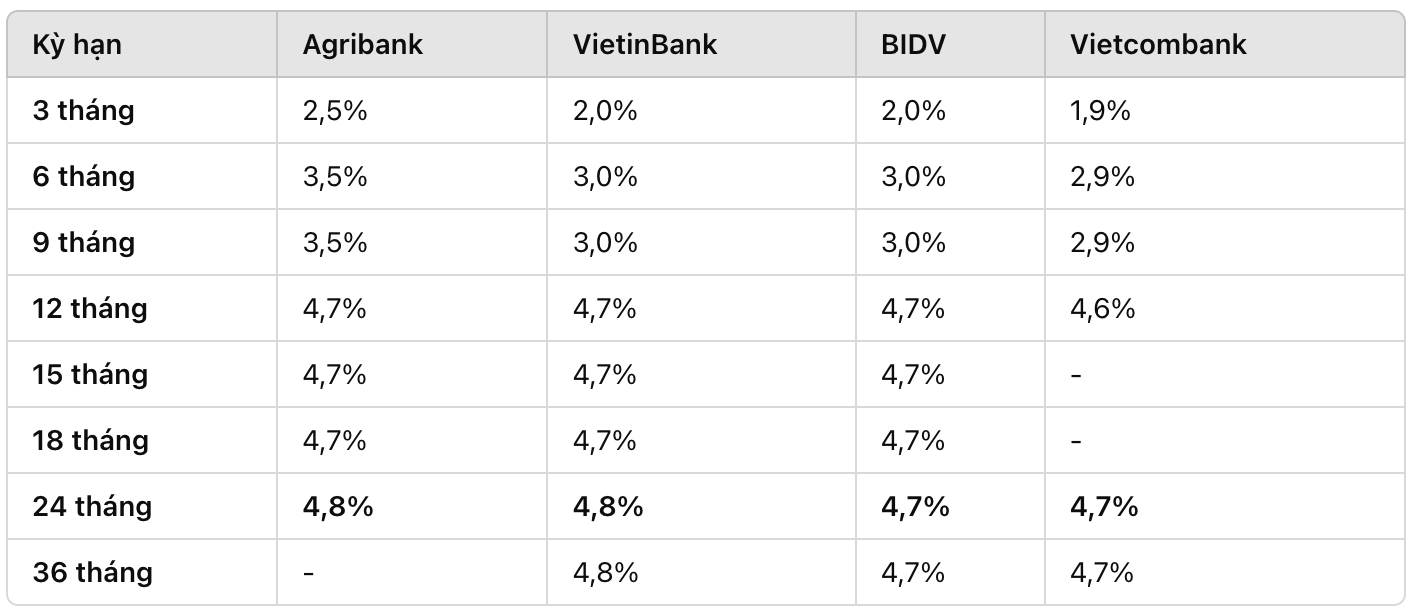

As of February 5, interest rates at Vietcombank, Agribank, VietinBank and BIDV continued to remain within the range of 1.9-4.8%/year.

Latest interest rates at Big 4 state-owned banks

According to updated data, Agribank and VietinBank are still the two banks with the highest interest rates in the Big 4 group, at 4.8%/year for a 24-month term. BIDV and Vietcombank maintain 4.7%/year, 0.1 percentage points lower.

Below is a detailed table of interest rates at the Big 4 group on February 5:

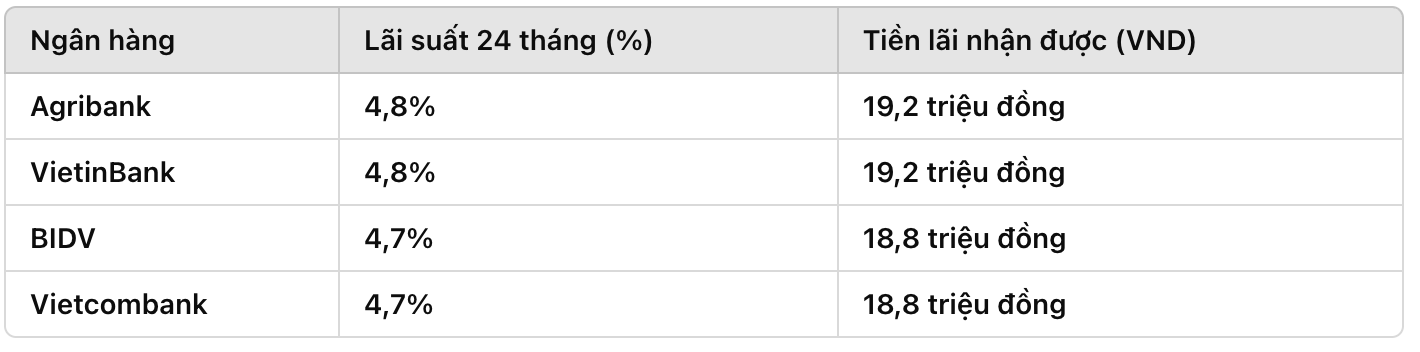

Deposit 200 million VND at Big 4, how much interest will I receive?

