According to a preliminary report from the University of Michigan, the US Consumer Psychology Index in July reached 61.8 points, higher than the forecast of 61.5 points and up from 60.7 points in June. This is the highest level in the past 5 months, but still 16% lower than December 2024 and below the historical average.

Ms. Joanne Hsu - Director of Consumer survey at the University of Michigan - commented: "Consular psychology has only increased slightly compared to last month. Although it reached a new high this year, consumers are still reserved and have not regained full confidence in the economy.

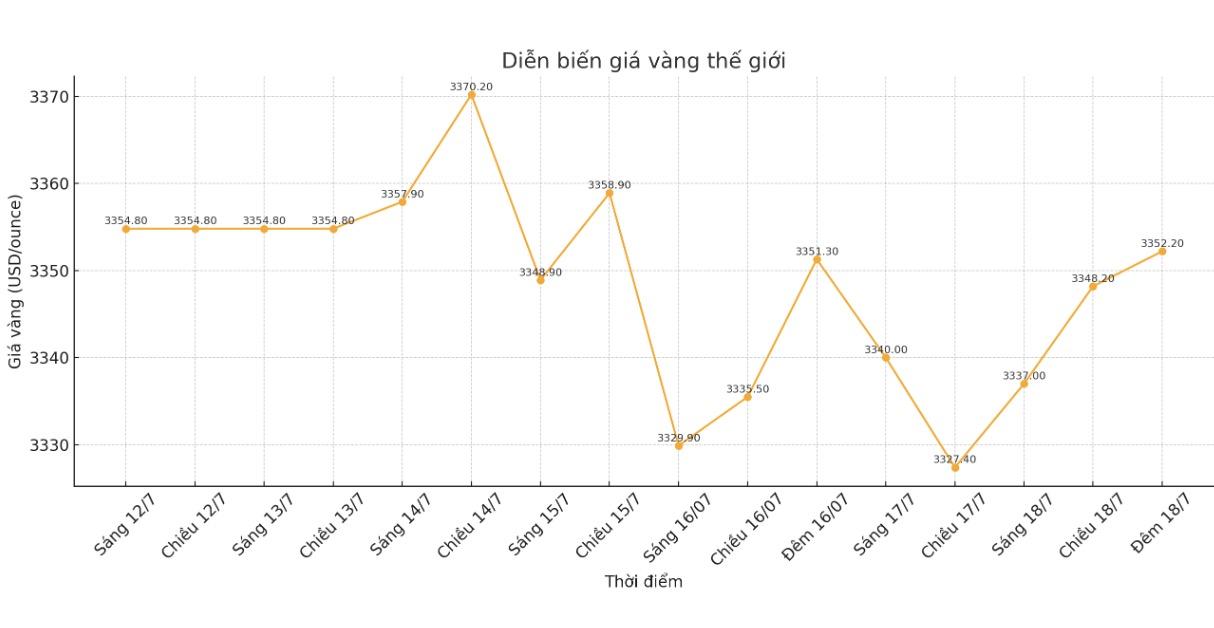

Gold prices have increased after this data was released at 9:00 p.m. on July 18 (Vietnam time). Recorded at that time, spot gold prices reached 3,356.84 USD/ounce, up 0.53% on the day. By the end of the session, prices continued to increase and reached 3,357.8 USD/ounce.

An important factor in the survey is consumer inflation expectations. In the short term, annual inflation expectations fell from 5.0% in June to 4.4% in July. Long-term inflation expectations also cooled down from 4.0% to 3.6% - the lowest level since February 2025, but still higher than December 2024. This shows that consumers are still concerned that inflation could return.

It will be difficult for consumers to regain confidence without seeing the stability of trade policy or other macro factors, said Joanne Hsu. Current data does not show a clear impact from the newly approved fiscal policies.

LPL Financial chief economist Jeffrey Roach said: Although inflation risks in the coming months remain, consumer expectations have been held tight. They believe that tariff inflation is only temporary and the situation will improve by 2026. This is a positive signal for the US Federal Reserve (FED).

On the same day, the US Department of Commerce also released data on the housing market, showing signs of recovery. The number of houses started in June increased by 4.6%, reaching a seasonal adjustment of 1.321 million units/year - 1.29 million units higher than the forecast. However, compared to the same period last year, housing construction activities still decreased by 0.5%.

The single-tension segment alone recorded a decrease of 4.6%, down to 883,000 units, lower than the 926,000 units in May after adjustment. Meanwhile, construction permits for future construction activities increased slightly by 0.2% to 1.397 million units, close to market forecasts.

Analysts said that despite positive signs, the US housing market still faces many challenges such as high mortgage rates due to the Fed's tight monetary policy and escalating housing prices due to scarce supply.

In that context, gold prices held steady around the peak in the session, showing that investor sentiment is still leaning towards safe assets against mixed positive and risky economic signals. Although inflation shows signs of cooling down and the housing market recovers slightly, caution still prevails as macro uncertainties continue.