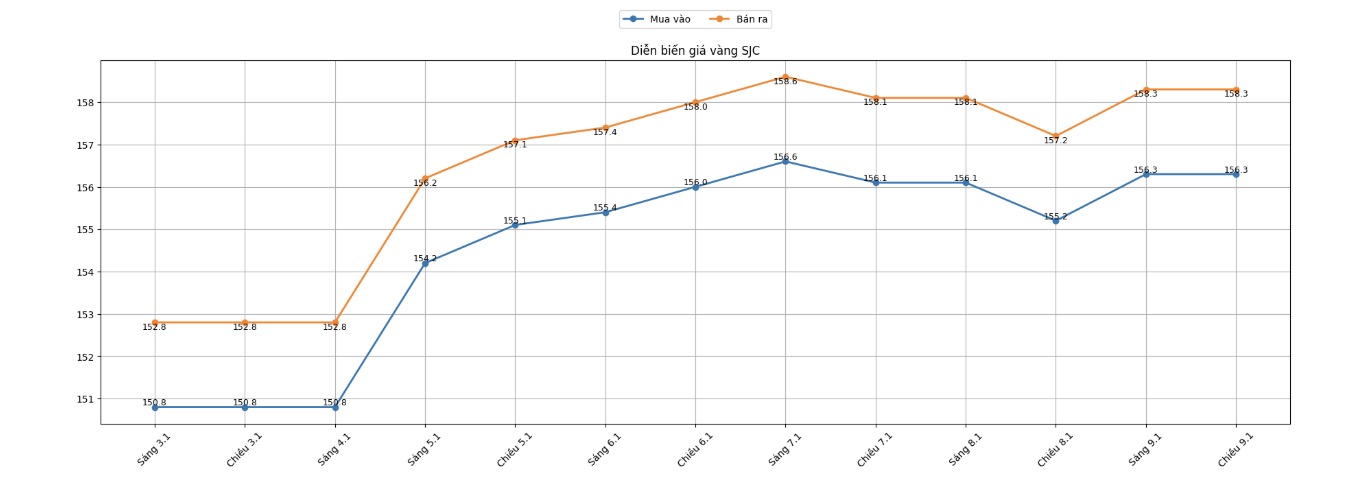

SJC gold bar price

As of 5:25 PM, SJC gold bar prices were listed by DOJI Group at the threshold of 156.3-158.3 million VND/tael (buying - selling), an increase of 1.1 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 156.3-158.3 million VND/tael (buying - selling), an increase of 1.1 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 155.8-158.3 million VND/tael (buying - selling), an increase of 600,000 VND/tael on the buying side and an increase of 1.1 million VND/tael on the selling side. The difference between buying and selling prices is at 2.5 million VND/tael.

