The first full job report released since August - due to being delayed by the US government shutdown lasting 43 days until October showed that the number of new jobs was lower than forecast.

According to the US Bureau of Labor Statistics (BLS), the number of non-farm jobs in the US in December only increased by 50,000, lower than the forecast of about 66,000 given by economists.

However, the unemployment rate decreased to 4.4%, from 4.6% in November.

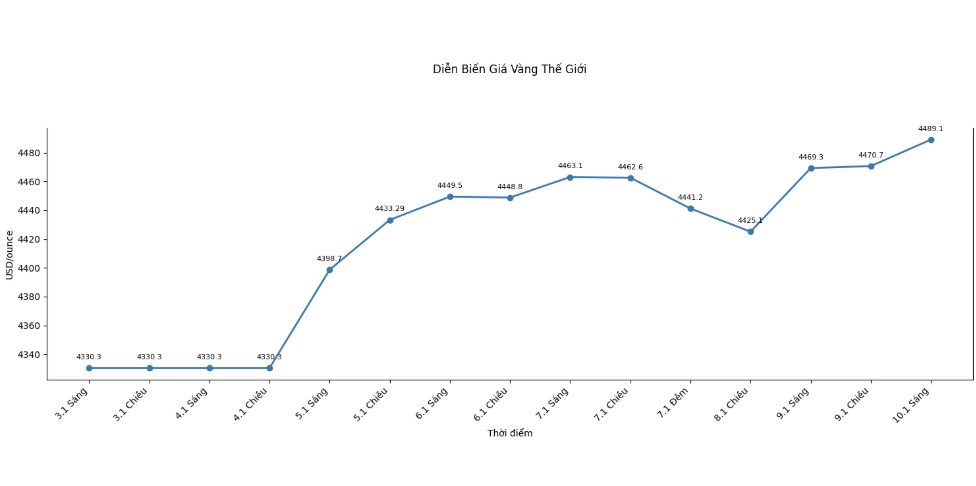

Immediately after the job data was announced, gold prices jumped up. Spot gold was traded at 4,486.60 USD/ounce, up 0.21% on the day.

Not only did December jobs disappoint, data from previous months also continued to be sharply reduced. The report said that the number of jobs in October was reduced to negative 173,000, compared to an initial estimate of negative 105,000. Meanwhile, November data was also reduced to 56,000 jobs, from the previously announced level of 64,000.

With these adjustments, the total number of jobs in October and November is 76,000 lower than the previous report," BLS said.

A bright spot in the US economy is that wages remained quite good. The report said that average hourly income in December increased by 0.3%, equivalent to 12 cents, to $37.02/hour.

In the past 12 months, hourly wages have increased by 3.8%" - the report stated clearly.

According to analysts, the latest jobs data will continue to support gold prices as the labor market weakens, while wage inflation remains high. Expectations are increasing that the US Federal Reserve (Fed) will continue to cut interest rates in the 2026 period, despite remaining inflationary pressure.

Experts believe that this environment will cause real yields to decrease, thereby reducing the cost of opportunities to hold gold - a non-profit asset - and supporting the upward trend of gold prices.

See more news related to gold prices HERE...