Canada's largest gold producer continues to maintain a strong performance as stable output and high gold prices have helped the company move to a state of net profit in the second quarter.

On Wednesday evening (North American time), right after the US stock market closed, Agnico Eagle Mines Limited (NYSE: AEM) announced net profit reached 1.069 billion USD, equivalent to 2.13 USD/share, and record adjusted net profit reached 976 million USD, equivalent to 1.94 USD/share, exceeding the average forecast of analysts of about 1.83 USD/share.

This record result was largely due to strong increases in gold prices and tight control of production costs.

Regarding production activities, in the period from April to June, Agnico exploited 866,029 ounces of gold, down slightly from 895,838 ounces in the same period in 2024. Since the beginning of the year, output has reached 1.74 million ounces, down slightly from 1.774 million ounces in the first half of last year.

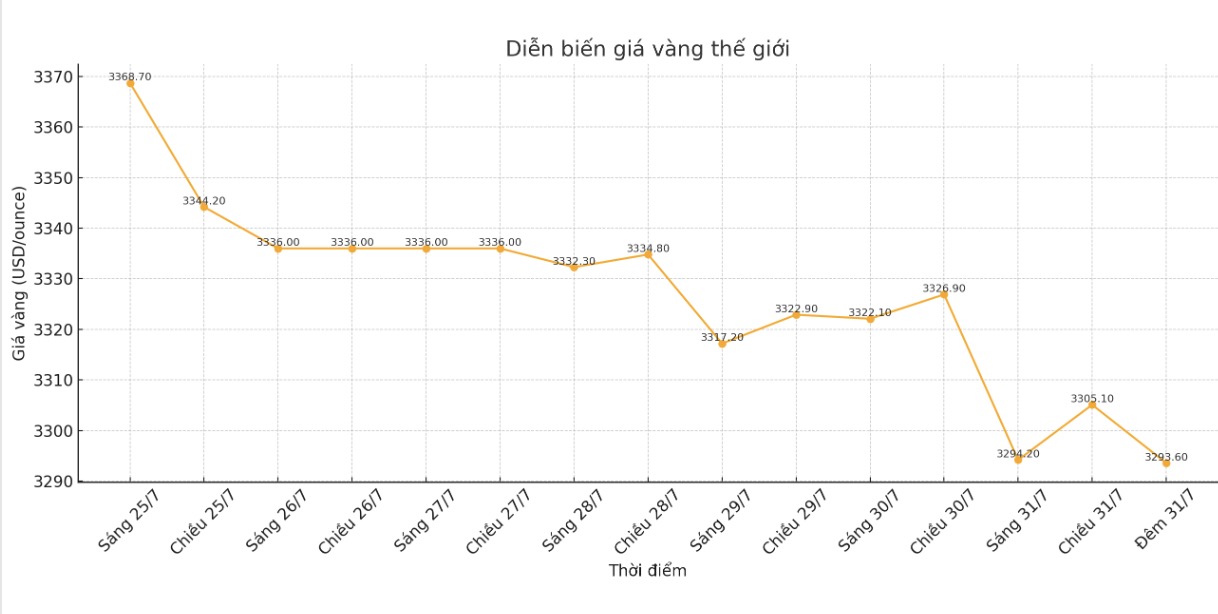

However, the company recorded an average gold price of $3,288/ounce, well above last year's $2,342/ounce. At the same time, the overall maintenance cost (AISC) also increased to $1,289/ounce, compared to $1,169/ounce in 2024.

Ammar Al-Joundi - Chairman and CEO of Agnico Eagle, said: Our high-quality asset portfolio continues to bring excellent results this quarter, creating a record free cash flow, double that of the previous quarter.

This success reflects a favorable gold price environment, a strict cost management strategy and stable operational efficiency.

Although production has slowed down, the company said the cause comes from the migration of reindeer affecting the Meadowbank mine, along with lower-level ore mining at Canadian Malartic and Fosterville. However, the company still maintains the production plan for 2025.

The recoverable gold output in 2025 remains unchanged at the expected 3.3 to 3.5 million ounces, with cash costs per ounce and AISC per ounce holding at $915965 and $1,2501,300, respectively, Agnico asserted.

With a record profit margin, Agnico has reduced long-term debt by 550 million USD, firmly consolidating the accounting balance sheet.

Mr. Al-Joundi emphasized: While creating a record free cash flow, we still maintain discipline in capital allocation - reinvestment for business operations, consolidate finance and return about 300 million USD to shareholders through dividends and share buybacks.

We continue to stick to the 2025 plan and promote core growth projects to create long-term value.