James Stanley - senior market strategist at Forex. com, emphasized confidence in gold's upward momentum. According to him, last week's sell-off was "very strong", but buying power quickly returned decisively. "I still see downtrends or corrections as opportunities. There is currently no reason to try to'go against the trend' with gold" - Stanley said.

Agreeing with this view, Darin Newsom - senior market analyst at Barchart.com - believes that both gold and silver are still in an upward trend, but warns that the road ahead will not be smooth.

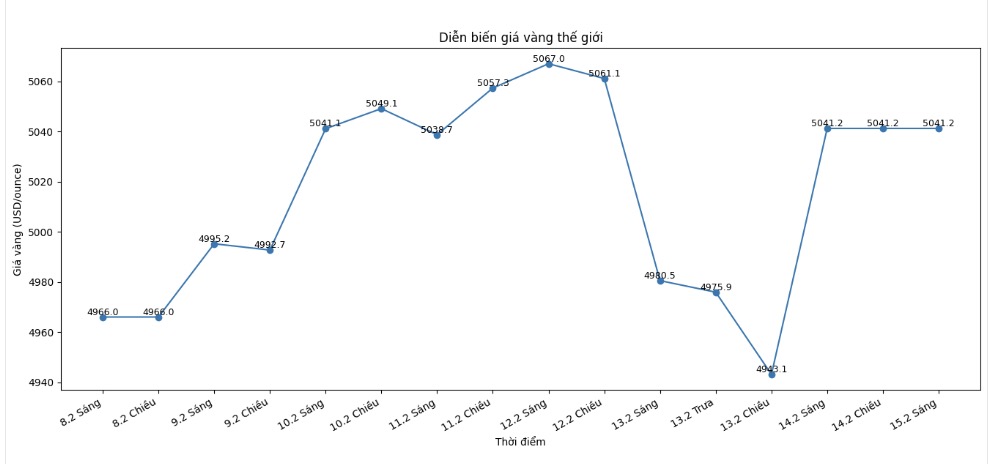

Although I think gold (and silver) will continue to fluctuate strongly next week, the long-term trend is still up," Newsom said.

Newsom also linked market developments to the geopolitical context. He noted that as countries attending the Munich Security Conference continue to build plans to move forward without the US, the need to hold defense assets such as gold and silver may be strengthened.

In particular, the scenario of other countries - notably China selling US Treasury bonds is considered a factor that can support precious metals.

Adrian Day - Chairman of Adrian Day Asset Management - also maintains a positive stance. According to him, the gold market is undergoing "a slow and unstable recovery process", but fundamental factors are still maintained. "Upward trend" - Day affirmed.

From a technical perspective, Kevin Grady - Chairman of Phoenix Futures and Options, focuses on analyzing open interest contract data on the CME exchange. He pointed out that the open contract level around January 23 was one of the recent peaks, but since then the market has decreased by nearly 150,000 contracts. "This is a very large volume of open contracts withdrawing from the market" - Grady said.

According to Grady, speculative capital is currently shifting to small-scale contract products. "If you observe mini-gold mini contracts and new silver contracts with a scale of less than 100 ounces, trading volume is continuously setting records" - he said. The increase in margin ratio on the CME before that has caused many small investors to leave standard contracts, but mini contracts are pulling them back to the market.

The consequence of this shift, according to Grady, is that the market is currently more dominated by speculators, individual investors and momentum-traded funds, while large and professional cash flows are temporarily standing aside. "I think that is happening and is a factor driving strong volatility," he said.

Regarding Thursday's fleeting sell-off, Grady admitted it was difficult to determine the specific cause. He believes that the possibility of margin calls for defensive selling positions may be a contributing factor.

Looking ahead, Grady said he is closely monitoring factors related to monetary policy and the Fed. "Finally, I believe gold will be higher this year" - he concluded, while emphasizing that the developments of open contracts will continue to provide important clues about the actions of major players.

Although experts maintain a positive view of the long-term trend, the general message is that investors need to prepare for strong fluctuations and short-term adjustments on the upward path of precious metals.