Gold price plummets

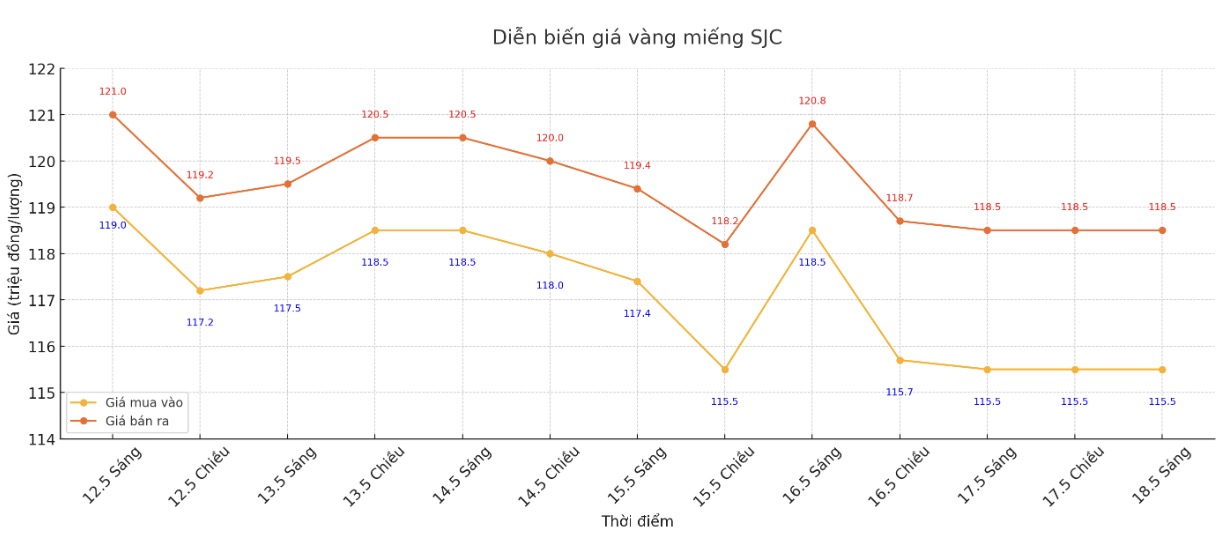

In the trading session on May 18, the price of SJC gold bars at both DOJI Group and Saigon Jewelry Company (SJC) decreased sharply compared to last week. The purchase price decreased by 4.5 million VND/tael and the selling price decreased by 3.5 million VND/tael. Both enterprises are currently listing SJC gold at VND 115.5-118.5 million/tael (buy in - sell out).

Thus, if investors buy SJC gold bars in the last session of the weekend (11.5) and sell them in today's session (18.), the recorded loss is up to 6.5 million VND/tael.

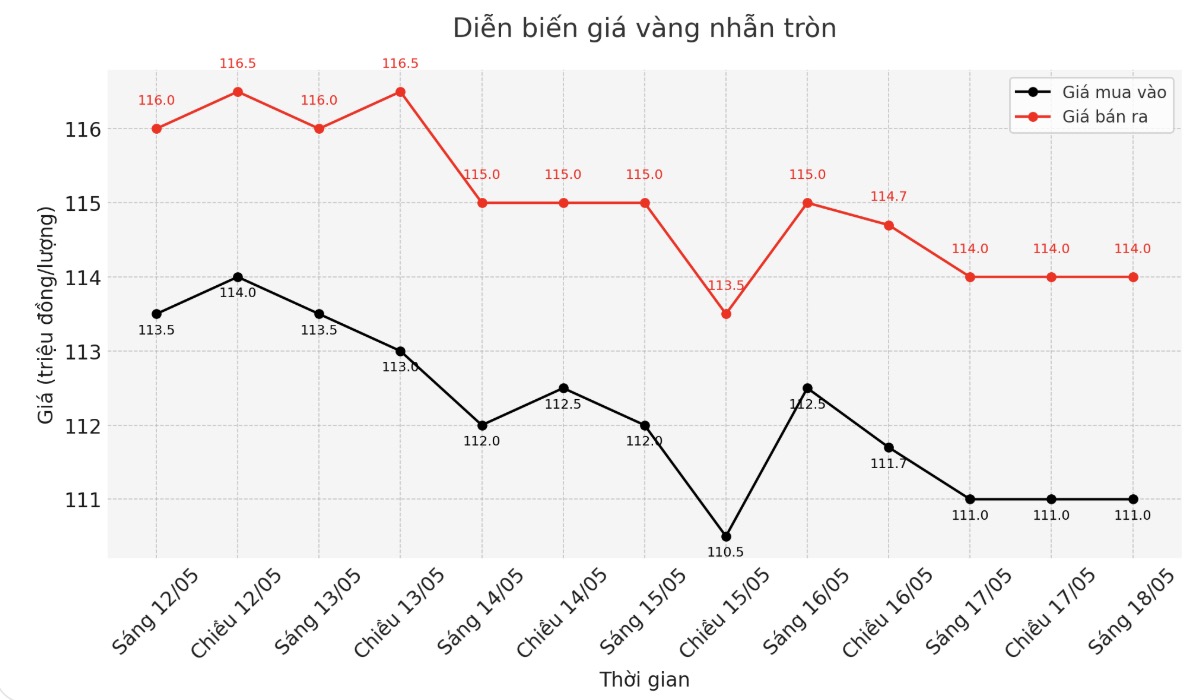

For 9999 gold rings, the price at DOJI on the morning of May 18 was 111-114 million VND/tael, down 3.5 million VND and 3 million VND/tael for each buy-sell compared to last weekend.

