In the world, although cryptocurrencies have struggled in the first three months of the year, they are still an important asset for investors. A surprising turning point, gold has outperformed Bitcoin since the beginning of the year.

In an interview with Kitco News, Jigna Gibb - Head of Commodity & Crypto Index Products at Bloomberg Index Services said that as inflation continues to weaken the purchasing power of global currencies, both gold and Bitcoin have become important alternative assets and portfolio allocation tools.

She said that in the current context, they should cooperate rather than compete: Inflation has become a major problem and a significant risk. This is the time for replacement assets to play a role, she said.

These comments were made after the company launched the Bloomberg Gold-Btained Average (BBIG) and the USD, Bitcoin, and Bloomberg Gold-BBSG.

Bloomberg Index Service said in a press release that the Bitcoin - gold average index was developed using a single unit framework, allowing adjustment and customization of future construction factors and weightings based on customer interest.

These indicators are aimed at grasping the growth of Bitcoin, combined with the historical stability of gold. The BBUG index combines the defensive properties of the US dollar with the potential of Bitcoin and gold, along with long-term non- correlational properties, they said.

Jigna Gibb noted that the Bitcoin and gold indexes weighed 50/50, which reduced cryptocurrency volatility from about 50% to 30%. She added that this decrease in volatility will make Bitcoin more attractive to retail investors.

Although Bitcoin has seen a strong recovery last year after US regulators approved the creation of ETFs to trade on Bitcoin spot, the cryptocurrency has struggled since reaching a high of over 109,000 USD/tael in January.

The expert said demand has not completely disappeared. She noted that Bitcoin has struggled in recent weeks due to weak support from US President Donald Trump. During the election campaign, Bitcoin analysts and investors expected to see a positive legal environment for cryptocurrencies, with Trump even talking about creating a Bitcoin Reserve Fund.

The US president fulfilled his promise earlier this month after he signed an executive decree calling for the creation of a digital currency reserve fund; however, the proposed reserve fund would only include government-owned Bitcoin, and no new money would be spent.

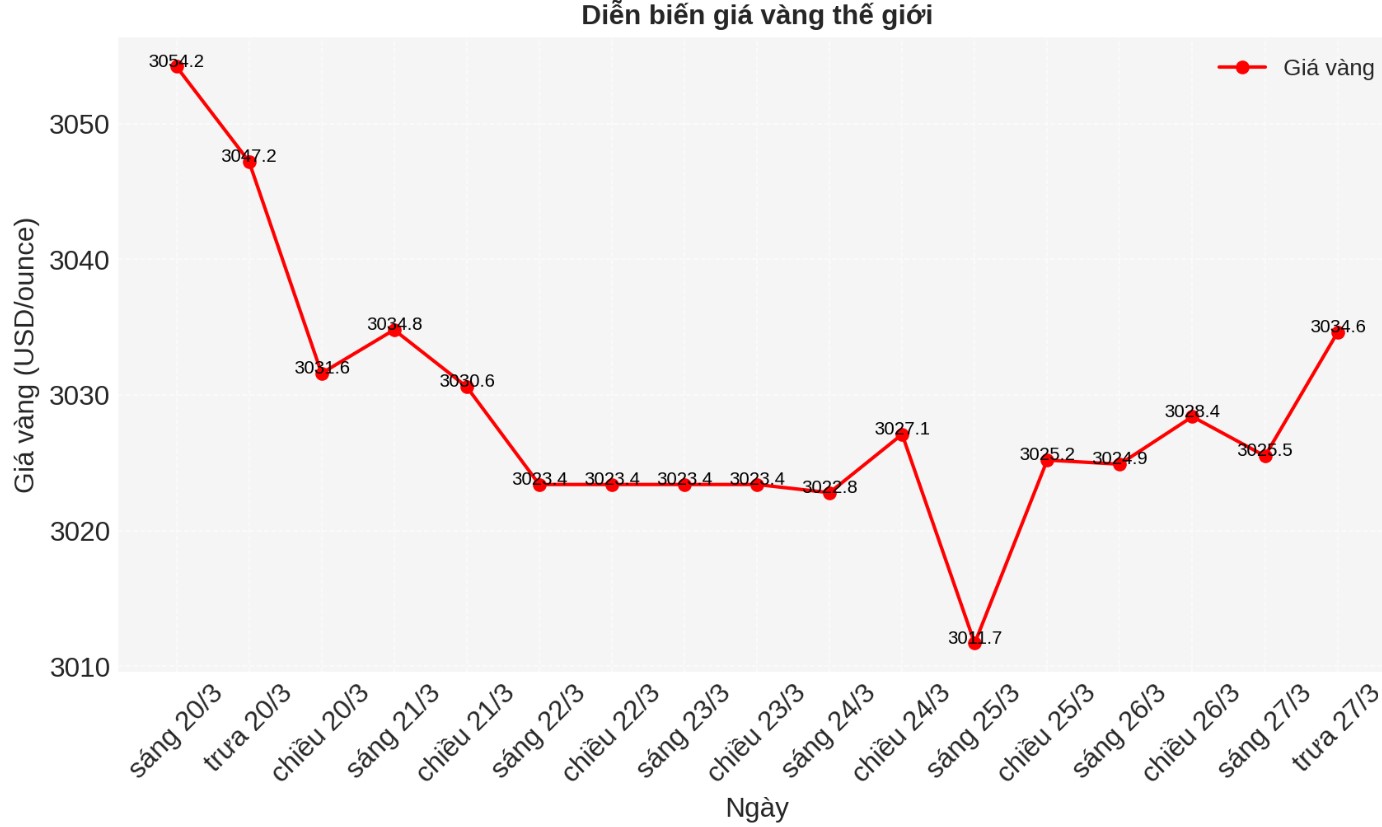

Since the high in January, Bitcoin has fallen 21%, currently trading around $86,000/tael. Meanwhile, gold prices have remained above $3,000/ounce and have increased by 15% so far this year.

She added that what makes gold and Bitcoin attractive alternative assets is their wide liquidity in the market. As stock markets continue to face difficulties in regulatory territory, owning liquid assets is important.

When you are in a stressful situation, what do you want to do with your replacement assets? You want them to reduce portfolio volatility, but you also want to be in a position where you can crystallize those profits and reinvest capital, and be able to buy back core assets as they increase and function well," she said.

In Vietnam, representatives of the State Bank have repeatedly sent out the message: Bitcoin and other similar virtual currencies are not legal currencies and payment methods.