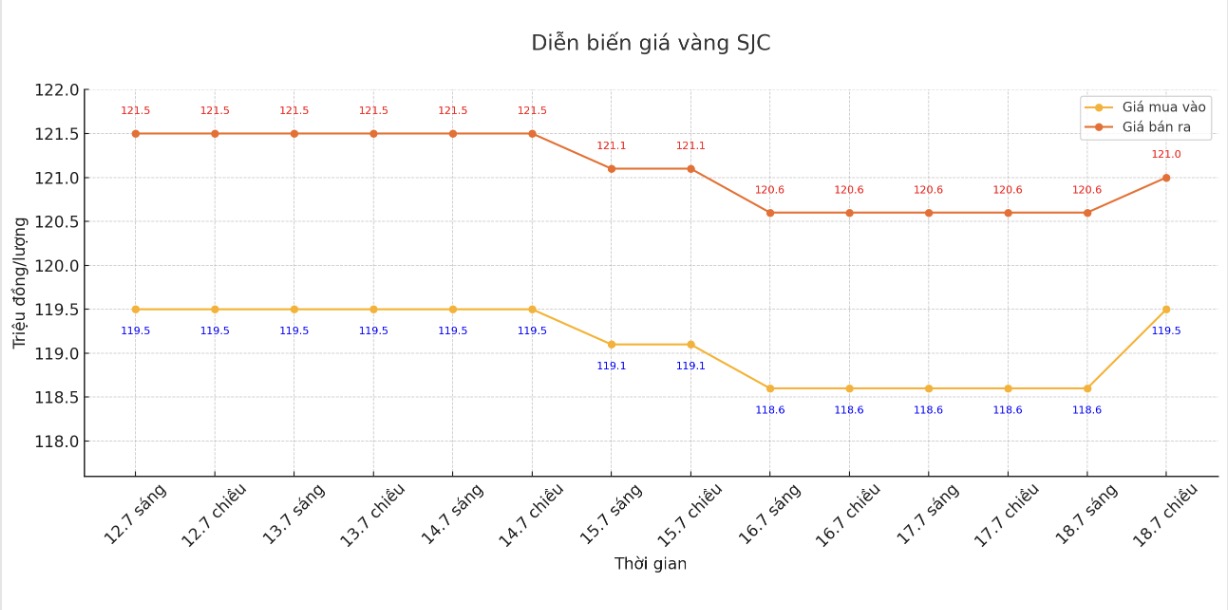

SJC gold bar price

As of 5:20 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 119.5-121 million/tael (buy - sell); increased by VND 900,000/tael for buying and increased by VND 400,000/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

DOJI Group listed at 119.5-121 million VND/tael (buy - sell); increased by 900,000 VND/tael for buying and increased by 400,000 VND/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at VND 119.5-121 million/tael (buy - sell); increased by VND 900,000/tael for buying and increased by VND 400,000/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 118.4-121 million VND/tael (buy - sell); increased by 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2.6 million VND/tael.

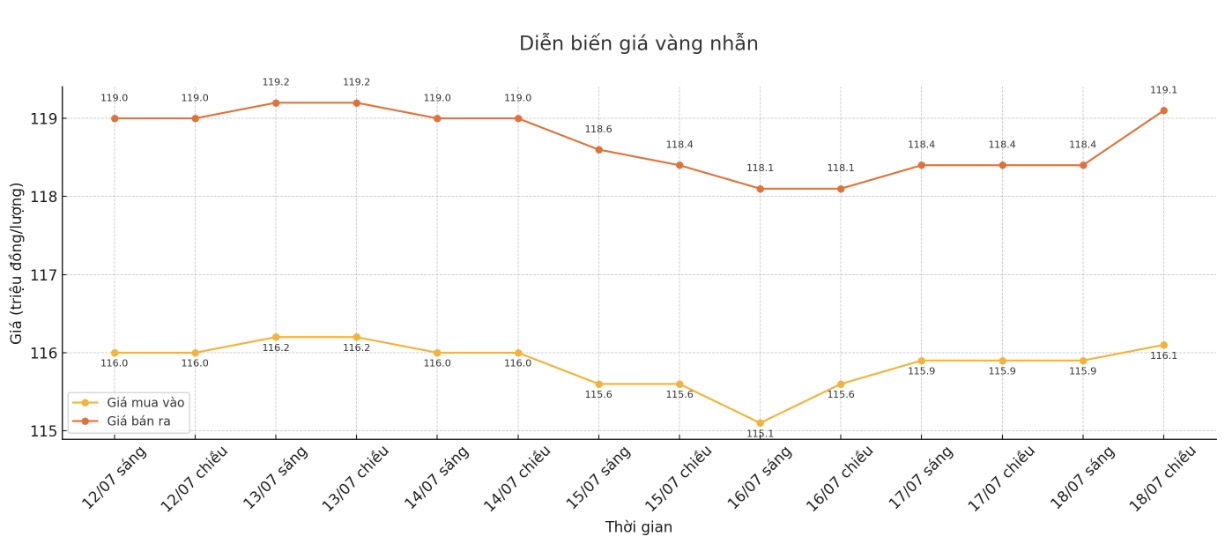

9999 gold ring price

As of 5:00 p.m., Bao Tin Minh Chau listed the price of gold rings at 116.1-119.1 million VND/tael (buy in - sell out), an increase of 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

