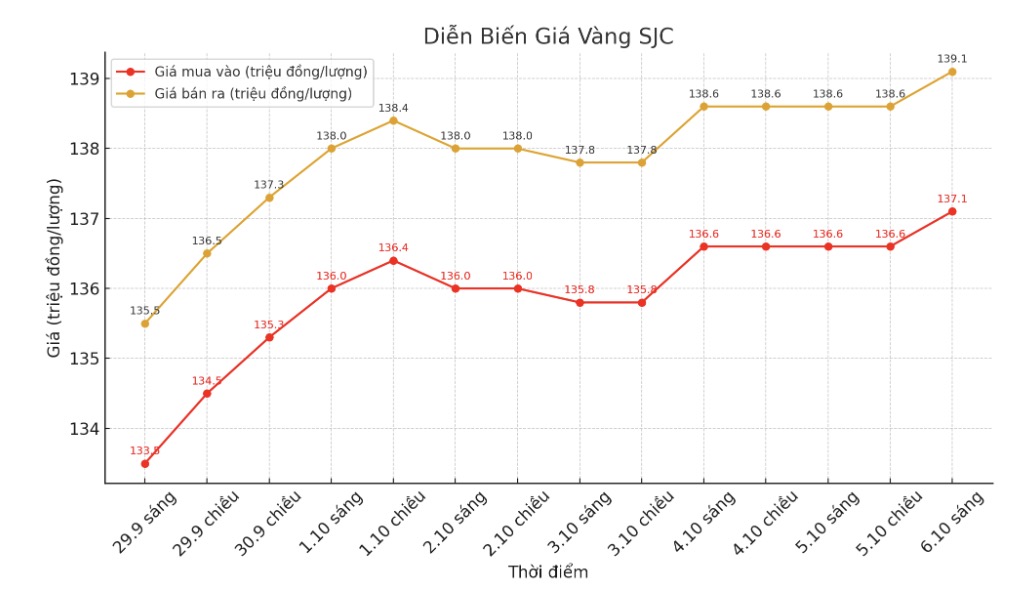

Updated SJC gold price

As of 9:40 a.m., the price of SJC gold bars was listed by DOJI Group and Bao Tin Minh Chau at 137.1-139.1 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 137-139.6 million VND/tael (buy - sell), an increase of 1 million VND/tael for buying and an increase of 800,000 VND/tael for selling. The difference between buying and selling prices is at 2.6 million VND/tael.

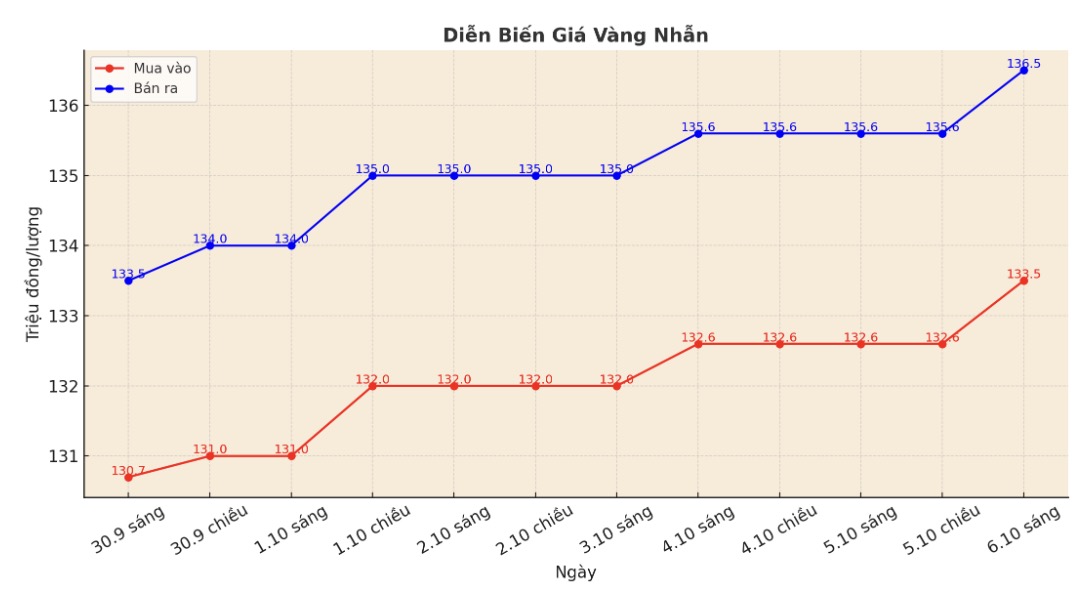

9999 round gold ring price

As of 9:40 a.m., DOJI Group listed the price of gold rings at 133.5-136.5 million VND/tael (buy in - sell out), an increase of 900,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 134.3-137.3 million VND/tael (buy - sell), an increase of 700,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 133.5-136.5 million VND/tael (buy in - sell out), an increase of 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

