Many analysts, investors and traders have been looking forward to this milestone. However, it is worth noting that the increase in gold was much stronger than expected. Gold prices have reached levels that many people previously thought could only be achieved in the second half of this year.

In October, at the annual precious metals conference of the Luan Don Gold Market Association (LBMA), delegates predicted that gold prices would reach 2,941 USD/ounce by October 2025. Few people thought that gold would reach $3,000/ounce, even if the long-term uptrend of this precious metal was clear.

However, less than a month after the conference, gold prices stagnated as the USD increased strongly due to new expectations for economic policy in the US.

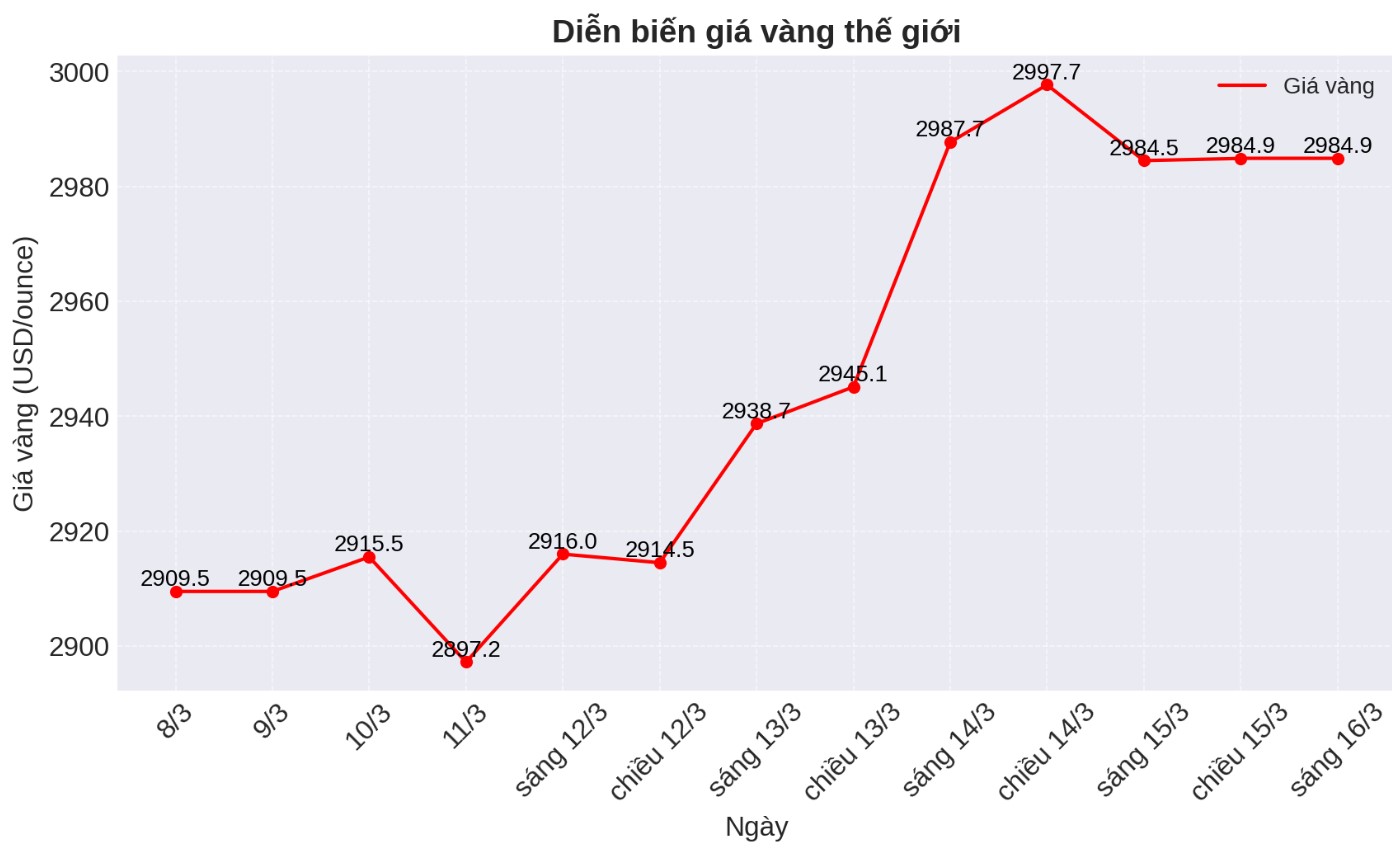

However, gold did not take too much time to recover. At the beginning of the new year, the increase returned, pushing gold prices to more than 300 USD/ounce in just three months, equivalent to an increase of more than 13% since the beginning of the year.

Optimism is increasingly strengthened as important price levels continue to break. After breaking above the resistance level of $2,700/ounce, gold did not look back and the $2,800/ounce mark was just a short stop on the increase. Many experts consider the accumulation period of the past four weeks as just a " momentum" before the market exploded.

Gold's $3,000/ounce mark is particularly noteworthy as it is just a step in a larger rally. Many experts predict that gold will reach an all-time high if adjusted to inflation, similar to the peak set in January 1980.

Recently, commodity experts in Macquarie have raised their gold price forecast to $3,500/ounce in the third quarter of 2025. They had set a target of $3,000 for the middle of the year, but gold prices hit the milestone earlier than expected.

Last week, Bart Melek - Head of Commodity Strategy at TD Securities commented that any adjustment is a buying opportunity. He predicted that gold will set a new price level of over 3,000 USD/ounce this year.

One of the main reasons why experts remain optimistic, even when gold prices are at a high level, is that the price increase momentum does not only come from technical factors. There is currently no "FOMO" in the gold market, investors are just starting to get involved.

The amount of capital poured into North American gold ETFs in the past month was the largest since July 2020. However, the amount of gold held by ETFs is still about 20% lower than the peak in 2020, when the gold price is currently lower at 1,000 USD/ounce.

In an interview with Kitco News, George Milling-Stanley - Chief Gold Strategist at State Street Global Advisors said that investors are looking to gold as a safe haven and anti-inflationary hedge in the context of increasing economic uncertainty and geopolitical tensions.

Some experts also believe that capital flows into gold have not really exploded, as the stock market is still fluctuating near the correction zone.

See more news related to gold prices HERE...