DOJI Group listed the price of gold rings at 115.9-118.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 2.5 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.8-117.8 million VND/tael (buy in - sell out), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

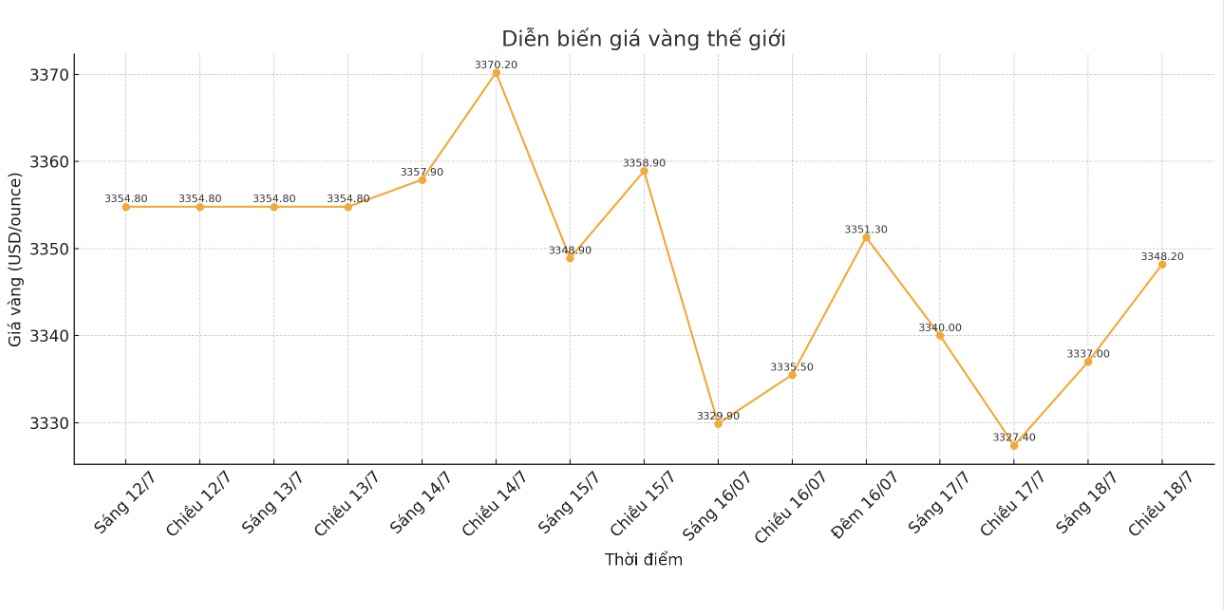

World gold price

The world gold price was listed at 5:20 p.m. at 3,348.2 USD/ounce, up 20.8 USD/ounce compared to 1 day ago.

Gold price forecast

Gold prices increased due to concerns about the independence of the US Federal Reserve (FED) soothing and strong US economic data.

During the week, some sources said that US President Donald Trump was ready to fire FED Chairman Jerome Powell, but later, Mr. Donald Trump denied this plan despite continuing to criticize the current interest rate policy.

Notably, US data showed that retail sales in June increased more strongly than expected, while the number of initial unemployment claims was also more positive than expected.

UBS commodity analyst Giovanni Staunovo commented: Investors are still concerned about the independence of the Fed. Currently, that risk has decreased and US economic data remains solid, limiting gold's increase. However, Mr. Trump wants the FED to cut interest rates aggressively... which is helping the market maintain the price base".

Gold is often considered a safe haven asset in times of uncertainty and thriving in a low interest rate environment.

Meanwhile, Adrian Ash - Research Director at Bullion Vault - commented: Although gold may face difficulties in the short term if there is no specific policy shock, the long-term uptrend is still solid thanks to central bank buying and more real cash flow for physical gold. In the precious metals market, the focus is gradually shifting from gold to silver, platinum and paladi - industrial and growth options.

According to the World Gold Council (WGC), world gold prices could reach $4,000/ounce by the end of 2025 if geopolitical and macro factors continue to support. However, in the opposite scenario, gold could lose up to 17% of its gains this year.

The WGC forecasts that if the economy develops as expected, gold could increase by 5% in the second half of the year. Meanwhile, if inflation and geopolitical tensions escalate, gold could increase by 10-15%. Conversely, if things cool down, gold prices could fall 12-17%.

CIBC Bank also believes that gold is in the "second" of the uptrend and could reach $3,600/ounce by the end of this year. CIBC raised its 2025 average forecast to $3,339/ounce and said gold will hold around $3,600 in 2026 before falling to $3,000 in 2027 as the economy is more stable.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...