In the context of the global financial market being continuously affected by monetary policy and fluctuations in technology stocks, Wall Street analysts believe that investor sentiment is revolving around the key factor: Next signal from the US Federal Reserve (FED). At the same time, gold prices continued to show resilience, despite a hot increase that has lasted for the past three months.

Kevin Grady - Chairman of Phoenix Futures and Options - told Kitco News that the market is in a state of waiting. According to him, every move of the FED, from the meeting minutes to individual statements of each official, has a strong impact on asset prices.

" Interest rates are still the focus of everyone's attention. Everyone is watching what the Fed will do in December. Every time a manager speaks, the market reacts immediately," Grady said.

Kevin Grady also dismissed the claim that the AI field is forming a bubble like in the technology era in 2000. The biggest difference, Grady said, is the financial structure. Technology bubbles were previously "inflated" by debt, when businesses were almost unpopular and relied on expectations.

In contrast, AI corporations today spend billions of dollars in cash on R&D and generate large revenue streams, of which NVIDIA is a typical example. Everyone was waiting for NVIDIA to exceed expectations, and in fact they did. Although the market has adjusted at times, the demand for AI is still extremely strong" - he emphasized.

From a precious metals perspective, Grady continues to maintain an optimistic stance even after gold has increased by 50% since the beginning of the year, while gold stocks increased by 125%, far exceeding the 12% increase of the S&P 500 index. He said the recent cuts have been part of a normal correction cycle.

"The market is in the vegetable eating stage before continuing the main meal. I believe gold prices will be even higher next year," he said. Grady believes that gold's most important foundation comes from central banks, with stable buying power and no signs of withdrawing from holding positions.

Sharing the same view on gold's resilience, Sean Lusk - co-head of commercial defense at Walsh Trading - said that this precious metal is standing incredibly strong despite the stronger USD thanks to the Fed's cautious stance.

Lusk said that gold tends to want to re-examine the recent peak when selling pressure, even appearing in strong fluctuations, is still not enough to reverse prices. He also noted that the metals market is entering a sensitive period as December options mature and silver continues to be an unpredictable hot spot.

According to Lusk, economic data from now until the end of the year will play a leading role in market sentiment. The latest unemployment report is somewhat positive but not enough to change the situation, while consumer sentiment is affected by living costs and political debates surrounding payment ability.

Lusk believes the market could move sideways or decline slightly before waiting until December to see if it will bring a Christmas boost. He said that without clear enough data, the FED will have little reason to switch to a softer stance.

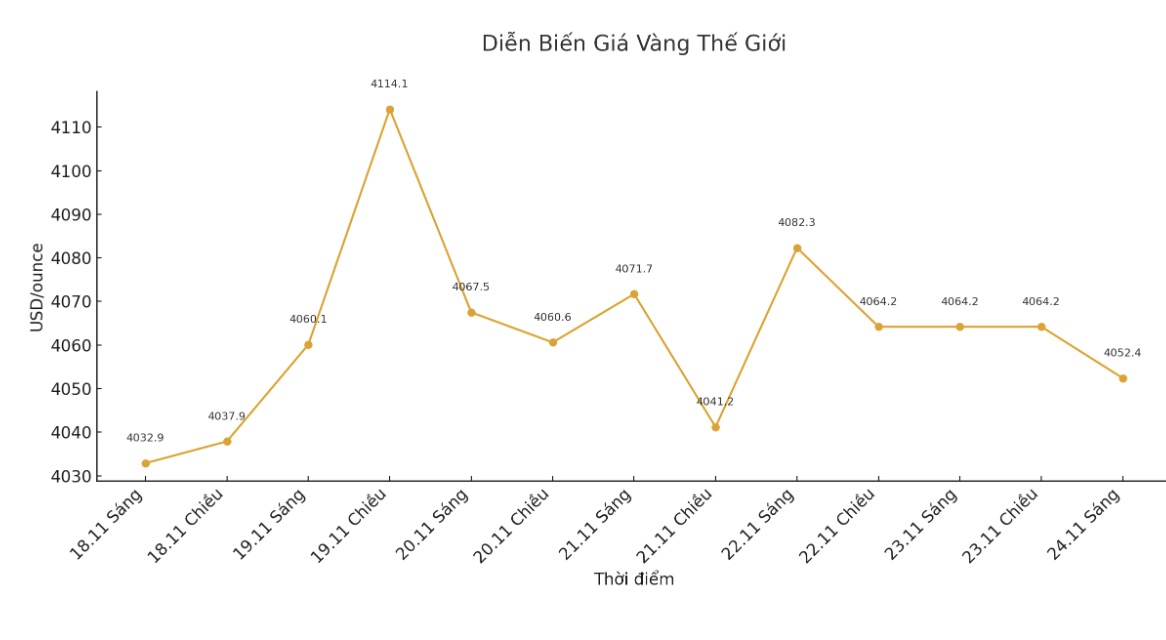

However, Lusk admitted that the clear direction of gold in the current context has not been determined. What is noteworthy, he said, is that prices have increased from $3,300 to $4,000-4.100/ounce in just three months but have not had a single strong correction. Continued buying power from central banks is considered a factor that helps the market maintain a solid foundation. The chart looks very solid. We have not seen any significant corrections, and that is quite strange, he said.

Kitco senior expert - Jim Wyckoff said that gold traders are closely monitoring the developments of the US stock market after a strong sell-off session. If stocks continue to be under pressure, safe-haven demand may increase.

He noted that December gold buyers are aiming to close above the strong resistance zone at the peak of November around $4,250/ounce, while sellers will seek to pull prices below $4,000/ounce.