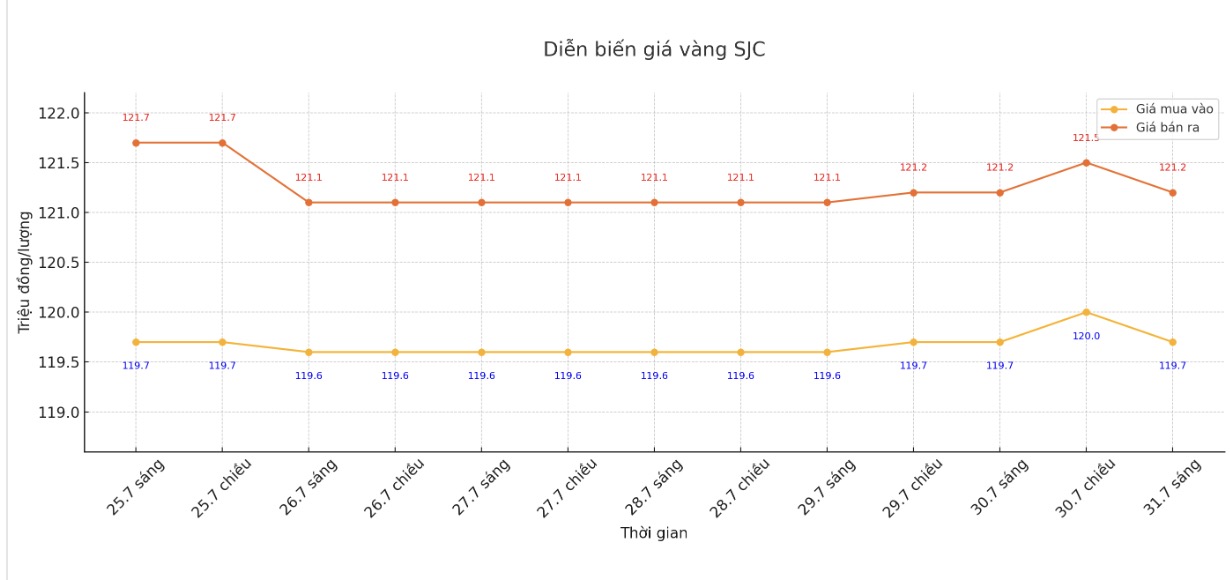

Updated SJC gold price

As of 9:00 a.m., the price of SJC gold bars listed by DOJI Group was at VND 119.7-121.2 million/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 119.7-121.2 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at VND 119.2-121.2 million/tael (buy in - sell out), down VND 300,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

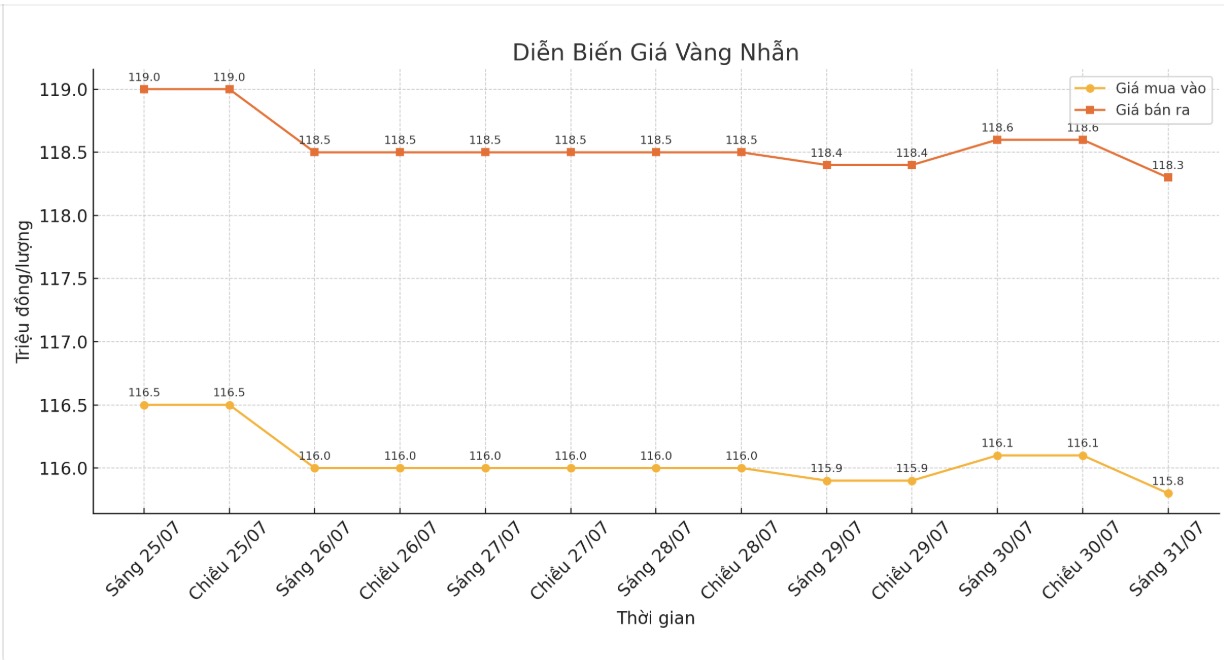

9999 round gold ring price

As of 9:00 a.m., DOJI Group listed the price of gold rings at 115.8-118.3 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116-119 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.6-117.6 million VND/tael (buy - sell), down 600,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

