Over the past week, the domestic gold market experienced an unprecedentedly strong price increase. SJC gold bar prices at many large enterprises increased to 9 million VND/tael in just 7 days.

However, many investors, even if they buy at the right time of " beginning the wave", still only earn modest profits of about 5 - 6 million VND/tael. The main reason is that the difference between buying and selling prices is too high.

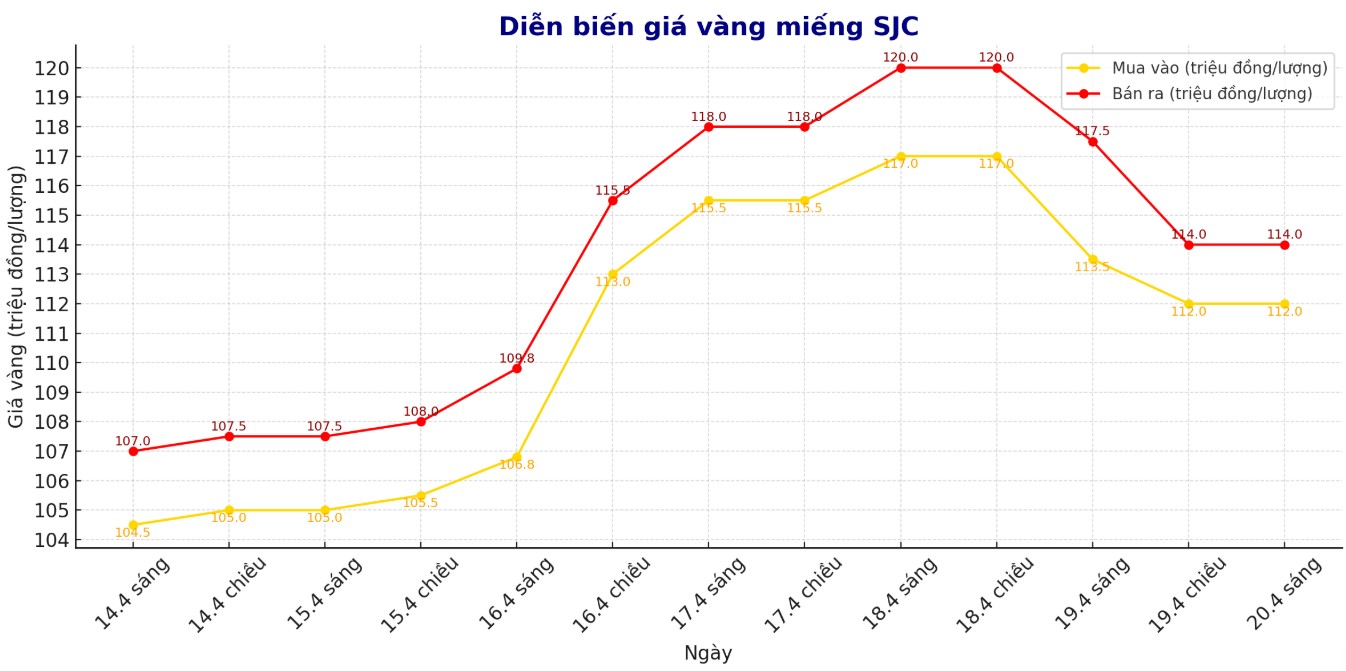

By April 20, 2025, DOJI Group and Saigon Jewelry Company (SJC) both listed the price of SJC gold bars at 112 - 114 million VND/tael (buy - sell).

Compared to the closing session of the previous week (September 13), the buying price increased by VND9 million/tael, while the selling price increased by VND7.5 million/tael. However, the difference between buying and selling prices is currently at 2 million VND/tael.

This means that if an investor buys gold from the above systems on April 13 and sells it today, the profit earned is only about 5.5 million VND/tael, significantly lower than the increase in the week.

This situation is even more evident in the gold ring market. On the morning of April 20, DOJI listed the price of Hung Thinh Vuong gold rings at 109.5 - 113.5 million VND/tael, an increase of 8.3 million VND/tael for buying and 8.7 million VND/tael for selling respectively compared to last week.

However, due to the extended buy-sell gap of up to 4 million VND/tael, investors only made a profit of about 4.7 million VND/tael.

Meanwhile, at Bao Tin Minh Chau, the price of gold rings also recorded a strong increase. The purchase price increased by 9.6 million VND/tael, the selling price increased by 8.9 million VND/tael, the price difference was 2.8 million VND/tael. Investors here can make a profit of about 6.1 million VND/tael if they buy on April 13 and sell today.

Experts say that during a period of strong market fluctuations, businesses often adjust the difference between buying and selling to prevent risks. That unintentionally reduces the actual profit margin of buyers.

Not only that, the domestic price increase is too hot, causing the market to fall into a state of "deadly" with the world. In the same week, the world gold price increased by only 91 USD/ounce - equivalent to about 2.83 - 2.86 million VND/tael when converted to the bank exchange rate.

Meanwhile, domestic SJC gold bar prices increased to VND9 million/tael. That is, domestic gold prices have increased 3 times in the world, clearly reflecting buyers' speculative psychology and excessive expectations.

April 17 is a typical example. In just 24 hours, the world gold price increased by about 68.9 USD/ounce - equivalent to 1.7 million VND/tael. But in Vietnam, gold prices increased by 9 million VND/tael. Such a lack of confidence shows that the domestic market has been pushed to an unreal price zone.

In response to this unusual development, Deputy Prime Minister Ho Duc Phoc has directed the State Bank to urgently coordinate with relevant agencies to implement solutions to stabilize the gold market. Immediately after the directive, domestic gold prices showed signs of cooling down. From the historical peak of 120 million VND/tael, the selling price has now decreased to 114 million VND/tael.

However, even after cooling down, domestic gold prices are still about 10 million VND/tael higher than the world price. The gap between buying and selling prices in many places is still widened by 2 - 4 million VND/tael, causing retail investors to face the risk of losses if the market suddenly reverses.

The current gold market is not only volatile but also has abnormalities in supply - demand and domestic - international differences. With the buying - selling gap being extended, it is very difficult for individual investors to achieve the expected profits, unless they grasp the exact time and sell at the highest price range.

In the context of unpredictable market fluctuations, people should consider carefully before spending money, especially for short-term speculative purposes. Closely monitoring market developments, operating policies and world gold trends will help investors make more wise decisions.