Customers depositing 200 million VND for a 24-month term at Big 4 banks will receive the following corresponding interest rates:

Thus, if depositing 200 million VND at Agribank or VietinBank, customers will receive the highest interest of 19.2 million VND after 24 months. Meanwhile, depositing at BIDV or Vietcombank, the interest received is 18.8 million VND.

Techcombank adjusts deposit interest rates

While the Big 4 group kept interest rates unchanged, Techcombank made a slight adjustment, increasing deposit interest rates by 0.2%/year for terms under 12 months. Accordingly:

Term 1-2 months: 3.35%/year.

Term 3-5 months: 3.65%/year.

Term 6-11 months: 4.65%/year.

Term 12-36 months: 4.85%/year (unchanged).

Techcombank also has a policy of adding 0.5%/year interest rate for the first deposit account with terms of 3, 6 and 12 months, bringing the highest possible interest rate up to 5.45%/year.

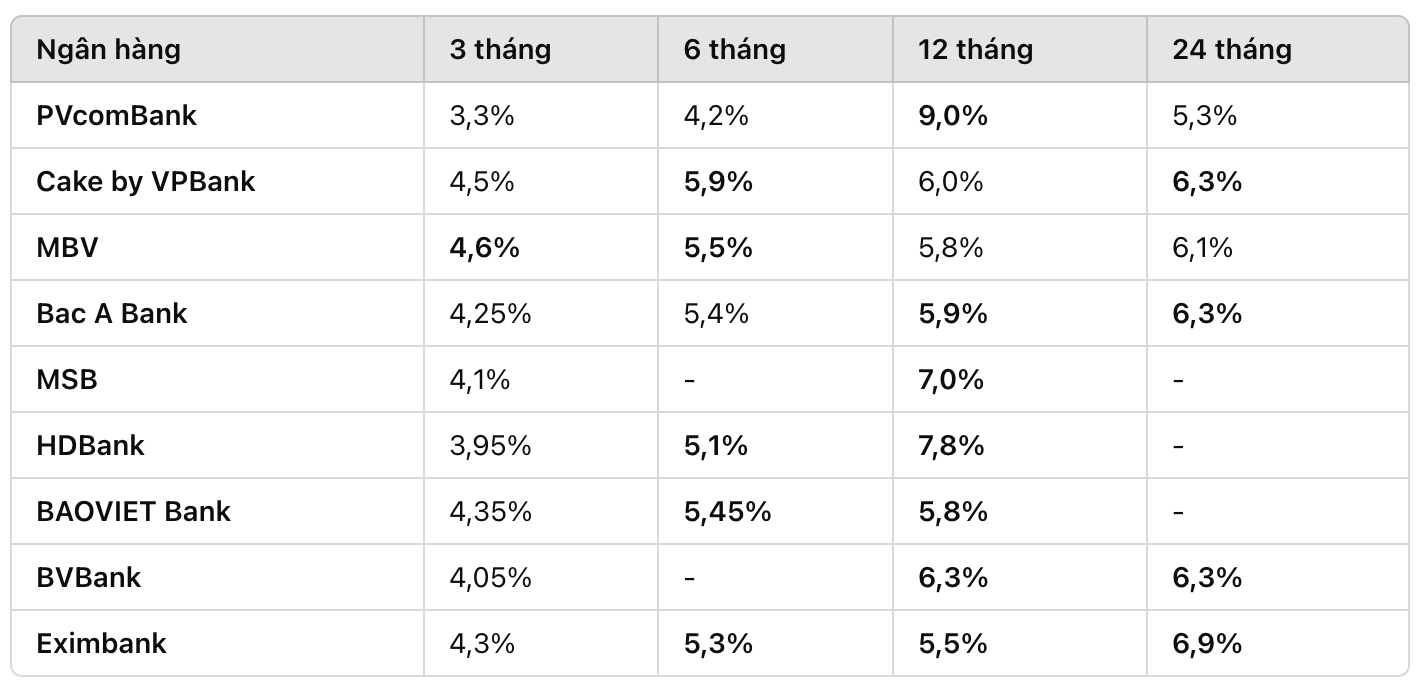

Which bank has the highest savings interest rate today?

Although the Big 4 group has high prestige, some joint stock commercial banks are listing more attractive interest rates, which can be up to 6-9%/year. However, these interest rates often come with conditions of large deposits or long terms.

Below is a comparison table of interest rates of some other banks on February 5:

PVcomBank currently has the highest interest rate, up to 9%/year, but requires a very large minimum deposit amount.

Note when saving

High interest rates often come with strings attached: Some banks offer high interest rates but require large deposits or long terms.

Check the terms of preparation: If the financial flexibility is needed, customers should choose the appropriate term because many banks will reduce interest rates strongly when withdrawing before the due date.

Choose a reputable bank: When depositing large amounts of money, you should prioritize banks with stable financial status and good liquidity.

Interest rates may change from time to time. For detailed information, customers should contact the bank directly or visit the official website to update the latest interest rates.