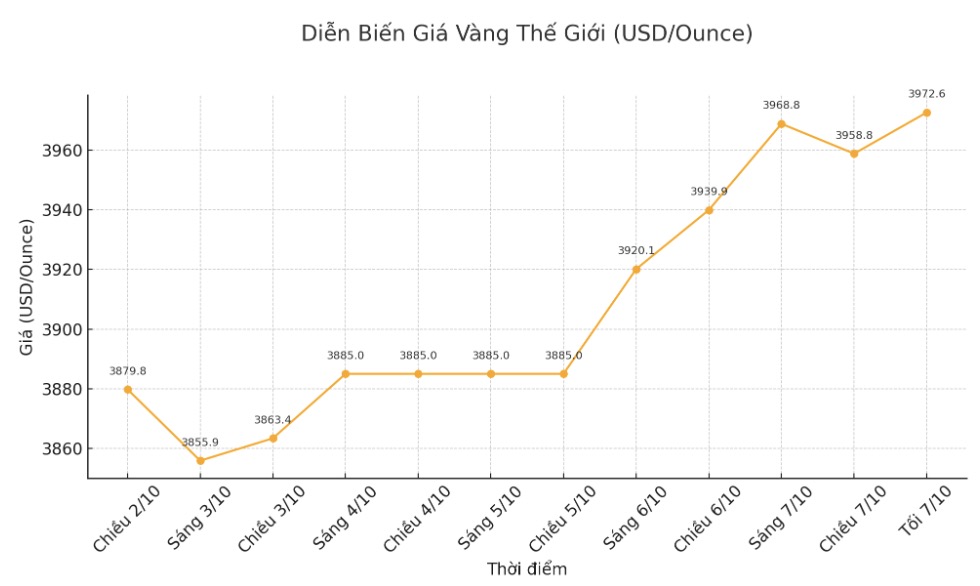

The world gold price for December delivery set a new contract record of 4,00010 USD/ounce. Safe-haven demand continues to keep gold prices high, while silver prices decreased slightly due to profit-taking activities after reaching a 14-year peak.

The global stock market last night fluctuated in different directions until weakening. US stock indexes are expected to open slightly lower when the New York trading session begins.

US President Donald Trump on Monday gave mixed signals about negotiations with Democrats over the federal government's shutdown.

After days of silence, he said he was ready to negotiate health benefits to end paralysis, even implying that discussions had begun, according to Bloomberg. This is seen as a change in stance after the Republicans previously confirmed that they would only discuss Obamacare benefits after the Democrats passed the budget bill.

If he is truly willing to cooperate, we will sit at the table, said Senate Democratic leader Chu Chu Schumer. However, a few hours later, Mr. Trump posted on social media: "I am willing to work with the Democrats on their failed health care policies or any other issue, but first of all, they must allow the government to reopen."

Bloomberg also said that expectations in the US Treasury bond market have fallen to their lowest level in nearly 4 years due to the government's suspension. The delay in releasing important economic data leaves investors lacking the basis for major fluctuations, causing the US interest rate market to enter a consolidation phase. However, if the closure is resolved unexpectedly, fluctuations can increase sharply again.

In South America, the Argentine government continued to sell USD on the foreign exchange market for the fifth consecutive day to prevent the peso from depreciating. The country's central bank has sold about 450-480 million USD at 1,430 peso/USD, causing the peso to weaken by 0.4%. The Rafael Milei administration is said to have sold a total of about 1.3 billion USD since last week, reducing capital reserves slightly.

According to Bloomberg, "the sale shows great pressure on the peso, despite support from the US and the re-appraisal of capital control, including a 9-day ban on reselling the USD". Economy Secretary Luis Caputo and Central Bank Governor Santiago Bausili have traveled to Washington to work with US Treasury Secretary Scott Bessent and the IMF.

Meanwhile, prominent hedge fund manager Paul Tudor Jones warned of the possibility of a "blow-off top" in the US stock market. He told CNBC that current conditions could create a strong rally before the market hits a peak: I think all factors are ready for a breakout. History often repeats itself, and if there is another, this time it can explode even more than in 1999".

He compared the current excitement to the period before the dot-com bubble, when technology stocks skyrocketed with high speculation. Nasdaq has gained 55% since the bottom of April, setting a new peak.

Technically, December gold buyers are holding a strong advantage in the short term. The next upside target is to close above the strong resistance zone of 4,000 USD/ounce, while the sellers aim to pull the price down below the strong support of 3,750 USD/ounce.

The most recent resistance level was at a record peak of $4,00010/ounce, then $4,025. immediate support was at an overnight low of $3,963.40 an ounce, followed by $3,950 an ounce.

In outside markets, the USD index increased again, crude oil prices stabilized around 61.75 USD/barrel, and the yield on 10-year Treasury bonds was 4.16%.

See more news related to gold prices HERE...