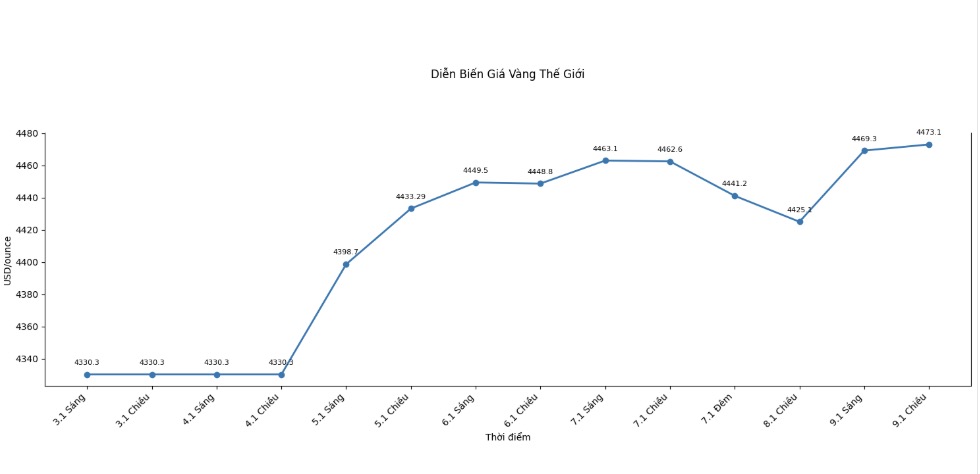

The recovery momentum of gold is showing that this precious metal still maintains a solid position near record highs, although the general market is facing many instabilities.

Meanwhile, silver contracts were under greater pressure, falling 1.3 USD (equivalent to 1.67%) to 76.89 USD. Previously, silver sometimes fell to 73.52 USD in the morning session before recovering slightly at the end of the day.

The mixed developments between gold and silver reflect changes in investor sentiment and different fundamental factors dominating each metal.

Both gold and silver may fluctuate sharply in the coming days due to BCOM's annual restructuring. This activity adjusts the proportion of items in the index based on liquidity and output of the previous year.

BCOM restructuring in the past often increased trading volume and created short-term price fluctuations when passive investment funds and trading systems automatically adjusted portfolios.

Besides the technical factor from BCOM, the market is also waiting for the US jobs report, expected to be released on Friday. The latest data shows that the number of job positions in the US in November decreased to 7.7 million, the lowest level in 14 months and lower than market expectations.

This development shows that the US labor market is gradually cooling down. In normal conditions, this trend will support gold prices, because when the labor market weakens, the possibility of future interest rate reductions will increase, reducing the opportunity cost of holding gold.

However, the relationship between gold and monetary policy is no longer as simple as before because inflation is still high. If the upcoming jobs report is weaker than expected, gold may benefit strongly thanks to increased safe-haven demand. Conversely, if the data is positive, the market may witness stronger profit-taking activity.

A noteworthy point is that although the USD index has increased by 1.23% in the last 9 sessions, gold prices have only slightly adjusted. This shows that the unconventional relationship between the USD and gold is temporarily weakening, as other factors such as demand for savings and risk hedging are dominating the market.

In general, since the beginning of 2024, gold prices have increased by more than 27%, while silver has recorded even stronger increases. Therefore, the recent adjustment is considered a natural profit-taking activity after a period of hot increase.

The upcoming prospects of the two precious metals will depend on separate drivers. Gold is mainly supported by long-term holding demand and the role of monetary value risk hedging. Meanwhile, silver, in addition to investment factors, is also heavily influenced by industrial demand, especially in clean energy sectors such as solar panel production.

Therefore, silver has the potential to increase more strongly when the economy recovers, but is also more likely to be deeply adjusted if the growth outlook weakens.

In the short term, the US jobs report and the global commodity index restructuring are forecast to be decisive factors in the direction of gold and silver prices. Investors are recommended to closely monitor market developments and carefully consider risks in the context of volatility that may increase sharply in the coming days.