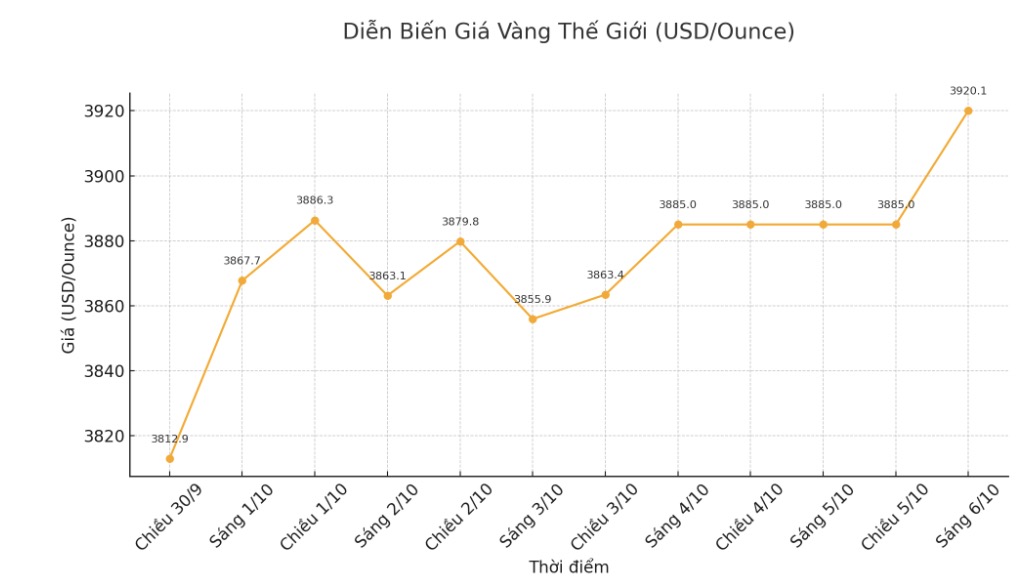

World gold price

At 9:40 a.m., the world gold price was listed around 3,920.1 USD/ounce, up 35.1 USD.

Gold price forecast

Experts say the precious metal is receiving many supportive factors. Mr. Daniel Pavilonis - senior commodity broker at RJO Futures - commented that the impact of the US Government's closure on the Fed's ability to assess employment data is insignificant.

I dont think the Fed depends entirely on government data, which has recently tended to be significantly different from forecasts. The Fed will definitely have its own data set to monitor, he said.

He said the market had a slight reaction to the cautious statements of FED officials over the weekend, but only for a short time. Gold prices fell slightly after FED Chairman Dallas Lorie Logan said they did not want to cut interest rates too strongly and then had to raise them again. But overall, everything is accumulating for a bounce.

In the current price range, there is always a group of investors loyal to gold. But now new cash flow from outside is starting to pour in, looking for a stronger breakthrough. I think the "fear of missing out" (FOMO) mentality is gradually emerging, which could push prices higher," said Pavilonis.

According to him, this is also clearly shown in the silver market. Crybery prices are hitting $48 an ounce, just about $2 away from a historical peak. If this mark is broken, there will be a lot of room to increase.

As for gold, a huge market that is unlikely to rotate quickly, long-term cash flow is still persistently accumulating, Pavilonis commented.

He recounted the story to a veteran trader who witnessed the US separating the US dollar from gold, when gold prices increased from 35 to 300 USD/ounce. If we look at Elliott wave models and current conditions, the possibility of gold prices reaching $8,000 to $10,000/ounce by 2030 is possible, he added.

Colin Cieszynski, chief strategist at SIA Wealth Management, is also bullish on gold next week. There is no currently any predictable factor that could disrupt the precious metals uptrend, unless a major surprise comes as a result, he said.

He said the US government's shutdown does not have a direct impact on the metals market. Actually, the problem is that this does not help the USD. It makes the US less attractive to investors. Previously, global capital flows have come to the US as a safe haven, but events like the government's closure have made many investors reconsider the stability of the US market, so part of the capital flow is temporarily shifting to precious metals.

Of course, if the situation is resolved, or peace is achieved somewhere, or there is great positive news, metal prices may slow down a bit. The metal market has been rising steadily for a long time, and at some point it will need a break or correction, but it is unpredictable when, he added.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...