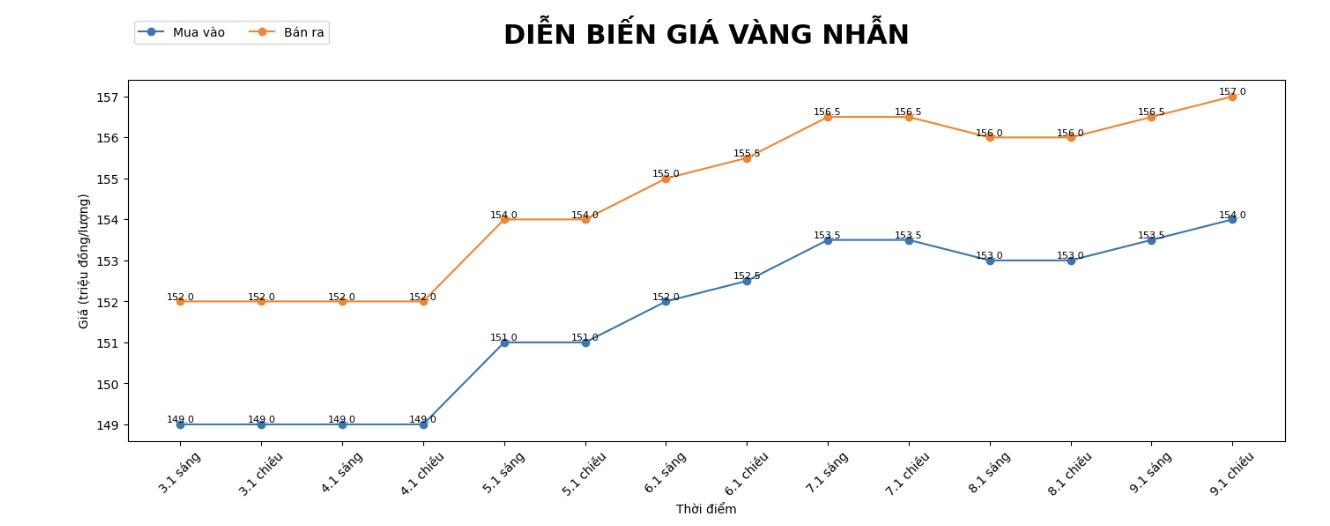

9999 gold ring price

As of 5:25 PM, DOJI Group listed the price of plain gold rings at the threshold of 154-157 million VND/tael (buying - selling), an increase of 1 million VND/tael in both buying and selling directions. The difference between buying and selling is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 155.6-158.6 million VND/tael (buying - selling), an increase of 800,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at the threshold of 154-157 million VND/tael (buying - selling), an increase of 700,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

The high buying - selling gap increases the risk for individual investors. Individual investors, especially those with a "surfing" mentality, need to consider carefully before spending money.

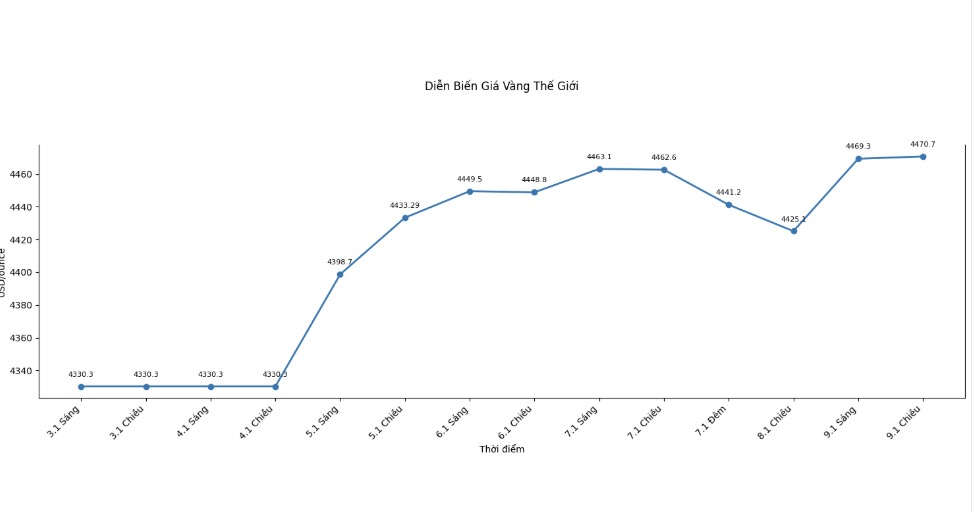

World gold price

World gold prices listed at 5:26 PM were at the threshold of 4,470.7 USD/ounce USD/ounce, up 45.6 USD compared to the previous day.

Gold price forecast

World gold prices are entering a sensitive phase as the USD maintains its recovery momentum, while the market is waiting for a series of important US economic data that could directly impact the monetary policy orientation of the US Federal Reserve (FED). After a booming 2025, with an increase of about 65% and continuously setting new peaks, the precious metal is facing the problem of both accumulating upward momentum and facing short-term correction pressure.

According to HSBC experts, global geopolitical risks and increasing public debt levels may continue to play a "backing" role for gold in the medium term. This bank raised the gold price forecast ceiling for 2026 to 5,050 USD/ounce and believes that the precious metal may peak in the first half of the year. However, HSBC also warned that the fluctuation range will be very wide, fluctuating from 3,950 to 5,050 USD/ounce, reflecting the great level of uncertainty of the global economic and financial environment.

Mr. Rodolphe Bohn - HSBC's monetary and commodity strategist - said that gold demand from central banks and individual investors is still maintained at a high level, especially amid concerns about the weakening USD and unresolved geopolitical risks. "Gold continues to be an effective portfolio diversification tool, helping investors cope with global shocks," Mr. Bohn emphasized. However, he also noted the possibility of gold prices adjusting if the FED suddenly returns to the "hawkish" stance or the global economic environment improves significantly.

From a short-term perspective, pressure on gold prices is coming from a stronger USD and portfolio restructuring activities of large commodity funds. Mr. Ole Hansen - Head of Commodity Strategy at Saxo Bank - said that the COMEX futures contract market may have to absorb sales of up to 6–7 billion USD in the coming days due to the annual commodity index adjustment process. This may cause gold and silver to fluctuate strongly in the short term, although the long-term trend is still considered positive.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...