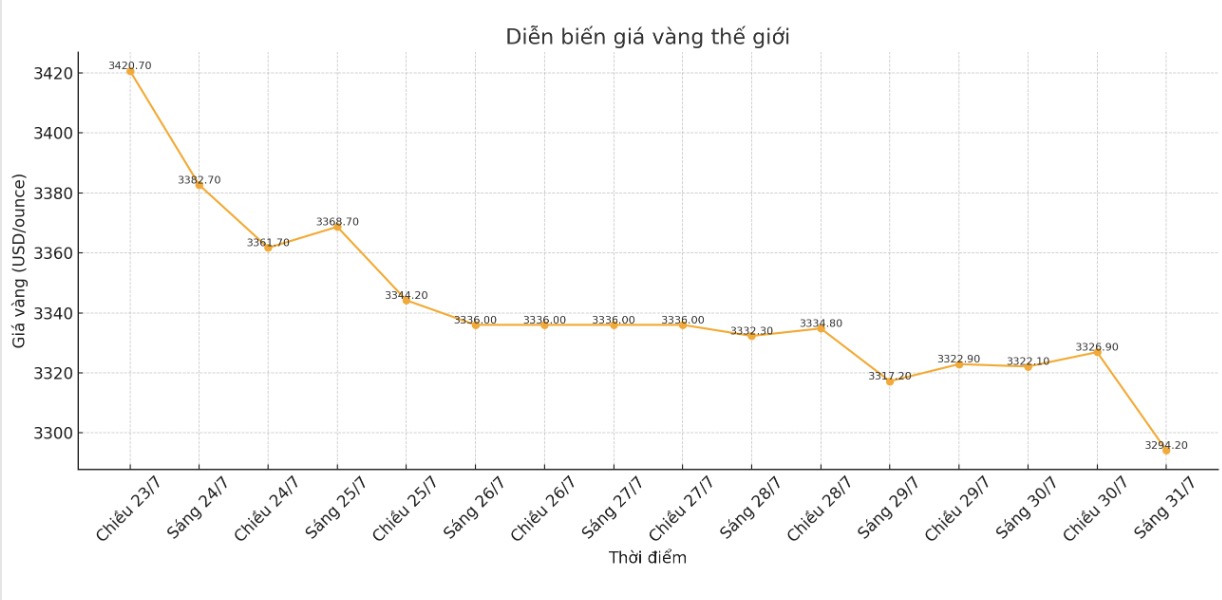

World gold price

At 9:05, the world gold price was listed around 3,294.2 USD/ounce, down 27.9 USD/ounce.

Gold price forecast

Gold prices plummeted after Federal Reserve Chairman Jerome Powell reaffirmed that the central bank was in no rush to cut interest rates, causing expectations of policy easing in September to be overwhelmed with cold water.

As expected, the FED voted to keep interest rates unchanged, but this decision did not reach absolute consensus. Two members of the Federal Open Market Committee (FOMC), Michelle Bowman and Christopher Waller, have disagreed, wanting to cut interest rates by another 25 basis points.

In its monetary policy statement, the Fed said economic activity had stagnated in the first half of the year. However, Powell noted that despite this slowdown, the labor market, consumer goods and the economy in general remain quite stable.

In addition, world gold prices are under pressure from the strong recovery of the US economy and the cautious attitude of central banks.

US GDP in the second quarter of 2025 increased by 3.0%, far exceeding expectations of 2.5%, dispelling concerns about recession. The increase in consumer spending along with the decrease in imports are the main factors driving growth. However, weak private investment and exports, along with domestic final spending increasing by only 1.2%, suggest that the recovery may not be sustainable. Inflation remained persistent as the core PCE index increased slightly to 2.5%, causing the Fed to not rush to ease policy.

However, the Bank of Canada (BoC) decided to keep interest rates unchanged for the second consecutive time, despite the country's economy being forecast to decline. The BoC emphasized that it will closely monitor the developments between inflationary pressures from high costs and the bearish trend due to weak economy, but has not yet given a clear signal about interest rate cuts. The sluggish delay of major central banks has caused expectations of global interest rate cuts to plummet, losing important support for gold.

After the data and policy decisions, gold prices fell more than $40/ounce. In the context of weakening supporting factors, gold may enter a deeper correction phase if market sentiment continues to be optimistic about growth and there are few concerns about macro risks.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...