Bao Tin Minh Chau also decreased by 3 million VND/tael in both directions, listed at 114-117 million VND/tael. Those who bought gold rings on May 11 and sold them on May 18 also suffered a loss of about 6 million VND/tael.

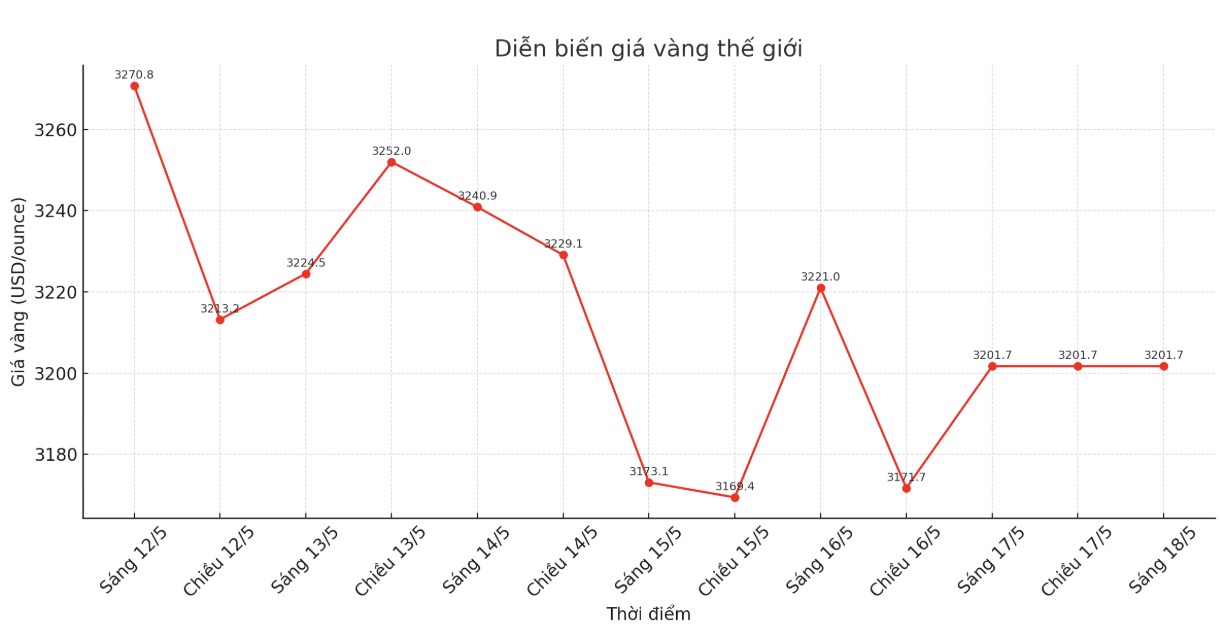

Domestic gold prices fell sharply last week due to the impact of the decline in the world market. At the end of the session on May 18, the world gold price on Kitco was at 3.201.7 USD/ounce, down 121.6 USD/ounce compared to the end of last week. This development has forced domestic enterprises to strongly adjust listed prices.

The buying - selling distance is too high

Not only affected by the bearish trend, domestic gold buyers also face another risk from the high difference between buying and selling. This is a silent erosion of profits and the reason why many investors suffer heavy losses, even when gold prices do not fluctuate.

Currently, the difference between the buying and selling prices at large enterprises such as DOJI, SJC or Bao Tin Minh Chau is at a very high level, ranging from 2.5 to 3 million VND/tael. This gap means that buyers will almost certainly suffer losses immediately upon making a trade, if there are no strong fluctuations in gold prices afterwards.

For example, if buying SJC gold bars on May 18 at DOJI or Saigon Jewelry Company at a selling price of VND 118.5 million/tael, then immediately reselling them at a buying price of VND 115.5 million/tael, buyers will immediately lose VND 3 million/tael - even though the market has no price fluctuations. This is the most obvious risk that investors face when the difference is pushed up too high.

The current strong fluctuations in gold prices accompanied by large buying and selling opportunities are a serious warning for those who are planning to "surf" gold to make a profit in the short term. In reality, with the current range of fluctuations and differences, investing in gold in a quick buy - sell style is almost certain to lead to losses.

Experts also emphasized that, in the context of the gold market being sensitive to many external factors such as US interest rate policy, global inflation, geopolitical tensions, tariff policies... gold investment should be carefully considered.

Individual investors need to closely monitor international fluctuations, while avoiding chasing trends or expecting immediate profits, to minimize risks in the current period of many fluctuations.